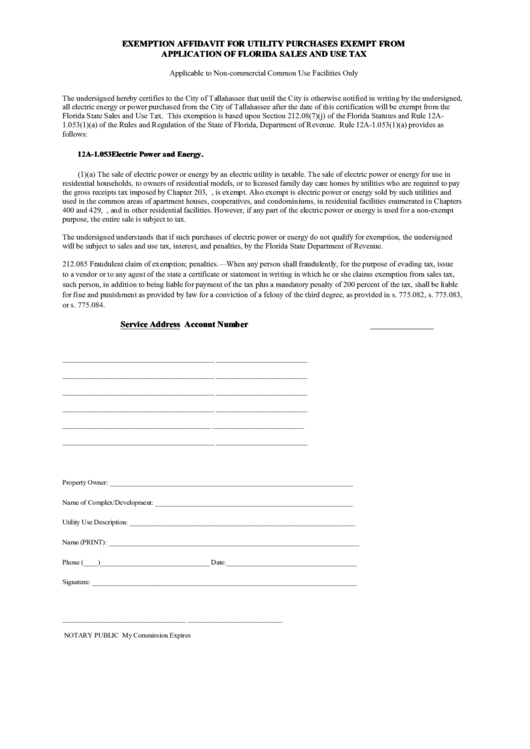

EXEMPTION AFFIDAVIT FOR UTILITY PURCHASES EXEMPT FROM

APPLICATION OF FLORIDA SALES AND USE TAX

Applicable to Non-commercial Common Use Facilities Only

The undersigned hereby certifies to the City of Tallahassee that until the City is otherwise notified in writing by the undersigned,

all electric energy or power purchased from the City of Tallahassee after the date of this certification will be exempt from the

Florida State Sales and Use Tax. This exemption is based upon Section 212.08(7)(j) of the Florida Statutes and Rule 12A-

1.053(1)(a) of the Rules and Regulation of the State of Florida, Department of Revenue. Rule 12A-1.053(1)(a) provides as

follows:

12A-1.053 Electric Power and Energy.

(1)(a) The sale of electric power or energy by an electric utility is taxable. The sale of electric power or energy for use in

residential households, to owners of residential models, or to licensed family day care homes by utilities who are required to pay

the gross receipts tax imposed by Chapter 203, F.S., is exempt. Also exempt is electric power or energy sold by such utilities and

used in the common areas of apartment houses, cooperatives, and condominiums, in residential facilities enumerated in Chapters

400 and 429, F.S., and in other residential facilities. However, if any part of the electric power or energy is used for a non-exempt

purpose, the entire sale is subject to tax.

The undersigned understands that if such purchases of electric power or energy do not qualify for exemption, the undersigned

will be subject to sales and use tax, interest, and penalties, by the Florida State Department of Revenue.

212.085 Fraudulent claim of exemption; penalties.—When any person shall fraudulently, for the purpose of evading tax, issue

to a vendor or to any agent of the state a certificate or statement in writing in which he or she claims exemption from sales tax,

such person, in addition to being liable for payment of the tax plus a mandatory penalty of 200 percent of the tax, shall be liable

for fine and punishment as provided by law for a conviction of a felony of the third degree, as provided in s. 775.082, s. 775.083,

or s. 775.084.

Service Address

Account Number

___________________________________________

__________________________

___________________________________________

__________________________

___________________________________________

__________________________

___________________________________________

__________________________

__________________________________________

__________________________

___________________________________________

__________________________

Property Owner: _____________________________________________________________________

Name of Complex/Development: ________________________________________________________

Utility Use Description: ________________________________________________________________

Name (PRINT): _______________________________________________________________________

Phone (____)_______________________________ Date:_____________________________________

Signature: ___________________________________________________________________________

___________________________________

___________________________

NOTARY PUBLIC

My Commission Expires

1

1