What Is Form SS-4?

IRS Form SS-4 allows any new or existing business to apply for an employer identification number (EIN) through the Internal Revenue Service.

An EIN is a nine-digit number assigned to any business, corporation, partnership or other entity for filing and reporting taxes. The latest fillable version of Form SS-4 can be downloaded below.

How to Get a Federal Tax ID Number With Form SS-4

The quickest way to apply for an EIN is via an online application. The application process is free and leaves you with your tax ID by the end of your session.

The applicant is also provided with an official downloadable copy of their EIN, which may then be used by the business in question to carry out any financial activities.

The second option is to apply for the EIN through Fax. Applicants can fax the completed Form SS-4 to the appropriate fax number. Fax numbers differ depending on the location of business:

- The Fax number is (855) 641-6935 for entities located in one of the 50 states or the District of Columbia;

- Fax numbers for businesses with no legal residence or principal office in any of the states are (855) 215-1627 (within the U.S.) and (304) 707-9471 (outside the U.S.).

Another way is to send a filled-in copy of Form SS-4 by mail. The processing time for EIN applications received by mail is 28 days.

Additionally, all international applicants may call 267-941-1099 from 6 AM to 11 PM Eastern Time Monday through Friday to apply for their EIN. The applicant will then be asked the same questions featured on Form SS-4.

Representatives of the taxpayer may apply for an EIN on behalf of their client. In these cases, the EIN can be faxed to the client on the same day as the application.

Changes to the EIN Application Process

As of May 21, 2012, the IRS has proposed a limit of one Employer Identification Number (EIN) issuance to one per responsible party per business day. This move was made to ensure fair and equitable treatment for all taxpayers.

For trusts, the limitation is applied to the grantor, owner, or trustor. For estates, the limitation is applied to the decedent (decedent estate) or the debtor (bankruptcy estate). This limitation is applicable to all requests for EINs whether online or by phone, fax or mail.

Form Ss-4 Templates

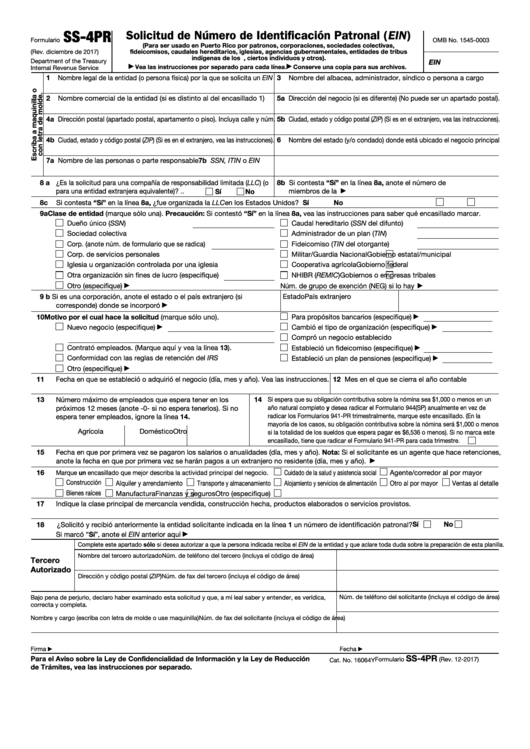

Formulario Ss-4pr - Solicitud De Numero De Identificacion Patronal (ein) (spanish Version) - 2017

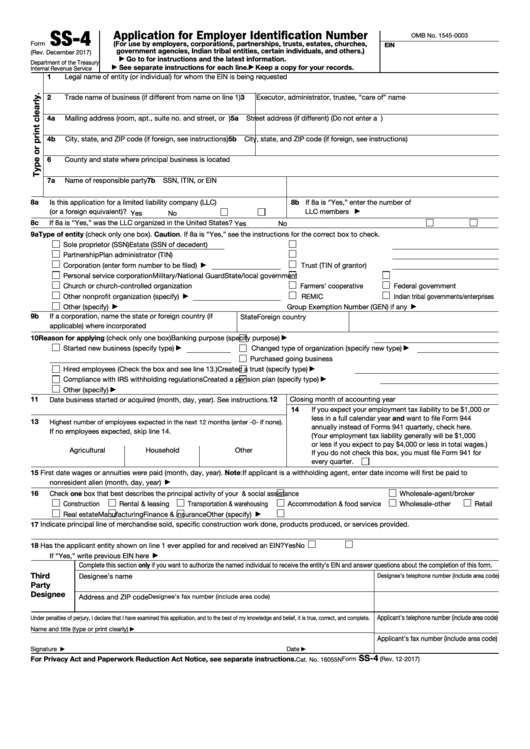

Form Ss-4 - Application For Employer Identification Number - 2017

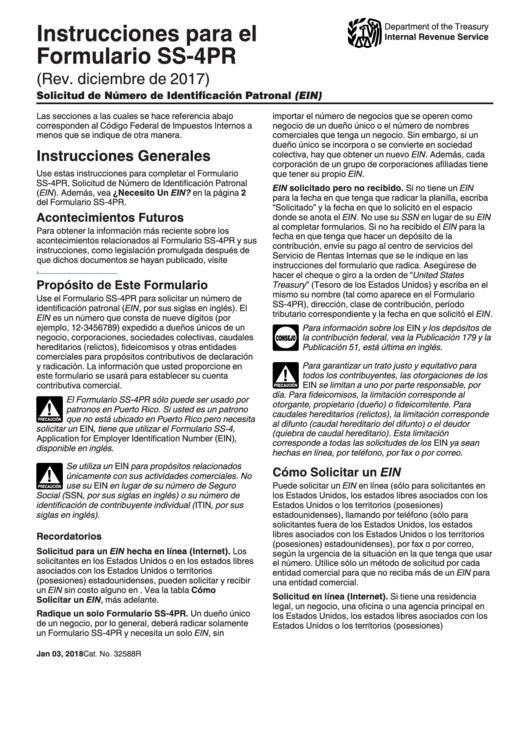

Instructions For Form Ss-4pr - Solicitud De Numero De Identificacion Patronal (ein) - 2017

Instructions For Form Ss-4 - Application For Employer Identification Number (ein) – 2017