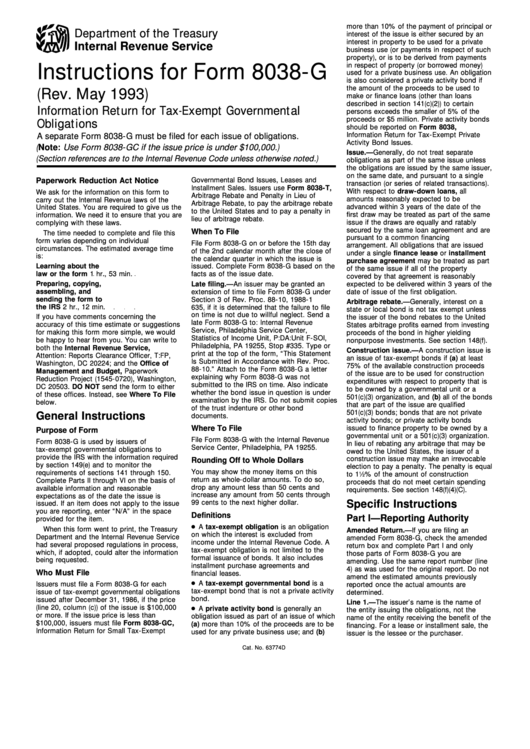

Instructions For Form 8038-G - Information Return For Tax-Exempt Governmental Obligations - 1993

ADVERTISEMENT

more than 10% of the payment of principal or

Department of the Treasury

interest of the issue is either secured by an

interest in property to be used for a private

Internal Revenue Service

business use (or payments in respect of such

property), or is to be derived from payments

in respect of property (or borrowed money)

Instructions for Form 8038-G

used for a private business use. An obligation

is also considered a private activity bond if

the amount of the proceeds to be used to

(Rev. May 1993)

make or finance loans (other than loans

described in section 141(c)(2)) to certain

Information Return for Tax-Exempt Governmental

persons exceeds the smaller of 5% of the

proceeds or $5 million. Private activity bonds

Obligations

should be reported on Form 8038,

Information Return for Tax-Exempt Private

A separate Form 8038-G must be filed for each issue of obligations.

Activity Bond Issues.

(Note: Use For m 8038-GC if the issue price is under $100,000. )

Issue.—Generally, do not treat separate

(Section references are to the Internal Revenue Code unless otherwise noted. )

obligations as part of the same issue unless

the obligations are issued by the same issuer,

on the same date, and pursuant to a single

Paperwork Reduction Act Notice

Governmental Bond Issues, Leases and

transaction (or series of related transactions).

Installment Sales. Issuers use Form 8038-T,

With respect to draw-down loans, all

We ask for the information on this form to

Arbitrage Rebate and Penalty in Lieu of

amounts reasonably expected to be

carry out the Internal Revenue laws of the

Arbitrage Rebate, to pay the arbitrage rebate

advanced within 3 years of the date of the

United States. You are required to give us the

to the United States and to pay a penalty in

first draw may be treated as part of the same

information. We need it to ensure that you are

lieu of arbitrage rebate.

issue if the draws are equally and ratably

complying with these laws.

secured by the same loan agreement and are

When To File

The time needed to complete and file this

pursuant to a common financing

form varies depending on individual

File Form 8038-G on or before the 15th day

arrangement. All obligations that are issued

circumstances. The estimated average time

of the 2nd calendar month after the close of

under a single finance lease or installment

is:

the calendar quarter in which the issue is

purchase agreement may be treated as part

Learning about the

issued. Complete Form 8038-G based on the

of the same issue if all of the property

law or the form

1 hr., 53 min.

facts as of the issue date.

covered by that agreement is reasonably

Preparing, copying,

Late filing.—An issuer may be granted an

expected to be delivered within 3 years of the

assembling, and

extension of time to file Form 8038-G under

date of issue of the first obligation.

sending the form to

Section 3 of Rev. Proc. 88-10, 1988-1 C.B.

Arbitrage rebate.—Generally, interest on a

the IRS

2 hr., 12 min.

