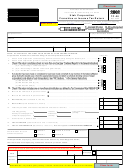

Supplemental Information To Be Supplied By All Corporations

1. What is the date of incorporation ________________________ and in what state? ___________________________

2. If this corporation is dissolved or withdrawn, see Dissolution or Withdrawal in the General Instructions.

3.

Yes

No

Did the corporation at any time during its tax year own more than 50 percent of the

voting stock of another corporation or corporations?

If yes, provide the following for each corporation so owned: (attach additional pages if necessary)

Name of corporation _________________________________________________________________________

Address

__________________________________________________________________________________

Percentage of stock owned __________%

Date stock acquired _____________________________________

4.

Yes

No

Is 50 percent or more of the voting stock of this corporation owned by another corporation?

If yes, provide the following information about the corporation:

Name of corporation ________________________________________________________________________

Address __________________________________________________________________________________

Percentage of stock held ____________%

5.

Yes

No

Did this corporation or its subsidiary(ies) have a change in control or ownership, or acquire

control or ownership of any other legal entity this year?

6. Where are the corporate books and records maintained?

______________________________________________________________________________________________

7. What is the state of commercial domicile? __________________________________________________________

8. What is the last year for which a federal examination has been completed? __________________________________

Under separate cover, send a summary and supporting schedules for all federal adjustments and the federal tax

liability for each year for which federal audit adjustments have not been reported to the Tax Commission and indicate

date of final determination. Forward information to Auditing Division, Utah State Tax Commission, 210 North 1950 West,

Salt Lake City, UT 84134-2000.

9. For what years are federal examinations now in progress, or final determination of past examinations still pending?

______________________________________________________________________________________________

10. For what years have extensions for proposing additional assessments of federal tax been agreed to with the Internal

Revenue Service?

______________________________________________________________________________________________

Schedule E - Prepayments of Any Type -

Enter the total from line 4 below on line 18e of Schedule A.

1.

Overpayment applied from prior year ..................................................................................... 1

00

2.

Extension prepayment

Date __________ Check number __________

....................... 2

00

3.

Other prepayments (attach additional page(s) if necessary)

a.

Date ____________

Check number ____________

3a

00

b.

Date ____________

Check number ____________

3b

00

c.

Date ____________

Check number ____________

3c

00

d.

Date ____________

Check number ____________

3d

00

Total of other prepayments (add lines 3a through 3d) ......................................................... 3

00

4.

Total prepayments (add lines 1, 2 and 3) Enter here and on Schedule A, line 18e ........ ......... 4

00

TC-20_2 Rev. 12/07

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2 3

3 4

4 5

5 6

6 7

7