Form M1x, Amended Minnesota Income Tax - 2016

ADVERTISEMENT

201613

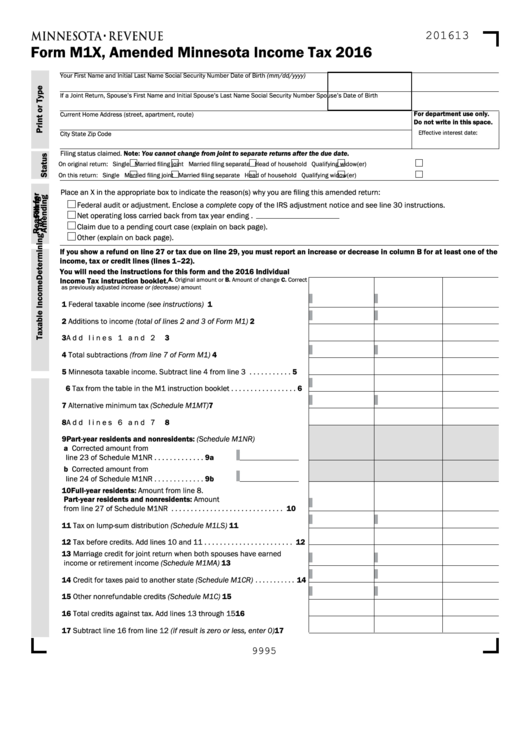

Form M1X, Amended Minnesota Income Tax 2016

Your First Name and Initial

Last Name

Social Security Number

Date of Birth (mm/dd/yyyy)

If a Joint Return, Spouse’s First Name and Initial

Spouse’s Last Name

Social Security Number

Spouse’s Date of Birth

For department use only.

Current Home Address (street, apartment, route)

Do not write in this space.

Effective interest date:

City

State

Zip Code

Filing status claimed. Note: You cannot change from joint to separate returns after the due date.

On original return:

Single

0DUULHG ÀOLQJ MRLQW

0DUULHG ÀOLQJ VHSDUDWH

Head of household

Qualifying widow(er)

On this return:

Single

0DUULHG ÀOLQJ MRLQW

0DUULHG ÀOLQJ VHSDUDWH

Head of household

Qualifying widow(er)

3ODFH DQ ; LQ WKH DSSURSULDWH ER[ WR LQGLFDWH WKH UHDVRQ

V

ZK\ \RX DUH ÀOLQJ WKLV DPHQGHG UHWXUQ

Federal audit or adjustment. Enclose a complete copy of the IRS adjustment notice and see line 30 instructions.

Net operating loss carried back from tax year ending

.

Claim due to a pending court case (explain on back page).

Other (explain on back page).

If you show a refund on line 27 or tax due on line 29, you must report an increase or decrease in column B for at least one of the

income, tax or credit lines (lines 1–22).

You will need the instructions for this form and the 2016 Individual

A. Original amount or

B. Amount of change

C. Correct

Income Tax instruction booklet.

as previously adjusted

increase or (decrease)

amount

1 Federal taxable income (see instructions) . . . . . . . . . . . . . . . . . . . . . 1

2 Additions to income (total of lines 2 and 3 of Form M1) . . . . . . . . . . . 2

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Total subtractions (from line 7 of Form M1) . . . . . . . . . . . . . . . . . . . . 4

5 Minnesota taxable income. Subtract line 4 from line 3 . . . . . . . . . . . 5

6 Tax from the table in the M1 instruction booklet . . . . . . . . . . . . . . . . . 6

7 Alternative minimum tax (Schedule M1MT) . . . . . . . . . . . . . . . . . . . . . 7

8 Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Part-year residents and nonresidents: (Schedule M1NR)

a Corrected amount from

line 23 of Schedule M1NR . . . . . . . . . . . . . 9a

b Corrected amount from

line 24 of Schedule M1NR . . . . . . . . . . . . . 9b

10 Full-year residents: Amount from line 8.

Part-year residents and nonresidents: Amount

from line 27 of Schedule M1NR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Tax on lump-sum distribution (Schedule M1LS) . . . . . . . . . . . . . . . . 11

12 Tax before credits. Add lines 10 and 11 . . . . . . . . . . . . . . . . . . . . . . . 12

13 Marriage credit for joint return when both spouses have earned

income or retirement income (Schedule M1MA) . . . . . . . . . . . . . . . . 13

14 Credit for taxes paid to another state (Schedule M1CR) . . . . . . . . . . . 14

15 Other nonrefundable credits (Schedule M1C) . . . . . . . . . . . . . . . . . . 15

16 Total credits against tax. Add lines 13 through 15 . . . . . . . . . . . . . . 16

17 Subtract line 16 from line 12 (if result is zero or less, enter 0). . . . . 17

9995

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4