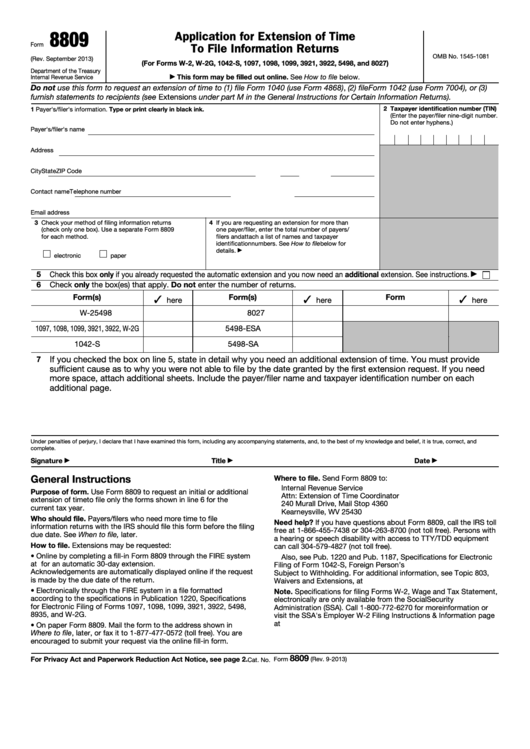

8809

Application for Extension of Time

Form

To File Information Returns

OMB No. 1545-1081

(Rev. September 2013)

(For Forms W-2, W-2G, 1042-S, 1097, 1098, 1099, 3921, 3922, 5498, and 8027)

Department of the Treasury

This form may be filled out online. See How to file below.

Internal Revenue Service

▶

Do not use this form to request an extension of time to (1) file Form 1040 (use Form 4868), (2) file Form 1042 (use Form 7004), or (3)

furnish statements to recipients (see Extensions under part M in the General Instructions for Certain Information Returns).

2 Taxpayer identification number (TIN)

1 Payer's/filer's information. Type or print clearly in black ink.

(Enter the payer/filer nine-digit number.

Do not enter hyphens.)

Payer's/filer's name

Address

City

State

ZIP Code

Contact name

Telephone number

Email address

3 Check your method of filing information returns

4 If you are requesting an extension for more than

(check only one box). Use a separate Form 8809

one payer/filer, enter the total number of payers/

for each method.

filers and attach a list of names and taxpayer

identification numbers. See How to file below for

details.

▶

electronic

paper

5

Check this box only if you already requested the automatic extension and you now need an additional extension. See instructions.

▶

6

Check only the box(es) that apply. Do not enter the number of returns.

Form(s)

Form(s)

Form

✓

✓

✓

here

here

here

W-2

5498

8027

1097, 1098, 1099, 3921, 3922, W-2G

5498-ESA

1042-S

5498-SA

If you checked the box on line 5, state in detail why you need an additional extension of time. You must provide

7

sufficient cause as to why you were not able to file by the date granted by the first extension request. If you need

more space, attach additional sheets. Include the payer/filer name and taxpayer identification number on each

additional page.

Under penalties of perjury, I declare that I have examined this form, including any accompanying statements, and, to the best of my knowledge and belief, it is true, correct, and

complete.

Signature

Title

Date

▶

▶

▶

General Instructions

Where to file. Send Form 8809 to:

Internal Revenue Service

Purpose of form. Use Form 8809 to request an initial or additional

Attn: Extension of Time Coordinator

extension of time to file only the forms shown in line 6 for the

240 Murall Drive, Mail Stop 4360

current tax year.

Kearneysville, WV 25430

Who should file. Payers/filers who need more time to file

Need help? If you have questions about Form 8809, call the IRS toll

information returns with the IRS should file this form before the filing

free at 1-866-455-7438 or 304-263-8700 (not toll free). Persons with

due date. See When to file, later.

a hearing or speech disability with access to TTY/TDD equipment

How to file. Extensions may be requested:

can call 304-579-4827 (not toll free).

• Online by completing a fill-in Form 8809 through the FIRE system

Also, see Pub. 1220 and Pub. 1187, Specifications for Electronic

at for an automatic 30-day extension.

Filing of Form 1042-S, Foreign Person’s U.S. Source Income

Acknowledgements are automatically displayed online if the request

Subject to Withholding. For additional information, see Topic 803,

is made by the due date of the return.

Waivers and Extensions, at

• Electronically through the FIRE system in a file formatted

Note. Specifications for filing Forms W-2, Wage and Tax Statement,

according to the specifications in Publication 1220, Specifications

electronically are only available from the Social Security

for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498,

Administration (SSA). Call 1-800-772-6270 for more information or

8935, and W-2G.

visit the SSA's Employer W-2 Filing Instructions & Information page

at

• On paper Form 8809. Mail the form to the address shown in

Where to file, later, or fax it to 1-877-477-0572 (toll free). You are

encouraged to submit your request via the online fill-in form.

8809

For Privacy Act and Paperwork Reduction Act Notice, see page 2.

Form

(Rev. 9-2013)

Cat. No. 10322N

1

1 2

2