Form Reg-5mf - Application For Motor Vehicle Fuels Tax Or Petroleum Products Gross Earnings Tax - Connecticut Department Of Revenue Services

ADVERTISEMENT

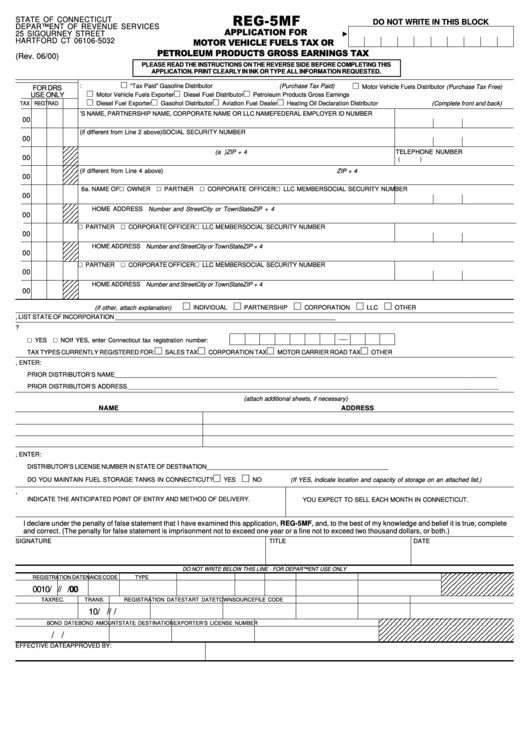

REG-5MF

STATE OF CONNECTICUT

DO NOT WRITE IN THIS BLOCK

DEPARTMENT OF REVENUE SERVICES

<

APPLICATION FOR

25 SIGOURNEY STREET

MOTOR VEHICLE FUELS TAX OR

HARTFORD CT 06106-5032

PETROLEUM PRODUCTS GROSS EARNINGS TAX

(Rev. 06/00)

PLEASE READ THE INSTRUCTIONS ON THE REVERSE SIDE BEFORE COMPLETING THIS

APPLICATION. PRINT CLEARLY IN INK OR TYPE ALL INFORMATION REQUESTED.

~

~

1. Reason for applying

:

“Tax Paid” Gasoline Distributor (Purchase Tax Paid)

Motor Vehicle Fuels Distributor (Purchase Tax Free)

FOR DRS

~

~

~

USE ONLY

Motor Vehicle Fuels Exporter

Diesel Fuel Distributor

Petroleum Products Gross Earnings

~

~

~

~

TAX REG

TR

AD

Diesel Fuel Exporter

Gasohol Distributor

Aviation Fuel Dealer

Heating Oil Declaration Distributor (Complete front and back)

2. OWNER’S NAME, PARTNERSHIP NAME, CORPORATE NAME OR LLC NAME

FEDERAL EMPLOYER ID NUMBER

00

3. TRADE NAME OR REGISTERED NAME (if different from Line 2 above)

SOCIAL SECURITY NUMBER

00

1 2 3 4 5

1 2 3 4 5

4. PHYSICAL LOCATION OF THIS BUSINESS (a P.O. Box is not acceptable)

ZIP + 4

TELEPHONE NUMBER

1 2 3 4 5

00

1 2 3 4 5

(

)

1 2 3 4 5

1 2 3 4 5

5. BUSINESS MAILING ADDRESS (if different from Line 4 above)

ZIP + 4

1 2 3 4 5

00

1 2 3 4 5

1 2 3 4 5

~ OWNER ~ PARTNER ~ CORPORATE OFFICER ~ LLC MEMBER

6a. NAME OF

SOCIAL SECURITY NUMBER

00

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

HOME ADDRESS Number and Street

City or Town

State

ZIP + 4

1 2 3 4 5

00

1 2 3 4 5

~ PARTNER ~ CORPORATE OFFICER ~ LLC MEMBER

6b. NAME OF

SOCIAL SECURITY NUMBER

00

1 2 3 4 5

1 2 3 4 5

HOME ADDRESS Number and Street

City or Town

State

ZIP + 4

1 2 3 4 5

00

1 2 3 4 5

1 2 3 4 5

~ PARTNER ~ CORPORATE OFFICER ~ LLC MEMBER

6c. NAME OF

SOCIAL SECURITY NUMBER

00

1 2 3 4 5

1 2 3 4 5

HOME ADDRESS Number and Street

City or Town

State

ZIP + 4

1 2 3 4 5

00

1 2 3 4 5

1 2 3 4 5

~

~

~

~

~

7.

TYPE OF OWNERSHIP (if other, attach explanation)

INDIVIDUAL

PARTNERSHIP

CORPORATION

LLC

OTHER

7a. IF A CORPORATION OR AN LLC, LIST STATE OF INCORPORATION _________________________________________________________________

8.

ARE YOU CURRENTLY REGISTERED WITH THE CONNECTICUT DEPARTMENT OF REVENUE SERVICES?

~ YES ~ NO

If YES, enter Connecticut tax registration number:

~

~

~

~

TAX TYPES CURRENTLY REGISTERED FOR:

SALES TAX

CORPORATION TAX

MOTOR CARRIER ROAD TAX

OTHER

9.

IF YOU ARE THE SUCCESSOR TO A REGISTERED DISTRIBUTOR, ENTER:

PRIOR DISTRIBUTOR’S NAME ________________________________________________________________________________________________________________

PRIOR DISTRIBUTOR’S ADDRESS _____________________________________________________________________________________________________________

10. LIST ALL SUPPLIERS OF MOTOR VEHICLE FUEL AND HOME HEATING OIL (attach additional sheets, if necessary)

NAME

ADDRESS

11. IF APPLYING FOR A MOTOR VEHICLE FUELS EXPORTER LICENSE, ENTER:

DISTRIBUTOR’S LICENSE NUMBER IN STATE OF DESTINATION ______________________________________________________

~

~

(If YES, indicate location and capacity of storage on an attached list.)

DO YOU MAINTAIN FUEL STORAGE TANKS IN CONNECTICUT?

YES

NO

12. IF IMPORTING DIESEL FUEL OR MOTOR VEHICLE FUEL INTO CONNECTICUT,

13. NUMBER OF GALLONS OF MOTOR VEHICLE FUEL OR DIESEL FUEL

INDICATE THE ANTICIPATED POINT OF ENTRY AND METHOD OF DELIVERY.

YOU EXPECT TO SELL EACH MONTH IN CONNECTICUT.

I declare under the penalty of false statement that I have examined this application, REG-5MF, and, to the best of my knowledge and belief it is true, complete

and correct. (The penalty for false statement is imprisonment not to exceed one year or a fine not to exceed two thousand dollars, or both.)

SIGNATURE

TITLE

DATE

DO NOT WRITE BELOW THIS LINE - FOR DEPARTMENT USE ONLY

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

TAX

REC.

TRANS.

REGISTRATION DATE

NAICS CODE

TYPE ORG.

STATE

LEGAL DATE

TOTAL SUBMITTED

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

00

10

/

/

/

/

00

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

TAX

REC.

TRANS.

REGISTRATION DATE

START DATE

TOWN

SOURCE

FILE CODE

10

/

/

/

/

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

BOND DATE

BOND AMOUNT

STATE DESTINATION

EXPORTER’S LICENSE NUMBER

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

/

/

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

EFFECTIVE DATE

APPROVED BY:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2