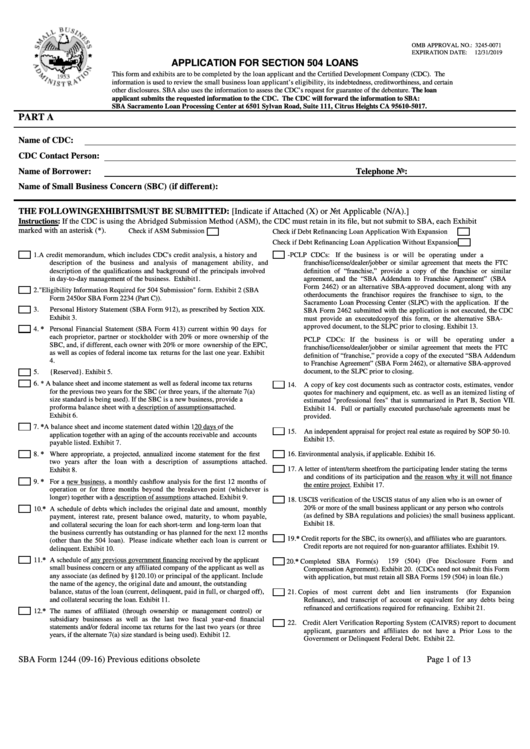

OMB APPROVAL NO.: 3245-0071

U.S. SMALL BUSINESS ADMINISTRATION

EXPIRATION DATE:

12/31/2019

APPLICATION FOR SECTION 504 LOANS

This form and exhibits are to be completed by the loan applicant and the Certified Development Company (CDC). The

information is used to review the small business loan applicant’s eligibility, its indebtedness, creditworthiness, and certain

other disclosures. SBA also uses the information to assess the CDC’s request for guarantee of the debenture. The loan

applicant submits the requested information to the CDC. The CDC will forward the information to SBA:

SBA Sacramento Loan Processing Center at 6501 Sylvan Road, Suite 111, Citrus Heights CA 95610-5017.

PART A

Name of CDC:

CDC Contact Person:

Name of Borrower:

Telephone No:

Name of Small Business Concern (SBC) (if different):

THE FOLLOWING EXHIBITS MUST BE SUBMITTED: [Indicate if Attached (X) or Not Applicable (N/A).]

Instructions: If the CDC is using the Abridged Submission Method (ASM), the CDC must retain in its file, but not submit to SBA, each Exhibit

Check if ASM Submission

Check if Debt Refinancing Loan Application With Expansion

marked with an asterisk (*).

Check if Debt Refinancing Loan Application Without Expansion

1.

A credit memorandum, which includes CDC's credit analysis, a history and

13.

Non-PCLP CDCs:

If the business is or will be operating under a

description of the business and analysis of management ability, and

franchise/license/dealer/jobber or similar agreement that meets the FTC

description of the qualifications and background of the principals involved

definition of “franchise,” provide a copy of the franchise or similar

in day-to-day management of the business. Exhibit 1.

agreement, and the “SBA Addendum to Franchise Agreement” (SBA

Form 2462) or an alternative SBA-approved document, along with any

2.

"Eligibility Information Required for 504 Submission" form. Exhibit 2 (SBA

other documents the franchisor requires the franchisee to sign, to the

Form 2450 or SBA Form 2234 (Part C)).

Sacramento Loan Processing Center (SLPC) with the application. If the

3.

Personal History Statement (SBA Form 912), as prescribed by Section XIX.

SBA Form 2462 submitted with the application is not executed, the CDC

Exhibit 3.

must provide an executed copy of this form, or the alternative SBA-

approved document, to the SLPC prior to closing. Exhibit 13.

4. * Personal Financial Statement (SBA Form 413) current within 90 days for

each proprietor, partner or stockholder with 20% or more ownership of the

PCLP CDCs: If the business is or will be operating under a

SBC, and, if different, each owner with 20% or more ownership of the EPC,

franchise/license/dealer/jobber or similar agreement that meets the FTC

as well as copies of federal income tax returns for the last one year. Exhibit

definition of “franchise,” provide a copy of the executed “SBA Addendum

4.

to Franchise Agreement” (SBA Form 2462), or alternative SBA-approved

document, to the SLPC prior to closing.

5.

{Reserved}. Exhibit 5.

6. * A balance sheet and income statement as well as federal income tax returns

14.

A copy of key cost documents such as contractor costs, estimates, vendor

for the previous two years for the SBC (or three years, if the alternate 7(a)

quotes for machinery and equipment, etc. as well as an itemized listing of

size standard is being used). If the SBC is a new business, provide a

estimated "professional fees" that is summarized in Part B, Section VII.

proforma balance sheet with a description of assumptions attached.

Exhibit 14. Full or partially executed purchase/sale agreements must be

Exhibit 6.

provided.

7. * A balance sheet and income statement dated within 120 days of the

15.

An independent appraisal for project real estate as required by SOP 50-10.

application together with an aging of the accounts receivable and accounts

Exhibit 15.

payable listed. Exhibit 7.

8. * Where appropriate, a projected, annualized income statement for the first

16.

Environmental analysis, if applicable. Exhibit 16.

two years after the loan with a description of assumptions attached.

17.

A letter of intent/term sheet from the participating lender stating the terms

Exhibit 8.

and conditions of its participation and the reason why it will not finance

9. * For a new business, a monthly cashflow analysis for the first 12 months of

the entire project. Exhibit 17.

operation or for three months beyond the breakeven point (whichever is

longer) together with a description of assumptions attached. Exhibit 9.

18.

USCIS verification of the USCIS status of any alien who is an owner of

20% or more of the small business applicant or any person who controls

10.* A schedule of debts which includes the original date and amount, monthly

(as defined by SBA regulations and policies) the small business applicant.

payment, interest rate, present balance owed, maturity, to whom payable,

Exhibit 18.

and collateral securing the loan for each short-term and long-term loan that

the business currently has outstanding or has planned for the next 12 months

19.* Credit reports for the SBC, its owner(s), and affiliates who are guarantors.

(other than the 504 loan). Please indicate whether each loan is current or

Credit reports are not required for non-guarantor affiliates. Exhibit 19.

delinquent. Exhibit 10.

11.* A schedule of any previous government financing received by the applicant

20.* Completed SBA Form(s) 159 (504) (Fee Disclosure Form and

small business concern or any affiliated company of the applicant as well as

Compensation Agreement). Exhibit 20. (CDCs need not submit this Form

any associate (as defined by §120.10) or principal of the applicant. Include

with application, but must retain all SBA Forms 159 (504) in loan file.)

the name of the agency, the original date and amount, the outstanding

balance, status of the loan (current, delinquent, paid in full, or charged off),

21.

Copies of most current debt and lien instruments (for Expansion

and collateral securing the loan. Exhibit 11.

Refinance), and transcript of account or equivalent for any debts being

refinanced and certifications required for refinancing. Exhibit 21.

12.* The names of affiliated (through ownership or management control) or

subsidiary businesses as well as the last two fiscal year-end financial

22. Credit Alert Verification Reporting System (CAIVRS) report to document

statements and/or federal income tax returns for the last two years (or three

applicant, guarantors and affiliates do not have a Prior Loss to the

years, if the alternate 7(a) size standard is being used). Exhibit 12.

Government or Delinquent Federal Debt. Exhibit 22.

SBA Form 1244 (09-16) Previous editions obsolete

Page 1 of 13

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13