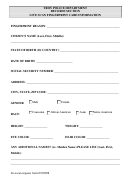

Living Trust Information Form (Short Form) Page 8

ADVERTISEMENT

During the term of the special needs trust, the trustee should be permitted to make discretionary payments to the special needs child

of:

____

Income only

____

Income and principal

Alternate Income Beneficiaries for the Special Needs Trust (SNT)

Note: The special needs child is the initial beneficiary of the SNT

If payment of income to the special needs child would disqualify the special needs child for benefits, the alternate beneficiaries should

be:

(Ascertainable standard is used)

____

The child or children of the special needs child

____

The husband of the special needs child

____

Other (Specify): ______________________

Termination Beneficiaries

Note: The Trustee of the Special Needs Trust should not be the termination beneficiary

Note: Where the special needs trust terminates due to the death of the special needs child, the

beneficiaries would be the children of the special needs child (if any) or, if none, the children of the

Settlors

Where the SNT is terminated because further payment would disqualify the special needs child for continued benefits, the termination

beneficiaries should be:

____

the children of the special needs child; or

____

to the following named individuals

____________________________

____________________________

____________________________

Where all the termination beneficiaries are deceased with no issue, disposition of the Special Needs Trust should be to:

______________________________________________________________________________

Should the Trustee be authorized to pay the death taxes for the special needs child from the Trust principal? Yes ____ No ____

Will any part of the Special Needs Trust be funded with assets from the special needs child, that child’s spouse (if applicable) or a

person or entity with legal authority to act on behalf of either of them? Yes ____ No ____

f yes, list assets that are to be included in the special needs trust:

____________________________________

____________________________________

____________________________________

____________________________________

If yes, ownership of these assets should be transferred to the Settlors, or another individual before the special needs trust is drafted.

Otherwise, upon the death of the special needs child, the Trustee must give the State the amounts remaining in the trust up to an

amount equal to the to the total Medi-Cal benefits paid on behalf of the beneficiary.

Do you have any other legal concerns? Yes ____ No ____. If yes, please explain:

____________________________________________________________________________________________________________

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9