Cobb County Board Of Tax Assessors

ADVERTISEMENT

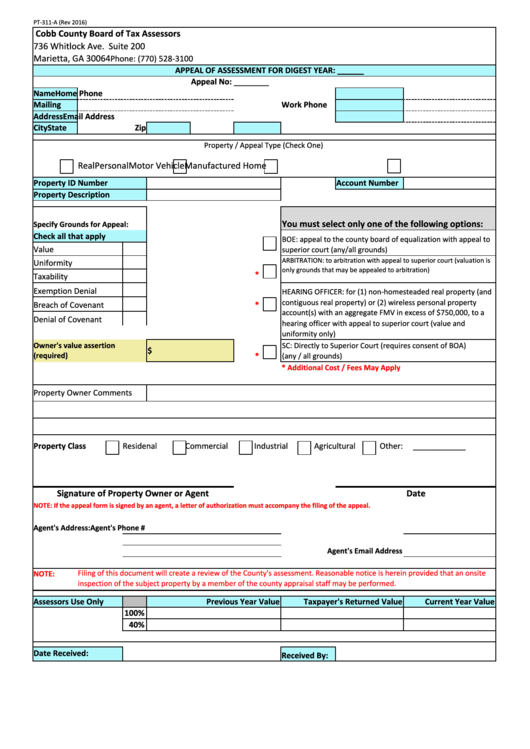

PT-311-A (Rev 2016)

Cobb County Board of Tax Assessors

736 Whitlock Ave. Suite 200

Marietta, GA 30064

Phone: (770) 528-3100

APPEAL OF ASSESSMENT FOR DIGEST YEAR: ______

Appeal No: ________

Name

Home Phone

Mailing

Work Phone

Address

Email Address

City

State

Zip

Property / Appeal Type (Check One)

Real

Personal

Motor Vehicle

Manufactured Home

Property ID Number

Account Number

Property Description

You must select only one of the following options:

Specify Grounds for Appeal:

Check all that apply

BOE: appeal to the county board of equalization with appeal to

Value

superior court (any/all grounds)

ARBITRATION: to arbitration with appeal to superior court (valuation is

Uniformity

only grounds that may be appealed to arbitration)

*

Taxability

Exemption Denial

HEARING OFFICER: for (1) non-homesteaded real property (and

contiguous real property) or (2) wireless personal property

Breach of Covenant

*

account(s) with an aggregate FMV in excess of $750,000, to a

Denial of Covenant

hearing officer with appeal to superior court (value and

uniformity only)

Owner's value assertion

SC: Directly to Superior Court (requires consent of BOA)

$

(required)

*

(any / all grounds)

* Additional Cost / Fees May Apply

Property Owner Comments

Property Class

Residential

Commercial

Industrial

Agricultural

Other:

____________

Signature of Property Owner or Agent

Date

NOTE: If the appeal form is signed by an agent, a letter of authorization must accompany the filing of the appeal.

Agent's Address:

Agent's Phone #

Agent's Email Address

Filing of this document will create a review of the County's assessment. Reasonable notice is herein provided that an onsite

NOTE:

inspection of the subject property by a member of the county appraisal staff may be performed.

Assessors Use Only

Previous Year Value

Taxpayer's Returned Value

Current Year Value

100%

40%

Date Received:

Received By:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1