- Financial

- United States Tax Forms

- Idaho Tax Forms

- Idaho State Tax Commission Forms

- Idaho 41 Forms

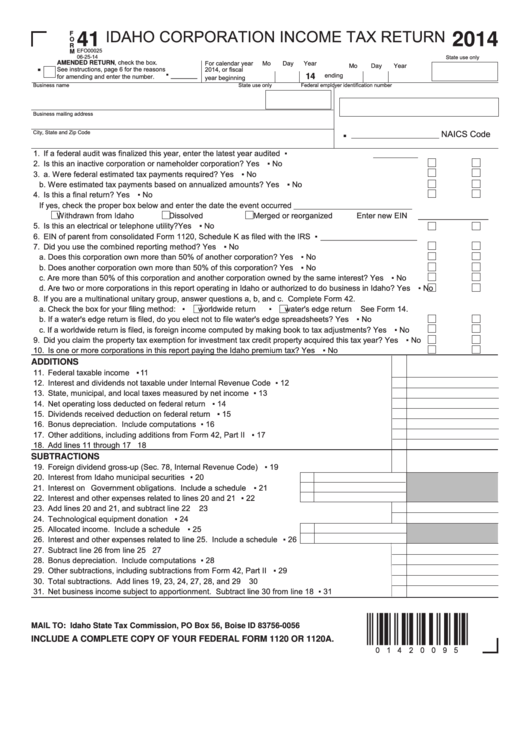

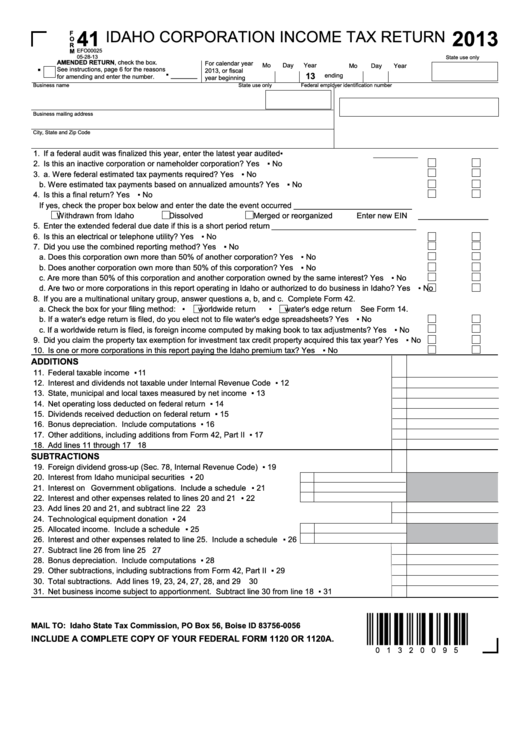

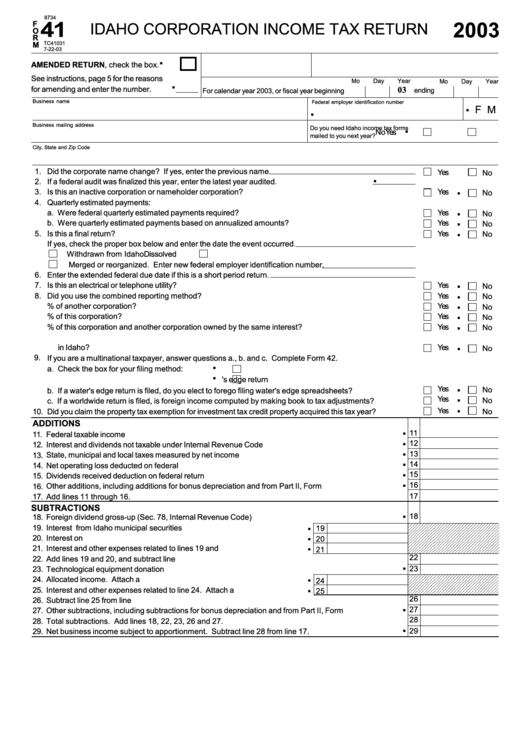

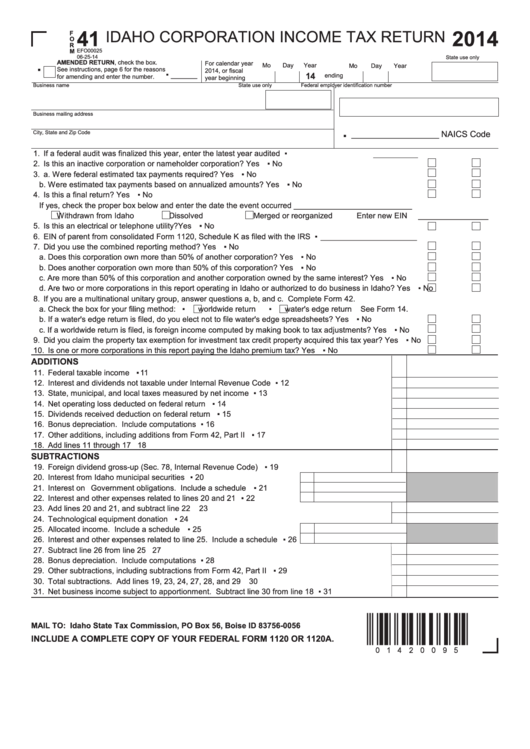

- Form 41 - Idaho Corporation Income Tax Return

Form 41 - Idaho Corporation Income Tax Return

Idaho Form 41 or the Idaho corporation income tax return is an income tax form for Idaho-based corporations. Corporations must file Form 41 if they're transacting business in Idaho, are registered with the Idaho Secretary of State to do business in Idaho, or have income attributable to Idaho. Idaho-based regular corporations, nonprofit organizations that receive unrelated business income, REITs and RICs are all subject to filing the form with the only exception being any corporation that falls under the protection of Public Law 86-272.

Idaho Form 41 Instructions

A corporation subject to Idaho corporate income tax must the Idaho Form 41. Returns must be filed by the fifteenth day of the fourth month after the close of the corporate tax year. For calendar-year filers, this is April 15th. A complete copy of the federal corporate income tax return must be attached to and mailed along with the form. Failure to provide a complete copy of the federal return along with the Idaho Form 41 may cause the return to be delinquent. Short period returns are due by the later of the fifteenth day of the fourth month following the close of the tax year or by the IRS-required date. See Form 41 instructions on the official IRS page for more information.

Form 41 - Idaho Corporation Income Tax Return Templates