Page 2

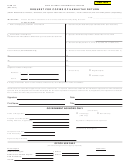

Instructions for Form 4506-F, Request for Copy of Fraudulent Tax Return

Purpose of the form:

If you are authorized to obtain the identity theft victim’s tax

Use this form to request a copy of a

information, the Form 4506-F must also be accompanied by

fraudulent return filed using your SSN as the primary or

documents demonstrating your authority to receive the requested

secondary taxpayer.

tax return information (for example, Form 2848, Form 8821, or a

NOTE:

court order) unless:

Some of the information on the fraudulent return will be

redacted. We may disclose information from a fraudulent return to

• You are requesting return information of your minor child as a

a person whose name and SSN are listed as the primary taxpayer

parent or legal guardian, or

or the spouse when the disclosure does not seriously impair tax

• Your authority to obtain return information for the requested tax

administration. Some information on the fraudulent return will be

year(s) is on file with the IRS and you are providing your CAF

redacted or partially redacted, but there will be enough data to

number.

determine how the taxpayer's personal information was used.

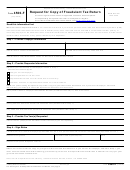

Step 3 – Provide Tax Year(s) Requested

Where to file your request:

you will need to send a

Line 7:

Enter the tax year(s) requested.

completed signed Form 4506-F and required documentation to

the following address:

NOTE:

You can request copies of fraudulent returns for the

Department of the Treasury

current tax year and previous six tax years.

Internal Revenue Service

Step 4 – Sign Below

Fresno, CA 93888-0025

Signature and Date:

This form must be signed and dated by

Note:

For requests being sent using a Private Delivery Service

the taxpayer(s) listed on Line 2 or the requestor listed on Line 6.

ship to:

NOTE:

Ensure that all applicable lines are completed prior

Internal Revenue Service

to signing. If the request is missing any of the above, it will

5045 East Butler Avenue

be rejected as incomplete and returned to secure the missing

Fresno, CA 93727

information.

"Identity Theft - Request for Fraudulent Return"

Privacy Act and Paperwork Reduction Act Notice.

We ask for

Specific Instructions:

the information on this form to establish your right to gain access to the

Step 1 – Provide Taxpayer Information

requested return(s) under the Internal Revenue Code. We need this

information to properly identify the return(s) and respond to your request.

Line 1:

Enter the SSN used on the fraudulent return.

If you request a copy of a tax return, sections 6103 and 6109 require you

to provide this information, including your SSN or EIN, to process your

Line 2:

Enter name of the taxpayer used on the fraudulent

request. If you do not provide this information, we may not be able to

return.

process your request. Providing false or fraudulent information may

subject you to penalties.

Line 3:

Enter SSN owner’s current address. If you use a P.O.

Routine uses of this information include giving it to the Department of

Box, please include it on this line.

Justice for civil and criminal litigation, and cities, states, the District of

Line 3a:

Columbia, and U.S. commonwealths and possessions for use in

Enter SSN owner’s current city, state and zip code

administering their tax laws. We may also disclose this information to

other countries under a tax treaty, to federal and state agencies to enforce

Line 4:

Enter the SSN owner’s complete address shown on the

federal nontax criminal laws, or to federal law enforcement and

last return filed if different from the address entered on

intelligence agencies to combat terrorism.

line 3 and 3a.

You are not required to provide the information requested on a form that

NOTE:

If the SSN owner’s addresses on lines 3, 3a and 4

is subject to the Paperwork Reduction Act unless the form displays a valid

are different and the address has not been changed with the

OMB control number. Books or records relating to a form or its

instructions must be retained as long as their contents may become

IRS, a Form 8822, Change of Address, must be filed.

material in the administration of any Internal Revenue law. Generally, tax

returns and return information are confidential, as required by section

Step 2 – Provide Requestor Information

6103.

Line 5:

Check the box that describes the relationship to the

The time needed to complete and file Form 4506 will vary depending on

taxpayer named in Step 1.

individual circumstances. The estimated average time is: Learning about

the law or the form, 10 min.; Preparing the form, 16 min.; and

Line 6:

Enter the SSN or appropriate TIN, name and mailing

Copying, assembling, and sending the form to the IRS, 20 min.

address of the requestor if different from Step 1.

If you have comments concerning the accuracy of these time estimates or

(Examples of appropriate TINs: Centralized

suggestions for making Form 4506 simpler, we would be happy to hear

Authorization File (CAF), Employer Identification

from you. You can write to:

Number (EIN))

Internal Revenue Service

Tax Forms and Publications Division

Form 4506-F must be accompanied by a copy of your

1111 Constitution Ave. NW; Washington, DC 20224

government-issued identification (for example, a driver’s

license or passport).

4506-F

Catalog Number 68948H

Form

(7-2016)

1

1 2

2