Health Fsa Reimbursement Form

ADVERTISEMENT

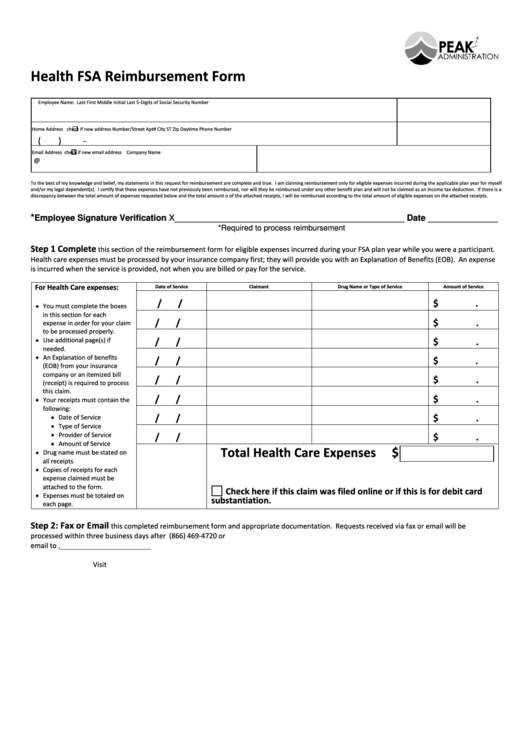

Health FSA Reimbursement Form

Employee Name: Last

First

Middle Initial

Last 5-Digits of Social Security Number

Home Address

check if new address Number/Street

Apt#

City

ST

Zip

Daytime Phone Number

(

)

-

Email Address

check if new email address

Company Name

@

To the best of my knowledge and belief, my statements in this request for reimbursement are complete and true. I am claiming reimbursement only for eligible expenses incurred during the applicable plan year for myself

and/or my legal dependent(s). I certify that these expenses have not previously been reimbursed, nor will they be reimbursed under any other benefit plan and will not be claimed as an income tax deduction. If there is a

discrepancy between the total amount of expenses requested below and the total amount o of the attached receipts, I will be reimbursed according to the total amount of eligible expenses on the attached receipts.

*

___________________________________________

_____________

Employee Signature Verification X

Date

*Required to process reimbursement

Step 1 Complete

this section of the reimbursement form for eligible expenses incurred during your FSA plan year while you were a participant.

Health care expenses must be processed by your insurance company first; they will provide you with an Explanation of Benefits (EOB). An expense

is incurred when the service is provided, not when you are billed or pay for the service.

For Health Care expenses:

Date of Service

Claimant

Drug Name or Type of Service

Amount of Service

/

/

$

.

You must complete the boxes

in this section for each

/

/

$

.

expense in order for your claim

to be processed properly.

Use additional page(s) if

/

/

$

.

needed.

An Explanation of benefits

/

/

$

.

(EOB) from your insurance

company or an itemized bill

/

/

$

.

(receipt) is required to process

this claim.

/

/

$

.

Your receipts must contain the

following:

/

/

$

.

Date of Service

Type of Service

Provider of Service

/

/

$

.

Amount of Service

Total Health Care Expenses

$

Drug name must be stated on

all receipts

Copies of receipts for each

expense claimed must be

attached to the form.

Check here if this claim was filed online or if this is for debit card

Expenses must be totaled on

substantiation.

each page.

Step 2: Fax or Email

this completed reimbursement form and appropriate documentation. Requests received via fax or email will be

processed within three business days after receipt. Please keep original receipts for your records as required by the IRS. Fax (866) 469-4720 or

email to .

Visit 24 hours a day to obtain account information and additional reimbursement forms.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1