Clear form

Business name

Account number (FEIN/EIN)

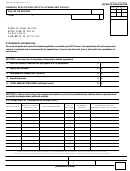

Section 3 - SFU

Special Fuel Users are not required to file a quarterly return, unless any of the following conditions apply.

1. If you have exempt use of Utah tax paid fuel, you may file for a refund on a quarterly basis using form TC-922, IFTA/SFU Tax Return.

2. If you are anticipating a refund or you have bulk storage, maintain detailed mileage records and summaries, detailed fuel purchase

records and bulk disbursement records for vehicles traveling in Utah.

3. If you purchase fuel without the proper Utah tax paid, you will be required to file a return, form TC-922, due and payable at the Tax

Commission on or before the last day of the month following the reporting period.

There is no charge for SFU decals.

Enter the number of qualified vehicles

needing SFU decals.

You are required to read and sign this application in Section 5.

Section 4 - IFTA

Mark all IFTA jurisdictions in which you will travel and/or have bulk fuel storage.

OP = Jurisdictions in which you plan to operate

BF = Jurisdictions in which you have bulk fuel storage

OP

BF

OP

BF

OP

BF

OP

BF

AK - Alaska

KS - Kansas

NM - New Mexico

WI - Wisconsin

AL - Alabama

KY - Kentucky

NV - Nevada

WV - West Virginia

AR - Arkansas

LA - Louisiana

NY - New York

WY - Wyoming

AZ - Arizona

MA - Massachusetts

OH - Ohio

AB - Alberta

CA - California

MD - Maryland

OK - Oklahoma

BC - British Columbia

CO - Colorado

ME - Maine

OR - Oregon

MB - Manitoba

CT - Connecticut

MI - Michigan

PA - Pennsylvania

NB - New Brunswick

DC - Dist. of Columbia

MN - Minnesota

RI - Rhode Island

NL - Newfoundland

DE - Delaware

MO - Missouri

SC - South Carolina

NS - Nova Scotia

FL - Florida

MS - Mississippi

SD - South Dakota

NT - NW Territories

GA - Georgia

MT - Montana

TN - Tennessee

ON - Ontario

HI - Hawaii

NC - North Carolina

TX - Texas

PE - Prince Ed.-IS

IA

- Iowa

ND - North Dakota

UT - Utah

QC - Quebec

ID - Idaho

NE - Nebraska

VA - Virginia

SK - Saskatchewan

IL

- Illinois

NH - New Hampshire

VT - Vermont

YT - Yukon Territory

IN - Indiana

NJ - New Jersey

WA - Washington

MX - Mexico

USTC Use

Only

A and B

1. Number of qualified vehicles

Check all

needing IFTA decals

that apply

A

B

2. Decal cost per set

$4.00

Amount due (multiply line 1 by line 2)

Make check or money order payable to

$

the Utah State Tax Commission.

You are required to read and sign this application in Section 5.

1

1 2

2 3

3 4

4