Sba Form 413 - Personal Financial Statement

ADVERTISEMENT

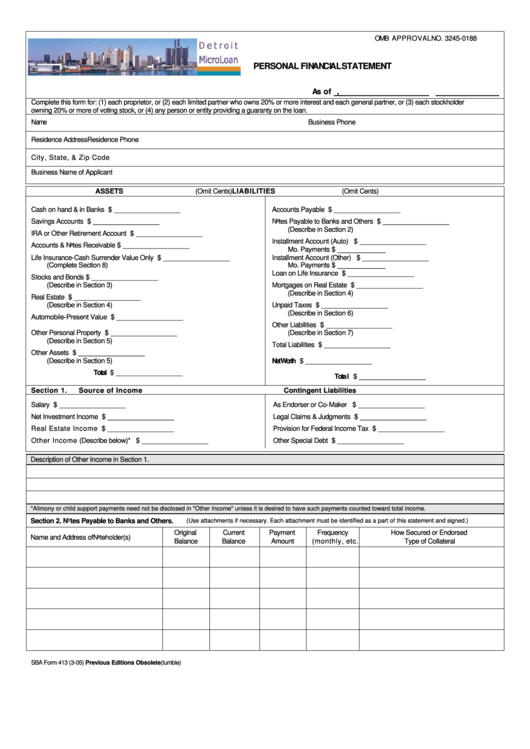

OMB APPROVAL NO. 3245-0188

PERSONAL FINANCIAL STATEMENT

As of

,

U.S. SMALL BUSINESS ADMINISTRATION

Complete this form for: (1) each proprietor, or (2) each limited partner who owns 20% or more interest and each general partner, or (3) each stockholder

owning 20% or more of voting stock, or (4) any person or entity providing a guaranty on the loan.

Name

Business Phone

Residence Address

Residence Phone

City, State, & Zip Code

Business Name of Applicant

ASSETS

(Omit Cents)

LIABILITIES

(Omit Cents)

Cash on hand & in Banks ................................ $ __________________

Accounts Payable ............................................ $ __________________

Savings Accounts ............................................ $ __________________

Notes Payable to Banks and Others ................ $ __________________

(Describe in Section 2)

IRA or Other Retirement Account .................... $ __________________

Installment Account (Auto) .............................. $ __________________

Accounts & Notes Receivable.......................... $ __________________

Mo. Payments $ _____________

Life Insurance-Cash Surrender Value Only ...... $ __________________

Installment Account (Other) ............................ $ __________________

(Complete Section 8)

Mo. Payments $ _____________

Loan on Life Insurance .................................... $ __________________

Stocks and Bonds ........................................... $ __________________

(Describe in Section 3)

Mortgages on Real Estate ............................... $ __________________

(Describe in Section 4)

Real Estate ...................................................... $ __________________

(Describe in Section 4)

Unpaid Taxes .................................................. $ __________________

(Describe in Section 6)

Automobile-Present Value ............................... $ __________________

Other Liabilities ................................................ $ __________________

Other Personal Property .................................. $ __________________

(Describe in Section 7)

(Describe in Section 5)

Total Liabilities ................................................. $ __________________

Other Assets ................................................... $ __________________

Net Worth ....................................................... $ __________________

(Describe in Section 5)

Total ................................ $ __________________

Total ............................... $ __________________

Section 1.

Source of Income

Contingent Liabilities

Salary .............................................................. $ __________________

As Endorser or Co-Maker ................................ $ __________________

Net Investment Income .................................... $ __________________

Legal Claims & Judgments ............................... $ __________________

Real Estate Income ......................................... $ __________________

Provision for Federal Income Tax ..................... $ __________________

Other Income (Describe below)* ..................... $ __________________

Other Special Debt ........................................... $ __________________

Description of Other Income in Section 1.

*Alimony or child support payments need not be disclosed in "Other Income" unless it is desired to have such payments counted toward total income.

Section 2. Notes Payable to Banks and Others.

(Use attachments if necessary. Each attachment must be identified as a part of this statement and signed.)

Original

Current

Payment

Frequency

How Secured or Endorsed

Name and Address of Noteholder(s)

Balance

Balance

Amount

(monthly, etc.)

Type of Collateral

SBA Form 413 (3-05) Previous Editions Obsolete

(tumble)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4