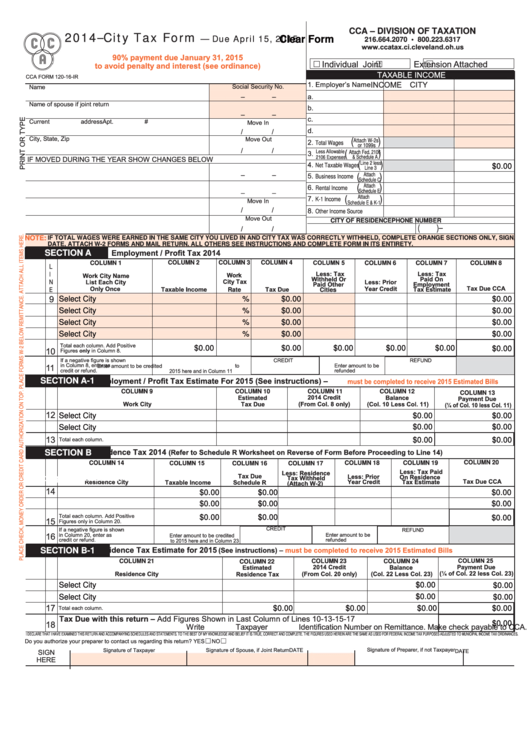

CCA – DIVISION OF TAXATION

2014–City Tax Form

— Due April 15, 2015

Clear Form

216.664.2070 • 800.223.6317

Individual

Joint

Extension Attached

TAXABLE INCOME

CCA FORM 120-16-IR

CITY

INCOME

1. Employer’s Name

Social Security No.

Name

–

–

a.

Name of spouse if joint return

b.

–

–

c.

Current address

Apt. #

Move In

d.

/

/

(

)

City, State, Zip

Move Out

Attach W-2s

2.

Total Wages

or 1099s

/

/

(

)

Less Allowable

Attach Fed. 2106

3.

& Schedule A

2106 Expenses

IF MOVED DURING THE YEAR SHOW CHANGES BELOW

(

)

Line 2 less

4.

Net Taxable Wages

$0.00

Line 3

(

)

–

–

Attach

5.

Business Income

Schedule C

(

)

Attach

6.

Rental Income

Schedule E

–

–

(

)

Attach

7.

K-1 Income

Move In

Schedule E & K-1

/

/

8.

Other Income Source

Move Out

CITY OF RESIDENCE

PHONE NUMBER

(

)

–

/

/

NOTE:

IF TOTAL WAGES WERE EARNED IN THE SAME CITY YOU LIVED IN AND CITY TAX WAS CORRECTLY WITHHELD, COMPLETE ORANGE SECTIONS ONLY, SIGN,

DATE, ATTACH W-2 FORMS AND MAIL RETURN. ALL OTHERS SEE INSTRUCTIONS AND COMPLETE FORM IN ITS ENTIRETY.

SECTION A

COLUMN 2

COLUMN 3

COLUMN 4

COLUMN 1

COLUMN 6

COLUMN 7

COLUMN 8

L

I

N

E

Rate

Cities

9

Select City

%

$0.00

$0.00

%

Select City

$0.00

$0.00

Select City

%

$0.00

$0.00

$0.00

Select City

%

$0.00

Total each column. Add Positive

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

10

Figures

in Column 8.

If a negative gure is sho n

CREDIT

REFUND

in Column 8, enter as

Enter amount to be

11

Enter amount to be credited to

credit or refund.

2015 here and in Column 11

refunded

SECTION A-1

COLUMN 9

COLUMN 10

COLUMN 11

COLUMN 12

COLUMN 13

12

Select City

$0.00

$0.00

$0.00

$0.00

Select City

13

Total each column.

$0.00

$0.00

SECTION B

COLUMN 20

COLUMN 14

COLUMN 18

COLUMN 19

COLUMN 16

COLUMN 17

Click here to go to calculation area

14

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

Total each column. Add Positive

$0.00

$0.00

$0.00

15

Figures only in Column 20.

CREDIT

If a negative gure is sho n

REFUND

16

Enter amount to be

in Column 20, enter as

Enter amount to be credited

credit or refund.

refunded

to 2015 here and in Column 23

SECTION B-1

COLUMN 21

COLUMN 23

COLUMN 24

COLUMN 22

Select City

$0.00

$0.00

Select City

$0.00

$0.00

17

$0.00

$0.00

Total each column.

$0.00

$0.00

Add Figures Shown in Last Column of Lines 10-13-15-17

18

$0.00

Write Taxpayer Identi cation Number on Remittance. Ma e chec payable to CCA.

I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS. TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND COMPLETE. THE FIGURES USED HEREIN ARE THE SAME AS USED FOR FEDERAL INCOME TAX PURPOSES ADJUSTED TO MUNICIPAL INCOME TAX ORDINANCES.

Do you authorize your preparer to contact us regarding this return? YES

NO

Signature of Preparer, if not Taxpayer

Signature of Taxpayer

Signature of Spouse, if Joint Return

DATE

DATE

SIGN

HERE

1

1 2

2