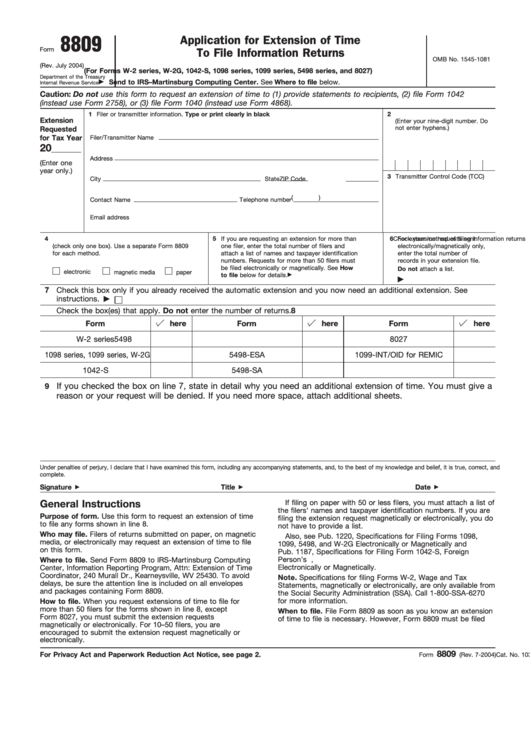

8809

Application for Extension of Time

Form

To File Information Returns

OMB No. 1545-1081

(Rev. July 2004)

(For Forms W-2 series, W-2G, 1042-S, 1098 series, 1099 series, 5498 series, and 8027)

Department of the Treasury

Send to IRS–Martinsburg Computing Center. See Where to file below.

Internal Revenue Service

Caution: Do not use this form to request an extension of time to (1) provide statements to recipients, (2) file Form 1042

(instead use Form 2758), or (3) file Form 1040 (instead use Form 4868).

1 Filer or transmitter information. Type or print clearly in black ink.

2

Taxpayer identification number

Extension

(Enter your nine-digit number. Do

not enter hyphens.)

Requested

for Tax Year

Filer/Transmitter Name

20

Address

(Enter one

year only.)

3 Transmitter Control Code (TCC)

City

State

ZIP Code

(

)

Contact Name

Telephone number

Email address

4

Check your method of filing information returns

5

If you are requesting an extension for more than

6

For extension requests sent

(check only one box). Use a separate Form 8809

one filer, enter the total number of filers and

electronically/magnetically only,

for each method.

attach a list of names and taxpayer identification

enter the total number of

numbers. Requests for more than 50 filers must

records in your extension file.

be filed electronically or magnetically. See How

Do not attach a list.

electronic

magnetic media

paper

to file below for details.

7

Check this box only if you already received the automatic extension and you now need an additional extension. See

instructions.

8

Check the box(es) that apply. Do not enter the number of returns.

here

here

here

Form

Form

Form

W-2 series

5498

8027

1098 series, 1099 series, W-2G

5498-ESA

1099-INT/OID for REMIC

1042-S

5498-SA

If you checked the box on line 7, state in detail why you need an additional extension of time. You must give a

9

reason or your request will be denied. If you need more space, attach additional sheets.

Under penalties of perjury, I declare that I have examined this form, including any accompanying statements, and, to the best of my knowledge and belief, it is true, correct, and

complete.

Signature

Title

Date

If filing on paper with 50 or less filers, you must attach a list of

General Instructions

the filers’ names and taxpayer identification numbers. If you are

Purpose of form. Use this form to request an extension of time

filing the extension request magnetically or electronically, you do

to file any forms shown in line 8.

not have to provide a list.

Who may file. Filers of returns submitted on paper, on magnetic

Also, see Pub. 1220, Specifications for Filing Forms 1098,

media, or electronically may request an extension of time to file

1099, 5498, and W-2G Electronically or Magnetically and

on this form.

Pub. 1187, Specifications for Filing Form 1042-S, Foreign

Person’s U.S. Source Income Subject to Withholding,

Where to file. Send Form 8809 to IRS-Martinsburg Computing

Center, Information Reporting Program, Attn: Extension of Time

Electronically or Magnetically.

Coordinator, 240 Murall Dr., Kearneysville, WV 25430. To avoid

Note. Specifications for filing Forms W-2, Wage and Tax

delays, be sure the attention line is included on all envelopes

Statements, magnetically or electronically, are only available from

and packages containing Form 8809.

the Social Security Administration (SSA). Call 1-800-SSA-6270

for more information.

How to file. When you request extensions of time to file for

more than 50 filers for the forms shown in line 8, except

When to file. File Form 8809 as soon as you know an extension

Form 8027, you must submit the extension requests

of time to file is necessary. However, Form 8809 must be filed

magnetically or electronically. For 10–50 filers, you are

encouraged to submit the extension request magnetically or

electronically.

8809

For Privacy Act and Paperwork Reduction Act Notice, see page 2.

Cat. No. 10322N

Form

(Rev. 7-2004)

1

1 2

2