Form 4136n Nebraska Nonhighway Use Motor Vehicle Fuels Credit

ADVERTISEMENT

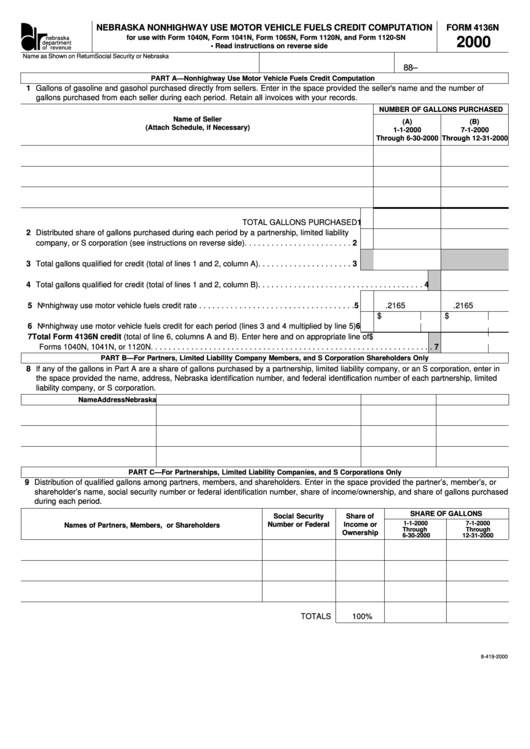

NEBRASKA NONHIGHWAY USE MOTOR VEHICLE FUELS CREDIT COMPUTATION

FORM 4136N

for use with Form 1040N, Form 1041N, Form 1065N, Form 1120N, and Form 1120-SN

2000

nebraska

department

• Read instructions on reverse side

of revenue

Name as Shown on Return

Social Security or Nebraska I.D. Number

Nebraska Nonhighway Use I.D. Number

88–

PART A — Nonhighway Use Motor Vehicle Fuels Credit Computation

1 Gallons of gasoline and gasohol purchased directly from sellers. Enter in the space provided the seller's name and the number of

gallons purchased from each seller during each period. Retain all invoices with your records.

NUMBER OF GALLONS PURCHASED

Name of Seller

(A)

(B)

(Attach Schedule, if Necessary)

1-1-2000

7-1-2000

Through 6-30-2000

Through 12-31-2000

TOTAL GALLONS PURCHASED

1

2 Distributed share of gallons purchased during each period by a partnership, limited liability

company, or S corporation (see instructions on reverse side) . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Total gallons qualified for credit (total of lines 1 and 2, column A) . . . . . . . . . . . . . . . . . . . . .

3

4 Total gallons qualified for credit (total of lines 1 and 2, column B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 Nonhighway use motor vehicle fuels credit rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.2165

.2165

$

$

6 Nonhighway use motor vehicle fuels credit for each period (lines 3 and 4 multiplied by line 5)

6

7 Total Form 4136N credit (total of line 6, columns A and B). Enter here and on appropriate line of

$

Forms 1040N, 1041N, or 1120N . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

PART B — For Partners, Limited Liability Company Members, and S Corporation Shareholders Only

8 If any of the gallons in Part A are a share of gallons purchased by a partnership, limited liability company, or an S corporation, enter in

the space provided the name, address, Nebraska identification number, and federal identification number of each partnership, limited

liability company, or S corporation.

Name

Address

Nebraska I.D. Number Federal I.D. Number

PART C — For Partnerships, Limited Liability Companies, and S Corporations Only

9 Distribution of qualified gallons among partners, members, and shareholders. Enter in the space provided the partner’s, member’s, or

shareholder’s name, social security number or federal identification number, share of income/ownership, and share of gallons purchased

during each period.

SHARE OF GALLONS

Social Security

Share of

1-1-2000

7-1-2000

Number or Federal

Income or

Names of Partners, Members, or Shareholders

Through

Through

I.D. Number

Ownership

6-30-2000

12-31-2000

TOTALS

100%

8-419-2000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2