Retirement Savings Worksheet Template

ADVERTISEMENT

Are you on track for retirement?

If you haven’t calculated how much retirement income your current savings may provide, it’s time. To maintain your

standard of living, some experts say retirement income should be about 85 percent of your current income.

1

Figure out

how much of your current pay you may need to reach your retirement savings goal. Grab a calculator to help with the

math.

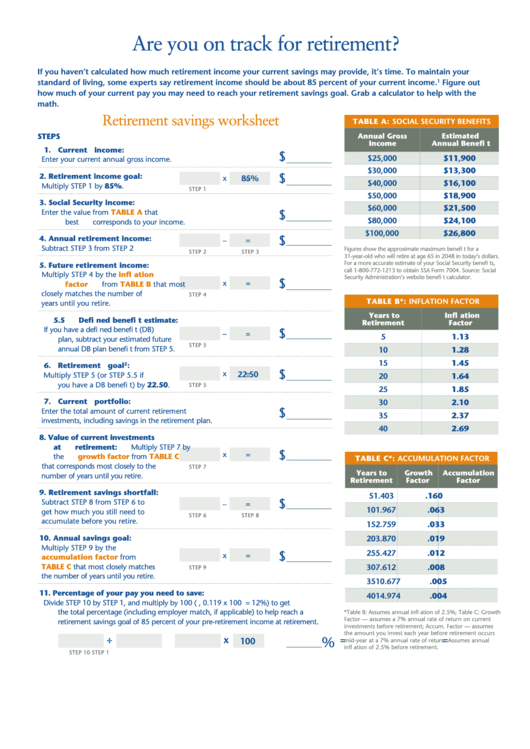

Retirement savings worksheet

TABLE A: SOCIAL SECURITY BENEFITS

Annual Gross

Estimated

STEPS

Income

Annual Benefi t

1. Current income:

$

$25,000

$11,900

Enter your current annual gross income.

$30,000

$13,300

$

2. Retirement income goal:

x

85%

=

$40,000

$16,100

Multiply STEP 1 by 85%.

STEP 1

$50,000

$18,900

3. Social Security income:

$60,000

$21,500

Enter the value from

TABLE A

that

$

$80,000

$24,100

best corresponds to your income.

$100,000

$26,800

$

4. Annual retirement income:

–

=

Subtract STEP 3 from STEP 2

Figures show the approximate maximum benefi t for a

STEP 2

STEP 3

31-year-old who will retire at age 65 in 2048 in today’s dollars.

For a more accurate estimate of your Social Security benefi ts,

5. Future retirement income:

call 1-800-772-1213 to obtain SSA Form 7004. Source: Social

Multiply STEP 4 by the

infl ation

Security Administration’s website benefi t calculator.

$

x

=

factor

from

TABLE B

that most

closely matches the number of

STEP 4

TABLE B*: INFLATION FACTOR

years until you retire.

Years to

Infl ation

5.5 Defi ned benefi t estimate:

Retirement

Factor

If you have a defi ned benefi t (DB)

$

–

=

5

1.13

plan, subtract your estimated future

STEP 5

annual DB plan benefi t from STEP 5.

10

1.28

15

1.45

6. Retirement goal

2

:

$

x

=

22.50

Multiply STEP 5 (or STEP 5.5 if

20

1.64

you have a DB benefi t) by 22.50.

STEP 5

25

1.85

7. Current portfolio:

30

2.10

$

Enter the total amount of current retirement

35

2.37

investments, including savings in the retirement plan.

40

2.69

8. Value of current investments

at retirement: Multiply STEP 7 by

$

x

=

the

growth factor

from

TABLE C

TABLE C*: ACCUMULATION FACTOR

that corresponds most closely to the

STEP 7

Years to

Growth

Accumulation

number of years until you retire.

Retirement

Factor

Factor

9. Retirement savings shortfall:

5

1.403

.160

$

Subtract STEP 8 from STEP 6 to

–

=

10

1.967

.063

get how much you still need to

STEP 6

STEP 8

accumulate before you retire.

15

2.759

.033

10. Annual savings goal:

20

3.870

.019

Multiply STEP 9 by the

25

5.427

.012

$

x

=

accumulation factor

from

TABLE C

that most closely matches

30

7.612

.008

STEP 9

the number of years until you retire.

35

10.677

.005

11. Percentage of your pay you need to save:

40

14.974

.004

Divide STEP 10 by STEP 1, and multiply by 100 (e.g., 0.119 x 100 = 12%) to get

the total percentage (including employer match, if applicable) to help reach a

*Table B: Assumes annual infl ation of 2.5%; Table C: Growth

Factor — assumes a 7% annual rate of return on current

retirement savings goal of 85 percent of your pre-retirement income at retirement.

investments before retirement; Accum. Factor — assumes

the amount you invest each year before retirement occurs

÷

=

x

=

%

100

mid-year at a 7% annual rate of return. Assumes annual

infl ation of 2.5% before retirement.

STEP 10

STEP 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1