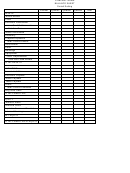

Company Balance Sheet Page 3

ADVERTISEMENT

INSTRUCTIONS FOR BALANCE SHEET

Introduction

A balance sheet (sometimes also referred to as a statement of financial position) is a summary of a individual's or business's balances. Assets, liabilities and ownership equity are listed as of a specific date, such as the

end of its financial year. A balance sheet is often described as a snapshot of a company's financial condition. Of the four basic financial statements, the balance sheet is the only statement which applies to a single point

in time.

A balance sheet has three parts: assets, liabilities and ownership equity. The main categories of assets are usually listed first and are followed by the liabilities. The difference between the assets and the liabilities is

known as equity or the net assets or the net worth of the company (i.e. Net worth = assets - liabilities.

Note: All calculations have been presaved in the template, so you don’t have to manually add or subtract etc. If you wish to make changes to the locked cells, the password is stgeorge.

Getting Started

Figures used to compile the balance sheet are taken from the previous and current balance sheet as well as the current income statement. The income statement is usually attached to the

balance sheet. The following text covers the essential elements of the balance sheet.

At the top of the page fill in the legal name of the business. Total assets include all net values. These are the amounts derived when you subtract depreciation and amortisation from the

original costs of acquiring the assets.

Assets

List anything of value that is owned or legally due the business. Total assets include all net values. These are the amounts derived when you subtract depreciation and amortisation from the

original costs of acquiring the assets.

Current Assets

–

Cash

List cash and resources that can be converted into cash within 12 months of the date of the balance sheet (or during one established cycle of operation). Include cash on hand and demand deposits in the

bank, e.g., cheque accounts and regular savings accounts.

Petty cash – If your business has a fund for small miscellaneous expenditures, include the total here.

Accounts receivable – The amounts due from customers in payment for goods or services.

Stock – Includes raw materials on hand, work in progress and all finished goods, either manufactured or purchased for resale.

Short-term investments – Also called temporary investments or marketable securities, these include interest – or dividend-yielding holdings expected to be converted into cash within a year. List stocks and bonds,

certificates of deposit and term-deposit savings accounts at either their cost or market-value, whichever is less.

Prepaid expenses – Goods, benefits or services a business buys or rents in advance. Examples are office supplies, insurance protection and floor space.

Long-term Investments

Also called long-term assets, these are holdings the business intends to keep for at least a year that typically yield interest or dividends. Included are stocks, bonds and savings accounts earmarked for special purpose.

Fixed Assets

Also called plant and equipment. Includes all resources a business owns or acquires for use in operations and not intended for resale. Fixed assets may be leased.

Depending on the leasing arrangements, both the value and the liability or the leased property may need to be listed on the balance sheet

Land – List the original purchase price without allowances for market value.

Buildings

Improvements

Equipment

Furniture

Motor vehicles

Liabilities

Current Liabilities

List all debts, monetary obligations and claims payable within 12 months or within one cycle or operation. Typically they include the following:

Accounts payable – Amounts owed to suppliers for goods and services purchased in connection with business operations.

Notes payable – The balance of principal due to pay off short-term debt for borrowed funds. Also includes the current amount due of total balance on notes whose terms exceed 12 months.

Interest payable – Any accrued fees due for use of both short and long-term borrowed capital and credit extended to the business.

Taxes payable – GST obligations and entitlements, PAYG and FBT as calculated by completing your Business Activity Statement (BAS).

Payroll accrual – Salaries and wages currently owed.

Long-term Liabilities

Notes payable – List notes, contract payments or mortgage payments due over a period exceeding 12 months or one cycle of operation. They are listed by outstanding balance less the current position due.

Net Worth

Also called owner’s equity, net worth is the claim of the owner(s) on the assets of the business. In a proprietorship or partnership, equity is each owner’s original investment plus earnings after withdrawals.

Total Liabilities and Net Worth

The sum of these two amounts must always match that for total assets.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3