Sba 504 Loan Application Form

ADVERTISEMENT

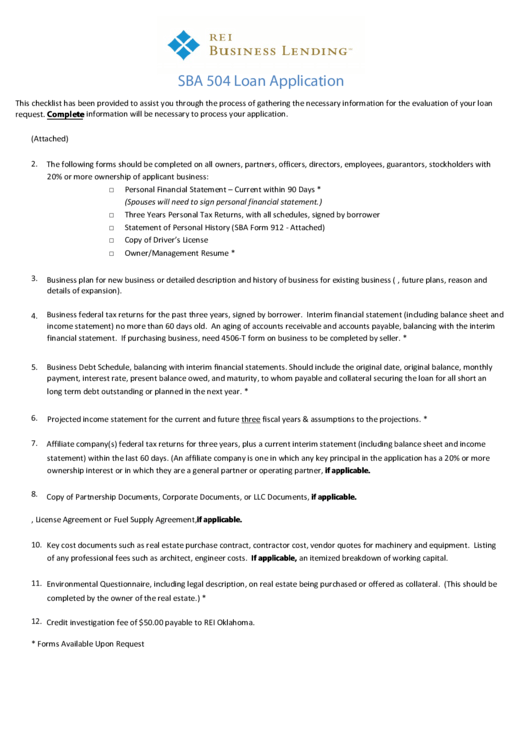

SBA 504 Loan Application

This checklist has been provided to assist you through the process of gathering the necessary information for the evaluation of your loan

request. Complete information will be necessary to process your application.

1. Completed Loan Forms (Attached)

2. The following forms should be completed on all owners, partners, officers, directors, employees, guarantors, stockholders with

20% or more ownership of applicant business:

□

Personal Financial Statement – Current within 90 Days *

(Spouses will need to sign personal financial statement.)

□

Three Years Personal Tax Returns, with all schedules, signed by borrower

□

Statement of Personal History (SBA Form 912 - Attached)

□

Copy of Driver’s License

□

Owner/Management Resume *

3. Business plan for new business or detailed description and history of business for existing business (i.e., future plans, reason and

details of expansion).

4. Business federal tax returns for the past three years, signed by borrower. Interim financial statement (including balance sheet and

income statement) no more than 60 days old. An aging of accounts receivable and accounts payable, balancing with the interim

financial statement. If purchasing business, need 4506-T form on business to be completed by seller. *

5. Business Debt Schedule, balancing with interim financial statements. Should include the original date, original balance, monthly

payment, interest rate, present balance owed, and maturity, to whom payable and collateral securing the loan for all short an

long term debt outstanding or planned in the next year. *

6.

Projected income statement for the current and future three fiscal years & assumptions to the projections. *

7. Affiliate company(s) federal tax returns for three years, plus a current interim statement (including balance sheet and income

statement) within the last 60 days. (An affiliate company is one in which any key principal in the application has a 20% or more

ownership interest or in which they are a general partner or operating partner, if applicable.

8. Copy of Partnership Documents, Corporate Documents, or LLC Documents, if applicable.

9. Copy of Franchise Agreements, License Agreement or Fuel Supply Agreement, if applicable.

10. Key cost documents such as real estate purchase contract, contractor cost, vendor quotes for machinery and equipment. Listing

of any professional fees such as architect, engineer costs. If applicable, an itemized breakdown of working capital.

11. Environmental Questionnaire, including legal description, on real estate being purchased or offered as collateral. (This should be

completed by the owner of the real estate.) *

12. Credit investigation fee of $50.00 payable to REI Oklahoma.

* Forms Available Upon Request

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5