Security Agreement

ADVERTISEMENT

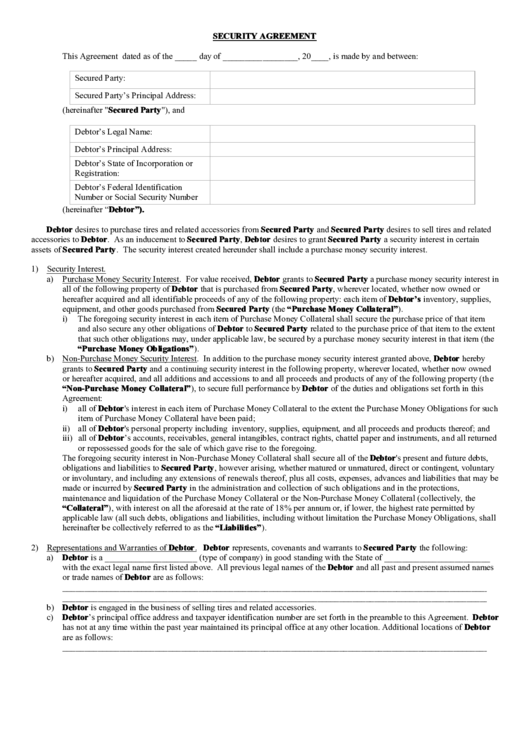

SECURITY AGREEMENT

This Agreement dated as of the _____ day of _________________, 20____, is made by and between:

Secured Party:

Secured Party’s Principal Address:

(hereinafter "Secured Party"), and

Debtor’s Legal Name:

Debtor’s Principal Address:

Debtor’s State of Incorporation or

Registration:

Debtor’s Federal Identification

Number or Social Security Number

(hereinafter “Debtor”).

Debtor desires to purchase tires and related accessories from Secured Party and Secured Party desires to sell tires and related

accessories to Debtor. As an inducement to Secured Party, Debtor desires to grant Secured Party a security interest in certain

assets of Secured Party. The security interest created hereunder shall include a purchase money security interest.

1) Security Interest.

a) Purchase Money Security Interest. For value received, Debtor grants to Secured Party a purchase money security interest in

all of the following property of Debtor that is purchased from Secured Party, wherever located, whether now owned or

hereafter acquired and all identifiable proceeds of any of the following property: each item of Debtor’s inventory, supplies,

equipment, and other goods purchased from Secured Party (the “Purchase Money Collateral”).

i)

The foregoing security interest in each item of Purchase Money Collateral shall secure the purchase price of that item

and also secure any other obligations of Debtor to Secured Party related to the purchase price of that item to the extent

that such other obligations may, under applicable law, be secured by a purchase money security interest in that item (the

“Purchase Money Obligations”).

b) Non-Purchase Money Security Interest. In addition to the purchase money security interest granted above, Debtor hereby

grants to Secured Party and a continuing security interest in the following property, wherever located, whether now owned

or hereafter acquired, and all additions and accessions to and all proceeds and products of any of the following property (the

“Non-Purchase Money Collateral”), to secure full performance by Debtor of the duties and obligations set forth in this

Agreement:

i)

all of Debtor's interest in each item of Purchase Money Collateral to the extent the Purchase Money Obligations for such

item of Purchase Money Collateral have been paid;

ii) all of Debtor's personal property including inventory, supplies, equipment, and all proceeds and products thereof; and

iii) all of Debtor’s accounts, receivables, general intangibles, contract rights, chattel paper and instruments, and all returned

or repossessed goods for the sale of which gave rise to the foregoing.

The foregoing security interest in Non-Purchase Money Collateral shall secure all of the Debtor's present and future debts,

obligations and liabilities to Secured Party, however arising, whether matured or unmatured, direct or contingent, voluntary

or involuntary, and including any extensions of renewals thereof, plus all costs, expenses, advances and liabilities that may be

made or incurred by Secured Party in the administration and collection of such obligations and in the protections,

maintenance and liquidation of the Purchase Money Collateral or the Non-Purchase Money Collateral (collectively, the

“Collateral”), with interest on all the aforesaid at the rate of 18% per annum or, if lower, the highest rate permitted by

applicable law (all such debts, obligations and liabilities, including without limitation the Purchase Money Obligations, shall

hereinafter be collectively referred to as the “Liabilities”).

2) Representations and Warranties of Debtor. Debtor represents, covenants and warrants to Secured Party the following:

a) Debtor is a _____________________ (type of company) in good standing with the State of ________________________

with the exact legal name first listed above. All previous legal names of the Debtor and all past and present assumed names

or trade names of Debtor are as follows:

_________________________________________________________________________________________________

_________________________________________________________________________________________________

b) Debtor is engaged in the business of selling tires and related accessories.

c) Debtor’s principal office address and taxpayer identification number are set forth in the preamble to this Agreement. Debtor

has not at any time within the past year maintained its principal office at any other location. Additional locations of Debtor

are as follows:

_________________________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7