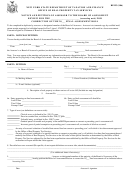

RP-552 (1/06)

2

Real Property Tax Law, Section 550(2):

A “clerical error” means:

(a) an entry of assessed value on the assessment roll which differs from the entry for the same parcel on the property record,

field book or other final work product of the assessor, due to an error in transcription;

(b) a mathematical error in the computation of a partial exemption;

(c) an incorrect entry due to the failure of the assessor to act on a partial exemption;

(d) [not applicable to tentative assessment rolls];

(e) an incorrect entry due to a mistake in the determination or transcription of a special assessment or other charge based on

units of service provided by a special district;

(f) a duplicate entry of the description or assessed valuation, or both, of an entire single parcel;

(g) an entry on an assessment roll which is incorrect by reason of an arithmetical mistake by the assessor appearing on the

property record card, field book or other final work product of the assessor, or;

(h),(i) [not applicable to tentative assessment rolls].

Real Property Tax Law, Section 550(3):

An “error in essential fact” means:

(a) the assessment of an improvement destroyed or removed prior to taxable status date;

(b) the assessment of an improvement not in existence or present on a different parcel;

(c) an incorrect entry of acreage which was considered by the assessor in valuing the parcel and which resulted in an incorrect

assessed valuation, where such acreage is shown to be incorrect on a survey submitted by the applicant;

(d) the omission of the value of an improvement present on real property prior to taxable status date;

(e) an incorrect entry of a partial exemption for a parcel which is not eligible for such exemption; or

(f) misclassification of a parcel in an approved assessing unit, which is exclusively used for either residential or non-

residential purposes.

Real Property Tax Law, Section 550(7):

An “unlawful entry” means:

(a) an assessment of wholly exempt property on the taxable portion of the assessment roll;

(b) an assessment of real property located entirely outside the boundaries of the assessing unit, the school district, or the

special district in which the real property is designated as being located;

(c) an entry made by a person or body without the authority to make such entry;

(d) an assessment of taxable state land which exceeds the assessment as approved by the Office of Real Property Tax

Services; or

(e) an assessment of special franchise property, which exceeds the final assessment as made by the Office of Real Property

Tax Services [or second condition not applicable to tentative roll].

Real Property Tax Law, Section 467(8):

Late Senior Citizen Exemption Renewal Application.

Each city, town, village, and county with the power to assess real property is authorized to enact a local law

authorizing the assessor to accept senior citizen exemption renewal applications filed after taxable status date and on or before

the date for the hearing of complaints. If such local law has been enacted and a senior citizen exemption was granted on the

preceding assessment roll, complete this form and send it to the Board of Assessment Review, with a copy to the taxpayer. Do

not enter the exemption on the assessment roll until authorized by the Board of Assessment Review.

1

1 2

2