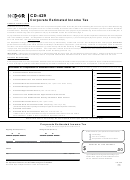

Corporate Estimated Income Tax Page 2

ADVERTISEMENT

DR 0112EP (09/21/16)

*DO=NOT=SEND*

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0008

Corporate Worksheet

Colorado Estimated Tax —

1. Estimated 2017 Colorado income tax — Corporate tax rate is 4.63%

$

00

2. Recapture of prior year credits

$

00

3. Total of lines 1 and 2

$

00

4. Estimated 2017 Form 112CR credits

$

00

5. Colorado tax liability, line 3 minus line 4

$

00

6. Net estimated tax liability, line 5 times 70%

$

00

Payment

2016

Net Amount Due

Payment Due

Due Dates

Number

Overpayment Applied

1

$

00 $

00 $

00

April 18

2

$

00 $

00 $

00

June 15

3

$

00 $

00 $

00

September 15

4

$

00 $

00 $

00

December 15, 2017

Round your payment to the nearest dollar. If paying by check, the amount on the check and the amount entered on the

payment form must be the same. This will help maintain accuracy in your tax account. It is strongly recommended that

estimated payments be submitted online at or by EFT at

eft to avoid problems or delays with the 2017 income tax return.

Due Dates: If the due date falls on a weekend or federal holiday, payment will be due the next business day.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3