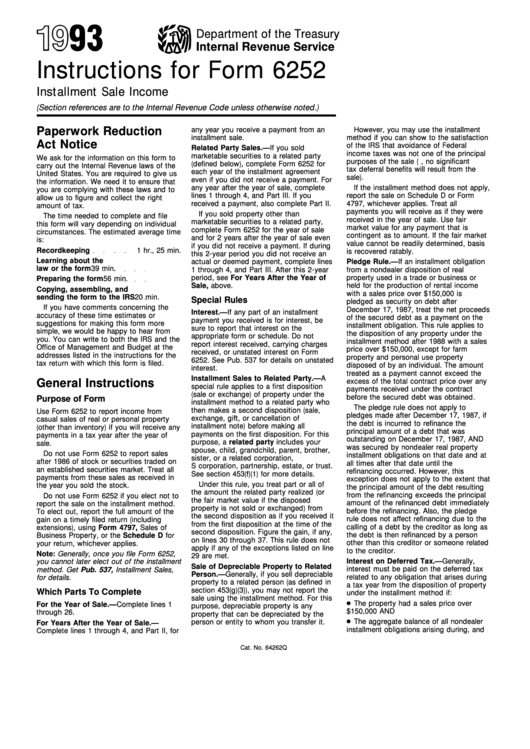

Irs Instructions For Form 6252 1993

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

Instructions for Form 6252

Installment Sale Income

(Section references are to the Internal Revenue Code unless otherwise noted.)

Paperwork Reduction

any year you receive a payment from an

However, you may use the installment

installment sale.

method if you can show to the satisfaction

Act Notice

of the IRS that avoidance of Federal

Related Party Sales.—If you sold

income taxes was not one of the principal

marketable securities to a related party

We ask for the information on this form to

purposes of the sale (e.g., no significant

(defined below), complete Form 6252 for

carry out the Internal Revenue laws of the

tax deferral benefits will result from the

each year of the installment agreement

United States. You are required to give us

sale).

even if you did not receive a payment. For

the information. We need it to ensure that

any year after the year of sale, complete

If the installment method does not apply,

you are complying with these laws and to

lines 1 through 4, and Part III. If you

report the sale on Schedule D or Form

allow us to figure and collect the right

received a payment, also complete Part II.

4797, whichever applies. Treat all

amount of tax.

payments you will receive as if they were

If you sold property other than

The time needed to complete and file

received in the year of sale. Use fair

marketable securities to a related party,

this form will vary depending on individual

market value for any payment that is

complete Form 6252 for the year of sale

circumstances. The estimated average time

contingent as to amount. If the fair market

and for 2 years after the year of sale even

is:

value cannot be readily determined, basis

if you did not receive a payment. If during

Recordkeeping

1 hr., 25 min.

is recovered ratably.

this 2-year period you did not receive an

Learning about the

actual or deemed payment, complete lines

Pledge Rule.—If an installment obligation

law or the form

39 min.

from a nondealer disposition of real

1 through 4, and Part III. After this 2-year

period, see For Years After the Year of

property used in a trade or business or

Preparing the form

56 min.

Sale, above.

held for the production of rental income

Copying, assembling, and

with a sales price over $150,000 is

sending the form to the IRS

20 min.

Special Rules

pledged as security on debt after

If you have comments concerning the

December 17, 1987, treat the net proceeds

Interest.—If any part of an installment

accuracy of these time estimates or

of the secured debt as a payment on the

payment you received is for interest, be

suggestions for making this form more

installment obligation. This rule applies to

sure to report that interest on the

simple, we would be happy to hear from

the disposition of any property under the

appropriate form or schedule. Do not

you. You can write to both the IRS and the

installment method after 1988 with a sales

report interest received, carrying charges

Office of Management and Budget at the

price over $150,000, except for farm

received, or unstated interest on Form

addresses listed in the instructions for the

property and personal use property

6252. See Pub. 537 for details on unstated

tax return with which this form is filed.

disposed of by an individual. The amount

interest.

treated as a payment cannot exceed the

Installment Sales to Related Party.—A

General Instructions

excess of the total contract price over any

special rule applies to a first disposition

payments received under the contract

(sale or exchange) of property under the

before the secured debt was obtained.

Purpose of Form

installment method to a related party who

The pledge rule does not apply to

then makes a second disposition (sale,

Use Form 6252 to report income from

pledges made after December 17, 1987, if

exchange, gift, or cancellation of

casual sales of real or personal property

the debt is incurred to refinance the

installment note) before making all

(other than inventory) if you will receive any

principal amount of a debt that was

payments on the first disposition. For this

payments in a tax year after the year of

outstanding on December 17, 1987, AND

purpose, a related party includes your

sale.

was secured by nondealer real property

spouse, child, grandchild, parent, brother,

Do not use Form 6252 to report sales

installment obligations on that date and at

sister, or a related corporation,

after 1986 of stock or securities traded on

all times after that date until the

S corporation, partnership, estate, or trust.

an established securities market. Treat all

refinancing occurred. However, this

See section 453(f)(1) for more details.

payments from these sales as received in

exception does not apply to the extent that

Under this rule, you treat part or all of

the year you sold the stock.

the principal amount of the debt resulting

the amount the related party realized (or

from the refinancing exceeds the principal

Do not use Form 6252 if you elect not to

the fair market value if the disposed

amount of the refinanced debt immediately

report the sale on the installment method.

property is not sold or exchanged) from

before the refinancing. Also, the pledge

To elect out, report the full amount of the

the second disposition as if you received it

rule does not affect refinancing due to the

gain on a timely filed return (including

from the first disposition at the time of the

calling of a debt by the creditor as long as

extensions), using Form 4797, Sales of

second disposition. Figure the gain, if any,

the debt is then refinanced by a person

Business Property, or the Schedule D for

on lines 30 through 37. This rule does not

other than this creditor or someone related

your return, whichever applies.

apply if any of the exceptions listed on line

to the creditor.

Note: Generally, once you file Form 6252,

29 are met.

Interest on Deferred Tax.—Generally,

you cannot later elect out of the installment

Sale of Depreciable Property to Related

interest must be paid on the deferred tax

method. Get Pub. 537, Installment Sales,

Person.—Generally, if you sell depreciable

related to any obligation that arises during

for details.

property to a related person (as defined in

a tax year from the disposition of property

section 453(g)(3)), you may not report the

Which Parts To Complete

under the installment method if:

sale using the installment method. For this

The property had a sales price over

For the Year of Sale.—Complete lines 1

purpose, depreciable property is any

$150,000 AND

through 26.

property that can be depreciated by the

The aggregate balance of all nondealer

person or entity to whom you transfer it.

For Years After the Year of Sale.—

installment obligations arising during, and

Complete lines 1 through 4, and Part II, for

Cat. No. 64262Q

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2