635, if it is determined that the failure to file

state or local bond is not tax exempt unless

on time is not due to willful neglect. Send a

If you have comments concerning the

the issuer of the bond rebates to the United

late Form 8038-G to: Internal Revenue

accuracy of this time estimate or suggestions

States arbitrage profits earned from investing

Service, Philadelphia Service Center,

for making this form more simple, we would

proceeds of the bond in higher yielding

Statistics of Income Unit, P:DA:Unit F-SOI,

be happy to hear from you. You can write to

nonpurpose investments. See section 148(f).

Philadelphia, PA 19255, Stop #335. Type or

both the Internal Revenue Service,

Construction issue.—A construction issue is

print at the top of the form, “This Statement

Attention: Reports Clearance Officer, T:FP,

an issue of tax-exempt bonds if (a) at least

Is Submitted in Accordance with Rev. Proc.

Washington, DC 20224; and the Office of

75% of the available construction proceeds

88-10.” Attach to the Form 8038-G a letter

Management and Budget, Paperwork

of the issue are to be used for construction

explaining why Form 8038-G was not

Reduction Project (1545-0720), Washington,

expenditures with respect to property that is

submitted to the IRS on time. Also indicate

DC 20503. DO NOT send the form to either

to be owned by a governmental unit or a

whether the bond issue in question is under

of these offices. Instead, see Where To File

501(c)(3) organization, and (b) all of the bonds

examination by the IRS. Do not submit copies

below.

that are part of the issue are qualified

of the trust indenture or other bond

501(c)(3) bonds; bonds that are not private

General Instructions

documents.

activity bonds; or private activity bonds

Where To File

issued to finance property to be owned by a

Purpose of Form

governmental unit or a 501(c)(3) organization.

File Form 8038-G with the Internal Revenue

Form 8038-G is used by issuers of

In lieu of rebating any arbitrage that may be

Service Center, Philadelphia, PA 19255.

tax-exempt governmental obligations to

owed to the United States, the issuer of a

provide the IRS with the information required

construction issue may make an irrevocable

Rounding Off to Whole Dollars

by section 149(e) and to monitor the

election to pay a penalty. The penalty is equal

You may show the money items on this

requirements of sections 141 through 150.

to 1

1

⁄

% of the amount of construction

2

return as whole-dollar amounts. To do so,

Complete Parts II through VI on the basis of

proceeds that do not meet certain spending

drop any amount less than 50 cents and

available information and reasonable

requirements. See section 148(f)(4)(C).

increase any amount from 50 cents through

expectations as of the date the issue is

99 cents to the next higher dollar.

Specific Instructions

issued. If an item does not apply to the issue

you are reporting, enter “N/A” in the space

Definitions

Part I—Reporting Authority

provided for the item.

A tax-exempt obligation is an obligation

When this form went to print, the Treasury

Amended Return.—If you are filing an

on which the interest is excluded from

Department and the Internal Revenue Service

amended Form 8038-G, check the amended

income under the Internal Revenue Code. A

had several proposed regulations in process,

return box and complete Part I and only

tax-exempt obligation is not limited to the

which, if adopted, could alter the information

those parts of Form 8038-G you are

formal issuance of bonds. It also includes

being requested.

amending. Use the same report number (line

installment purchase agreements and

4) as was used for the original report. Do not

Who Must File

financial leases.

amend the estimated amounts previously

A tax-exempt governmental bond is a

Issuers must file a Form 8038-G for each

reported once the actual amounts are

tax-exempt bond that is not a private activity

issue of tax-exempt governmental obligations

determined.

bond.

issued after December 31, 1986, if the price

Line 1.—The issuer’s name is the name of

(line 20, column (c)) of the issue is $100,000

A private activity bond is generally an

the entity issuing the obligations, not the

or more. If the issue price is less than

obligation issued as part of an issue of which

name of the entity receiving the benefit of the

$100,000, issuers must file Form 8038-GC,

(a) more than 10% of the proceeds are to be

financing. For a lease or installment sale, the

Information Return for Small Tax-Exempt

used for any private business use; and (b)

issuer is the lessee or the purchaser.

Cat. No. 63774D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2