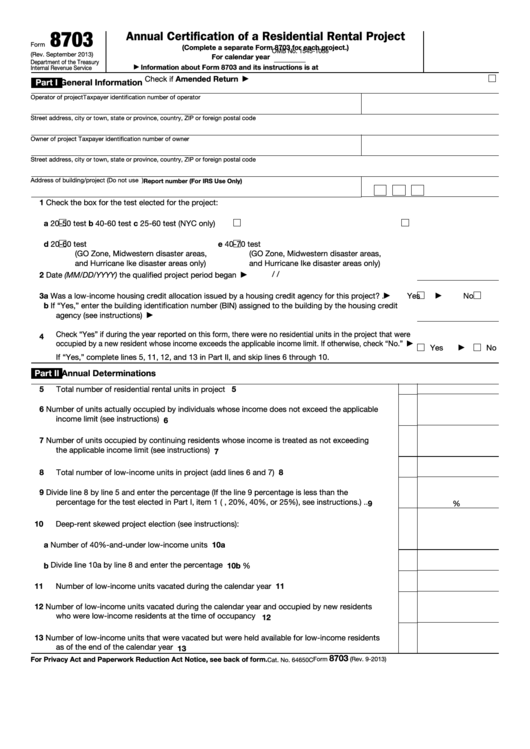

Form 8703 - Annual Certification Of A Residential Rental Project

ADVERTISEMENT

8703

Annual Certification of a Residential Rental Project

Form

(Complete a separate Form 8703 for each project.)

OMB No. 1545-1038

(Rev. September 2013)

For calendar year

Department of the Treasury

Information about Form 8703 and its instructions is at

Internal Revenue Service

▶

Check if Amended Return

▶

Part I

General Information

Operator of project

Taxpayer identification number of operator

Street address, city or town, state or province, country, ZIP or foreign postal code

Owner of project

Taxpayer identification number of owner

Street address, city or town, state or province, country, ZIP or foreign postal code

Address of building/project (Do not use P.O. box.)

Report number (For IRS Use Only)

1

Check the box for the test elected for the project:

a

20-50 test

b

40-60 test

c

25-60 test (NYC only)

d

e

20-60 test

40-70 test

(GO Zone, Midwestern disaster areas,

(GO Zone, Midwestern disaster areas,

and Hurricane Ike disaster areas only)

and Hurricane Ike disaster areas only)

/

/

2

Date (MM/DD/YYYY) the qualified project period began .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

3a Was a low-income housing credit allocation issued by a housing credit agency for this project?

.

Yes

No

▶

▶

b If “Yes,” enter the building identification number (BIN) assigned to the building by the housing credit

agency (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

Check “Yes” if during the year reported on this form, there were no residential units in the project that were

4

occupied by a new resident whose income exceeds the applicable income limit. If otherwise, check “No.”

▶

Yes

No

▶

If “Yes,” complete lines 5, 11, 12, and 13 in Part II, and skip lines 6 through 10.

Part II

Annual Determinations

5

Total number of residential rental units in project .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6

Number of units actually occupied by individuals whose income does not exceed the applicable

income limit (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

Number of units occupied by continuing residents whose income is treated as not exceeding

the applicable income limit (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

8

Total number of low-income units in project (add lines 6 and 7) .

.

.

.

.

.

.

.

.

.

.

9

Divide line 8 by line 5 and enter the percentage (If the line 9 percentage is less than the

percentage for the test elected in Part I, item 1 (i.e., 20%, 40%, or 25%), see instructions.) .

.

9

%

10

Deep-rent skewed project election (see instructions):

a Number of 40%-and-under low-income units .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10a

b Divide line 10a by line 8 and enter the percentage

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10b

%

11

11

Number of low-income units vacated during the calendar year

.

.

.

.

.

.

.

.

.

.

.

12

Number of low-income units vacated during the calendar year and occupied by new residents

who were low-income residents at the time of occupancy .

.

.

.

.

.

.

.

.

.

.

.

.

12

13

Number of low-income units that were vacated but were held available for low-income residents

as of the end of the calendar year .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

8703

For Privacy Act and Paperwork Reduction Act Notice, see back of form.

Form

(Rev. 9-2013)

Cat. No. 64650C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4