Information Concerning Claims For - Cch Site Builder

ADVERTISEMENT

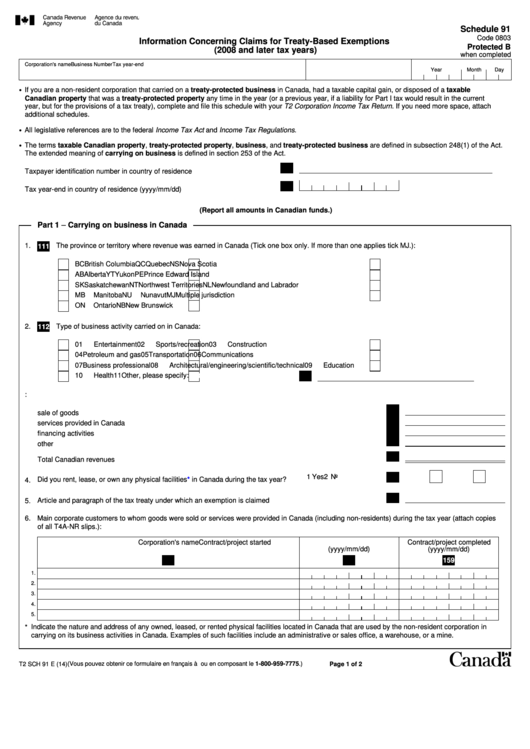

Schedule 91

Code 0803

Information Concerning Claims for Treaty-Based Exemptions

Protected B

(2008 and later tax years)

when completed

Corporation's name

Business Number

Tax year-end

Year

Month

Day

•

If you are a non-resident corporation that carried on a treaty-protected business in Canada, had a taxable capital gain, or disposed of a taxable

Canadian property that was a treaty-protected property any time in the year (or a previous year, if a liability for Part I tax would result in the current

year, but for the provisions of a tax treaty), complete and file this schedule with your T2 Corporation Income Tax Return. If you need more space, attach

additional schedules.

•

All legislative references are to the federal Income Tax Act and Income Tax Regulations.

•

The terms taxable Canadian property, treaty-protected property, business, and treaty-protected business are defined in subsection 248(1) of the Act.

The extended meaning of carrying on business is defined in section 253 of the Act.

105

Taxpayer identification number in country of residence . . . . . . . . . . . . . . . . . . .

110

Tax year-end in country of residence (yyyy/mm/dd) . . . . . . . . . . . . . . . . . . . . . .

(Report all amounts in Canadian funds.)

Part 1 – Carrying on business in Canada

1.

The province or territory where revenue was earned in Canada (Tick one box only. If more than one applies tick MJ.):

111

BC

British Columbia

QC

Quebec

NS

Nova Scotia

AB

Alberta

YT

Yukon

PE

Prince Edward Island

SK

Saskatchewan

NT

Northwest Territories

NL

Newfoundland and Labrador

MB

Manitoba

NU

Nunavut

MJ

Multiple jurisdiction

ON

Ontario

NB

New Brunswick

2.

Type of business activity carried on in Canada:

112

01

Entertainment

02

Sports/recreation

03

Construction

04

Petroleum and gas

05

Transportation

06

Communications

07

Business professional

08

Architectural/engineering/scientific/technical

09

Education

10

Health

11

Other, please specify:

113

3. Canadian revenues derived by:

115

sale of goods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

116

services provided in Canada . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

117

financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

118

other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

125

Total Canadian revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

135

1 Yes

2 No

4. Did you rent, lease, or own any physical

facilities*

in Canada during the tax year?. . . . . . . . . . . . . . . . . . . . . .

146

5. Article and paragraph of the tax treaty under which an exemption is claimed . . . . . . . . . . . . . . . . . . . . . . . . .

6. Main corporate customers to whom goods were sold or services were provided in Canada (including non-residents) during the tax year (attach copies

of all T4A-NR slips.):

Corporation's name

Contract/project started

Contract/project completed

(yyyy/mm/dd)

(yyyy/mm/dd)

155

158

159

1.

2.

3.

4.

5.

* Indicate the nature and address of any owned, leased, or rented physical facilities located in Canada that are used by the non-resident corporation in

carrying on its business activities in Canada. Examples of such facilities include an administrative or sales office, a warehouse, or a mine.

T2 SCH 91 E (14)

(Vous pouvez obtenir ce formulaire en français à ou en composant le 1-800-959-7775.)

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2