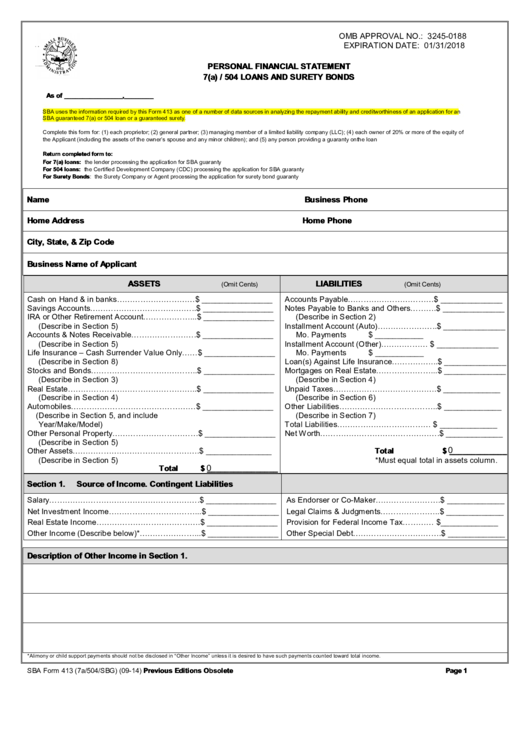

Sba Form 413 - Personal Financial Statement 7(A) / 504 Loans And Surety Bonds

ADVERTISEMENT

OMB APPROVAL NO.: 3245-0188

EXPIRATION DATE: 01/31/2018

PERSONAL FINANCIAL STATEMENT

7(a) / 504 LOANS AND SURETY BONDS

U.S. SMALL BUSINESS ADMINISTRATION

As of ________________, ________

SBA uses the information required by this Form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an

SBA guaranteed 7(a) or 504 loan or a guaranteed surety.

Complete this form for: (1) each proprietor; (2) general partner; (3) managing member of a limited liability company (LLC); (4) each owner of 20% or more of the equity of

the Applicant (including the assets of the owner’s spouse and any minor children); and (5) any person providing a guaranty on the loan

Return completed form to:

For 7(a) loans: the lender processing the application for SBA guaranty

For 504 loans: the Certified Development Company (CDC) processing the application for SBA guaranty

For Surety Bonds: the Surety Company or Agent processing the application for surety bond guaranty

Name

Business Phone

Home Address

Home Phone

City, State, & Zip Code

Business Name of Applicant

(Omit Cents)

(Omit Cents)

ASSETS

LIABILITIES

Cash on Hand & in banks…………………………$ ________________

Accounts Payable……………………………$ ______________

Savings Accounts…………………………………..$ ________________

Notes Payable to Banks and Others……….$ ______________

IRA or Other Retirement Account………………...$ ________________

(Describe in Section 2)

(Describe in Section 5)

Installment Account (Auto)…………………..$ ______________

Accounts & Notes Receivable…………………….$ ________________

Mo. Payments

$ ___________

(Describe in Section 5)

Installment Account (Other)………………....$ ______________

Life Insurance – Cash Surrender Value Only……$ ________________

Mo. Payments

$ ___________

(Describe in Section 8)

Loan(s) Against Life Insurance……………...$ ______________

Stocks and Bonds…………………………………..$ ________________

Mortgages on Real Estate…………………...$ ______________

(Describe in Section 3)

(Describe in Section 4)

Real Estate…………………………………………..$ ________________

Unpaid Taxes………………………………….$ _____________

(Describe in Section 4)

(Describe in Section 6)

Automobiles…………………………………………$ ________________

Other Liabilities………………………………..$ _____________

(Describe in Section 5, and include

(Describe in Section 7)

Year/Make/Model)

Total Liabilities………………………………....$ _____________

Other Personal Property……………………………$ ________________

Net Worth……………………………………….$ _____________

(Describe in Section 5)

Other Assets………………………………………….$ _______________

0

Total

$ _____________

(Describe in Section 5)

*Must equal total in assets column.

0

Total

$ ________________

Section 1.

Source of Income.

Contingent Liabilities

Salary………………………………………………….$ ________________

As Endorser or Co-Maker…………………….$ _____________

Net Investment Income……………………………...$ ________________

Legal Claims & Judgments…………………..$ _____________

Real Estate Income………………………………….$ ________________

Provision for Federal Income Tax…………....$_____________

Other Income (Describe below)*…………………...$ ________________

Other Special Debt…………………………….$ _____________

Description of Other Income in Section 1.

*Alimony or child support payments should not be disclosed in “Other Income” unless it is desired to have such payments counted toward total income.

SBA Form 413 (7a/504/SBG) (09-14) Previous Editions Obsolete

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5