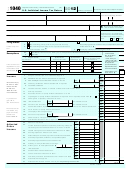

1040

2009

Department of the Treasury—Internal Revenue Service

U.S. Individual Income Tax Return

(99)

IRS Use Only—Do not write or staple in this space.

Label

For the year Jan. 1–Dec. 31, 2009, or other tax year beginning

, 2009, ending

, 20

OMB No. 1545-0074

Last name

Your first name and initial

Your social security number

L

A

(See

B

instructions

If a joint return, spouse’s first name and initial

Last name

Spouse’s social security number

E

on page 14.)

L

Use the IRS

label.

Home address (number and street). If you have a P.O. box, see page 14.

Apt. no.

H

You must enter

E

Otherwise,

your SSN(s) above.

R

please print

City, town or post office, state, and ZIP code. If you have a foreign address, see page 14.

E

Checking a box below will not

or type.

change your tax or refund.

Presidential

You

Spouse

Check here if you, or your spouse if filing jointly, want $3 to go to this fund (see page 14)

Election Campaign

1

4

Single

Head of household (with qualifying person). (See page 15.) If the

Filing Status

2

Married filing jointly (even if only one had income)

qualifying person is a child but not your dependent, enter this

Check only one

child’s name here.

3

Married filing separately. Enter spouse’s SSN above

box.

and full name here.

5

Qualifying widow(er) with dependent child (see page 16)

Boxes checked

6a

Yourself. If someone can claim you as a dependent, do not check box 6a .

.

.

.

.

Exemptions

on 6a and 6b

b

Spouse

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

No. of children

Dependents:

on 6c who:

c

(4)

if qualifying

(2) Dependent’s

(3) Dependent’s

● lived with you

child for child tax

social security number

relationship to you

(1) First name

Last name

credit (see page 17)

● did not live with

you due to divorce

or separation

If more than four

(see page 18)

dependents, see

Dependents on 6c

not entered above

page 17 and

check here

Add numbers on

d

Total number of exemptions claimed

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

lines above

7

7

Wages, salaries, tips, etc. Attach Form(s) W-2

.

.

.

.

.

.

.

.

.

.

.

.

Income

8a

Taxable interest. Attach Schedule B if required .

.

.

.

.

.

.

.

.

.

.

.

8a

b

Tax-exempt interest. Do not include on line 8a .

.

.

8b

Attach Form(s)

9 a

9a

Ordinary dividends. Attach Schedule B if required

.

.

.

.

.

.

.

.

.

.

.

W-2 here. Also

b

Qualified dividends (see page 22)

.

.

.

.

.

.

.

9b

attach Forms

W-2G and

10

Taxable refunds, credits, or offsets of state and local income taxes (see page 23) .

.

10

1099-R if tax

11

11

Alimony received .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

was withheld.

12

12

Business income or (loss). Attach Schedule C or C-EZ .

.

.

.

.

.

.

.

.

.

13

Capital gain or (loss). Attach Schedule D if required. If not required, check here

13

If you did not

14

Other gains or (losses). Attach Form 4797 .

.

.

.

.

.

.

.

.

.

.

.

.

.

14

get a W-2,

15 a

15a

b Taxable amount (see page 24)

15b

IRA distributions .

see page 22.

16 a

Pensions and annuities

16a

b Taxable amount (see page 25)

16b

17

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

17

Enclose, but do

18

18

Farm income or (loss). Attach Schedule F .

.

.

.

.

.

.

.

.

.

.

.

.

.

not attach, any

19

Unemployment compensation in excess of $2,400 per recipient (see page 27) .

.

.

19

payment. Also,

20 a

Social security benefits

20a

b Taxable amount (see page 27)

20b

please use

Form 1040-V.

21

21

Other income. List type and amount (see page 29)

22

Add the amounts in the far right column for lines 7 through 21. This is your total income

22

23

Educator expenses (see page 29) .

.

.

.

.

.

.

23

Adjusted

24

Certain business expenses of reservists, performing artists, and

Gross

24

fee-basis government officials. Attach Form 2106 or 2106-EZ

Income

25

Health savings account deduction. Attach Form 8889

.

25

26

Moving expenses. Attach Form 3903 .

.

.

.

.

.

26

27

27

One-half of self-employment tax. Attach Schedule SE .

28

Self-employed SEP, SIMPLE, and qualified plans

.

.

28

29

Self-employed health insurance deduction (see page 30)

29

30

30

Penalty on early withdrawal of savings .

.

.

.

.

.

31 a

b Recipient’s SSN

31a

Alimony paid

32

IRA deduction (see page 31)

.

.

.

.

.

.

.

.

32

33

33

Student loan interest deduction (see page 34)

.

.

.

34

34

Tuition and fees deduction. Attach Form 8917

.

.

.

35

Domestic production activities deduction. Attach Form 8903

35

36

Add lines 23 through 31a and 32 through 35 .

.

.

.

.

.

.

.

.

.

.

.

.

36

37

Subtract line 36 from line 22. This is your adjusted gross income

.

.

.

.

.

37

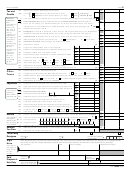

1040

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see page 97.

Form

(2009)

Cat. No. 11320B

1

1 2

2 3

3