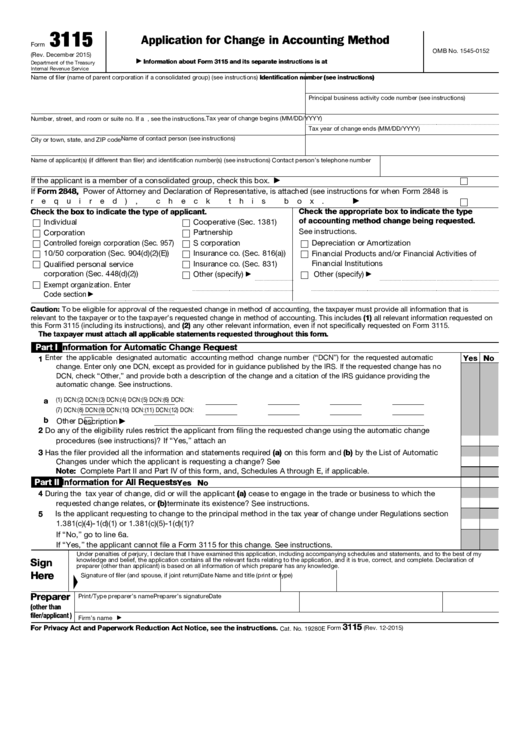

3115

Application for Change in Accounting Method

Form

OMB No. 1545-0152

(Rev. December 2015)

Information about Form 3115 and its separate instructions is at

▶

Department of the Treasury

Internal Revenue Service

Identification number (see instructions)

Name of filer (name of parent corporation if a consolidated group) (see instructions)

Principal business activity code number (see instructions)

Number, street, and room or suite no. If a P.O. box, see the instructions.

Tax year of change begins (MM/DD/YYYY)

Tax year of change ends (MM/DD/YYYY)

Name of contact person (see instructions)

City or town, state, and ZIP code

Name of applicant(s) (if different than filer) and identification number(s) (see instructions)

Contact person’s telephone number

If the applicant is a member of a consolidated group, check this box.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

If Form 2848, Power of Attorney and Declaration of Representative, is attached (see instructions for when Form 2848 is

required), check this box. .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

Check the box to indicate the type of applicant.

Check the appropriate box to indicate the type

of accounting method change being requested.

Individual

Cooperative (Sec. 1381)

See instructions.

Corporation

Partnership

Depreciation or Amortization

Controlled foreign corporation (Sec. 957)

S corporation

10/50 corporation (Sec. 904(d)(2)(E))

Insurance co. (Sec. 816(a))

Financial Products and/or Financial Activities of

Financial Institutions

Insurance co. (Sec. 831)

Qualified personal service

corporation (Sec. 448(d)(2))

Other (specify)

Other (specify)

▶

▶

Exempt organization. Enter

Code section

▶

Caution: To be eligible for approval of the requested change in method of accounting, the taxpayer must provide all information that is

relevant to the taxpayer or to the taxpayer’s requested change in method of accounting. This includes (1) all relevant information requested on

this Form 3115 (including its instructions), and (2) any other relevant information, even if not specifically requested on Form 3115.

The taxpayer must attach all applicable statements requested throughout this form.

Part I

Information for Automatic Change Request

Enter the applicable designated automatic accounting method change number (“DCN”) for the requested automatic

Yes No

1

change. Enter only one DCN, except as provided for in guidance published by the IRS. If the requested change has no

DCN, check “Other,” and provide both a description of the change and a citation of the IRS guidance providing the

automatic change. See instructions.

(1) DCN:

(2) DCN:

(3) DCN:

(4) DCN:

(5) DCN:

(6) DCN:

a

(7) DCN:

(8) DCN:

(9) DCN:

(10) DCN:

(11) DCN:

(12) DCN:

b Other

Description

▶

2

Do any of the eligibility rules restrict the applicant from filing the requested change using the automatic change

procedures (see instructions)? If “Yes,” attach an explanation.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Has the filer provided all the information and statements required (a) on this form and (b) by the List of Automatic

Changes under which the applicant is requesting a change? See instructions. . . . . . . . . . . . . . . .

Note: Complete Part II and Part IV of this form, and, Schedules A through E, if applicable.

Part II

Information for All Requests

Yes No

4

During the tax year of change, did or will the applicant (a) cease to engage in the trade or business to which the

requested change relates, or (b) terminate its existence? See instructions.

.

.

.

.

.

.

.

.

.

.

.

.

.

Is the applicant requesting to change to the principal method in the tax year of change under Regulations section

5

1.381(c)(4)-1(d)(1) or 1.381(c)(5)-1(d)(1)? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If “No,” go to line 6a.

If “Yes,” the applicant cannot file a Form 3115 for this change. See instructions.

Under penalties of perjury, I declare that I have examined this application, including accompanying schedules and statements, and to the best of my

knowledge and belief, the application contains all the relevant facts relating to the application, and it is true, correct, and complete. Declaration of

Sign

preparer (other than applicant) is based on all information of which preparer has any knowledge.

Here

Signature of filer (and spouse, if joint return)

Date

Name and title (print or type)

Preparer

Preparer’s signature

Date

Print/Type preparer’s name

(other than

filer/applicant)

Firm’s name

▶

3115

For Privacy Act and Paperwork Reduction Act Notice, see the instructions.

Form

(Rev. 12-2015)

Cat. No. 19280E

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8