Instructions For Form 19 (For Claiming Final Settlement From Provident Fund)

ADVERTISEMENT

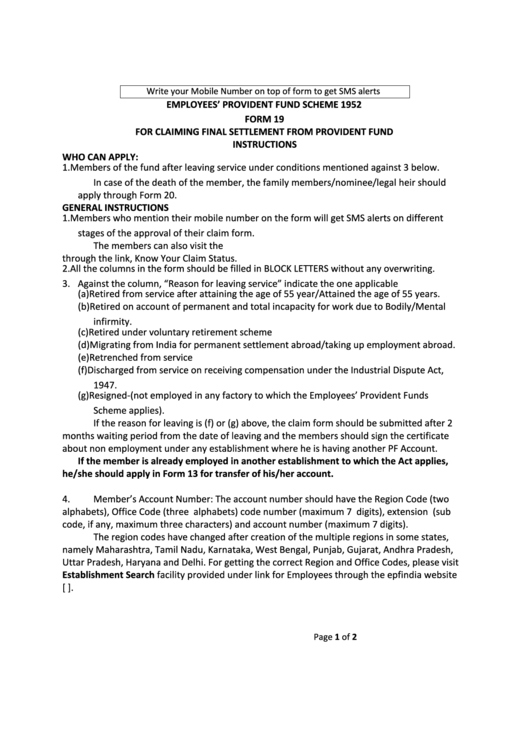

Write your Mobile Number on top of form to get SMS alerts

EMPLOYEES’ PROVIDENT FUND SCHEME 1952

FORM 19

FOR CLAIMING FINAL SETTLEMENT FROM PROVIDENT FUND

INSTRUCTIONS

WHO CAN APPLY:

1. Members of the fund after leaving service under conditions mentioned against 3 below.

In case of the death of the member, the family members/nominee/legal heir should

apply through Form 20.

GENERAL INSTRUCTIONS

1. Members who mention their mobile number on the form will get SMS alerts on different

stages of the approval of their claim form.

The members can also visit the epfindia.gov.in website to view the status of their claims

through the link, Know Your Claim Status.

2. All the columns in the form should be filled in BLOCK LETTERS without any overwriting.

3. Against the column, “Reason for leaving service” indicate the one applicable

(a) Retired from service after attaining the age of 55 year/Attained the age of 55 years.

(b) Retired on account of permanent and total incapacity for work due to Bodily/Mental

infirmity.

(c) Retired under voluntary retirement scheme

(d) Migrating from India for permanent settlement abroad/taking up employment abroad.

(e) Retrenched from service

(f) Discharged from service on receiving compensation under the Industrial Dispute Act,

1947.

(g) Resigned-(not employed in any factory to which the Employees’ Provident Funds

Scheme applies).

If the reason for leaving is (f) or (g) above, the claim form should be submitted after 2

months waiting period from the date of leaving and the members should sign the certificate

about non employment under any establishment where he is having another PF Account.

If the member is already employed in another establishment to which the Act applies,

he/she should apply in Form 13 for transfer of his/her account.

4.

Member’s Account Number: The account number should have the Region Code (two

alphabets), Office Code (three alphabets) code number (maximum 7 digits), extension (sub

code, if any, maximum three characters) and account number (maximum 7 digits).

The region codes have changed after creation of the multiple regions in some states,

namely Maharashtra, Tamil Nadu, Karnataka, West Bengal, Punjab, Gujarat, Andhra Pradesh,

Uttar Pradesh, Haryana and Delhi. For getting the correct Region and Office Codes, please visit

Establishment Search facility provided under link for Employees through the epfindia website

[epfindia.gov.in].

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2