Direct Conversion Request Form

Download a blank fillable Direct Conversion Request Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Direct Conversion Request Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

*SF2350*

SF2350/11-15

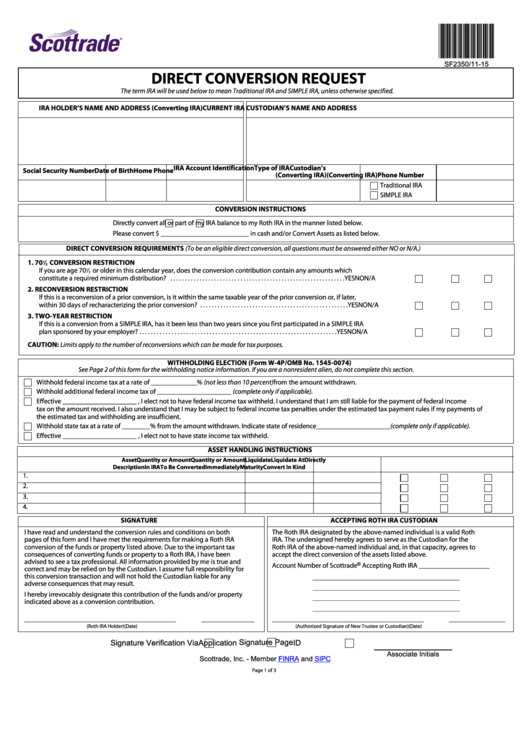

DIRECT CONVERSION REQUEST

The term IRA will be used below to mean Traditional IRA and SIMPLE IRA, unless otherwise specified.

IRA HOLDER’S NAME AND ADDRESS (Converting IRA)

CURRENT IRA CUSTODIAN’S NAME AND ADDRESS

IRA Account Identification

Type of IRA

Custodian’s

Social Security Number

Date of Birth

Home Phone

(Converting IRA)

(Converting IRA)

Phone Number

Traditional IRA

SIMPLE IRA

CONVERSION INSTRUCTIONS

Directly convert

all or

part of my IRA balance to my Roth IRA in the manner listed below.

Please convert $ _________________________ in cash and/or Convert Assets as listed below.

DIRECT CONVERSION REQUIREMENTS

(To be an eligible direct conversion, all questions must be answered either NO or N/A.)

1. 70

⁄

CONVERSION RESTRICTION

1

2

If you are age 70

⁄

or older in this calendar year, does the conversion contribution contain any amounts which

1

2

constitute a required minimum distribution? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

N/A

2. RECONVERSION RESTRICTION

If this is a reconversion of a prior conversion, is it within the same taxable year of the prior conversion or, if later,

within 30 days of recharacterizing the prior conversion? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

N/A

3. TWO-YEAR RESTRICTION

If this is a conversion from a SIMPLE IRA, has it been less than two years since you first participated in a SIMPLE IRA

plan sponsored by your employer? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

N/A

CAUTION: Limits apply to the number of reconversions which can be made for tax purposes.

WITHHOLDING ELECTION (Form W-4P/OMB No. 1545-0074)

See Page 2 of this form for the withholding notice information. If you are a nonresident alien, do not complete this section.

Withhold federal income tax at a rate of _____________% (not less than 10 percent) from the amount withdrawn.

Withhold additional federal income tax of _____________________ (complete only if applicable).

Effective _____________________ , I elect not to have federal income tax withheld. I understand that I am still liable for the payment of federal income

tax on the amount received. I also understand that I may be subject to federal income tax penalties under the estimated tax payment rules if my payments of

the estimated tax and withholding are insufficient.

Withhold state tax at a rate of ________% from the amount withdrawn. Indicate state of residence_____________________ (complete only if applicable).

Effective _____________________ , I elect not to have state income tax withheld.

ASSET HANDLING INSTRUCTIONS

Asset

Quantity or Amount

Quantity or Amount

Liquidate

Liquidate At

Directly

Description

In IRA

To Be Converted

Immediately

Maturity

Convert In Kind

1.

2.

3.

4.

SIGNATURE

ACCEPTING ROTH IRA CUSTODIAN

I have read and understand the conversion rules and conditions on both

The Roth IRA designated by the above-named individual is a valid Roth

pages of this form and I have met the requirements for making a Roth IRA

IRA. The undersigned hereby agrees to serve as the Custodian for the

conversion of the funds or property listed above. Due to the important tax

Roth IRA of the above-named individual and, in that capacity, agrees to

consequences of converting funds or property to a Roth IRA, I have been

accept the direct conversion of the assets listed above.

advised to see a tax professional. All information provided by me is true and

Account Number of Scottrade

®

Accepting Roth IRA ____________________

correct and may be relied on by the Custodian. I assume full responsibility for

this conversion transaction and will not hold the Custodian liable for any

_______________________________________________________

adverse consequences that may result.

_______________________________________________________

I hereby irrevocably designate this contribution of the funds and/or property

_______________________________________________________

indicated above as a conversion contribution.

_______________________________________________________

___________________________________________

_______________

___________________________________________

________________

(Roth IRA Holder)

(Date)

(Authorized Signature of New Trustee or Custodian)

(Date)

Signature Page

Signature Verification Via

Application

ID

Associate Initials

Scottrade, Inc. - Member

FINRA

and

SIPC

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3