Commercial Personal Property Rendition Form Page 3

ADVERTISEMENT

ACD Commercial Personal Property Rendition Form

PPAN # On Each Page

(Optional Bar Code)

SECTION G: INVENTORY AND SUPPLIES

Please list below the average prior year value of inventory and supplies owned by your business, including floor-planned goods and those consigned from outside of Arkansas

MERCHANTS

(Note: Inventory and supplies are required to be reported.)

Owner's Value

1. Last year's average goods held for sale

2. Last year's average supplies, packaging, etc....

3. Total Average Inventory (Lines 1 & 2)

4. OPTIONAL---

Last year's annual gross sales if inventory is not reported:

(Note: Inventory Multipliers located in the Commercial Personal Property Manual will be applied to

Gross Sales to determine the inventory, if the business fails to report inventory above.)

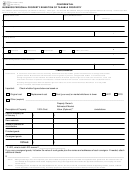

SECTION H: MANUFACTURERS' INVENTORY REPORT

This section is for the purpose of allowing County Assessor's to determine the extent of assessment of manufactures' raw materials, work-in-progress, and finished goods

inventories. The portion of the average value of these inventories sold in Arkansas are assessable. The contents of the section must be attested by the appropriate individual or

corporate officer, and are subject to audit and verification.

Instructions for Completion: Under Arkansas Law, the value of raw materials, work-in -progress, and finished goods inventories are assessed based on the annual average level

from the year prior to the year of assessment. (1) The cost basis for raw material value should reflect the sum of acquisition cost,freight, overhead, and any other costs necessary

to bring the material to a condition of utility to the owner. (2) The cost basis for work-in progress should reflect the total cost of raw material plus labor, machine time, and any

additional overhead or costs necessary to reflect it's state as work-in-progress. (3) The cost basis for finished goods should reflect the total cost of raw material plus labor,

machine time, and any additional overhead or cost necessary to produce these finished goods. Please note that the LIFO and FIFO inventory cost basis are unacceptable, but the

Weighted Average inventory cost basis is appropriate. All supplies which are not consumed and are not considered raw materials are considered taxable in Arkansas.

SIC NUMBER_____________________________

Raw Materials

Annual Average Raw Materials

$

1.

Work-in-Progress

Annual Average WIP

$

2.

Finished Goods

Annual Average Finished Goods

$

3.

Supplies

Annual Average Not Consumed in WIP

$

4.

Sales

Sales in Arkansas at cost

$

5.

Sales outside Arkansas at cost

$

6.

Total Goods Sold (Line 5 + Line 6)

$

7.

FOR ASSESSOR'S USE ONLY

Percent Sold in Arkansas (Line 5 / Line 7)

%

8.

Assessable Inventory:

a) Raw Material (Line 1 X Line 8)

$

9.

b) Work-in-Progress (Line 2 X Line 8)

$

10.

c) Finished Goods (Line 3 X Line 8)

$

11.

Supplies (Line 4)

$

12.

Total Assessable Inventory (Sum of Lines 9 through 12)

$

Assessor/Deputy: ___________________________________________________________________________________

Date: _______________________________________________________

This form prepared in accordance with Act 153 of 1995, Act 621 of 1987, Act 35 of 1988, and Act 1294 of 1997

I hereby swear or affirm that this is a true and complete list of all the personal property that by law I am required to list for taxation and that the values rendered are true and

accurate to the best of my knowledge. I do solemnly swear or affirm that I will well, and truly answer all questions that may be asked of me touching on the assessment of my

property.

Owner/Agent:_______________________________________ Print Name:_______________________________________________

Date:______________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4