Instructions For Form 1099-S - Proceeds From Real Estate Transactions - 2013

ADVERTISEMENT

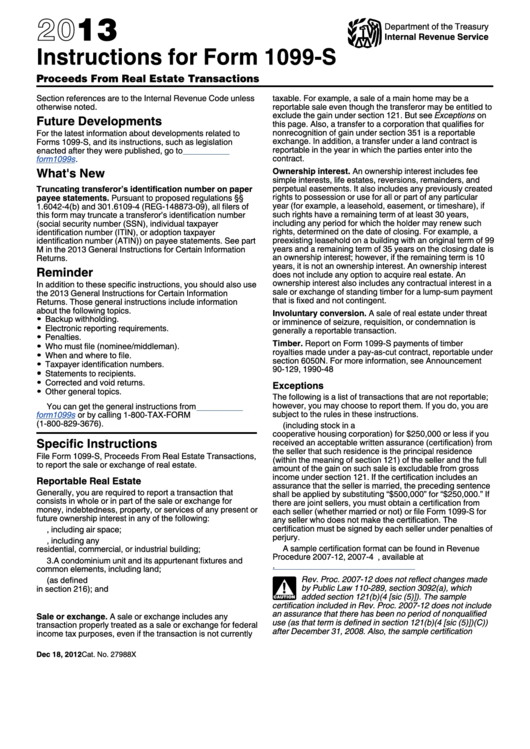

2013

Department of the Treasury

Internal Revenue Service

Instructions for Form 1099-S

Proceeds From Real Estate Transactions

Section references are to the Internal Revenue Code unless

taxable. For example, a sale of a main home may be a

otherwise noted.

reportable sale even though the transferor may be entitled to

exclude the gain under section 121. But see Exceptions on

Future Developments

this page. Also, a transfer to a corporation that qualifies for

nonrecognition of gain under section 351 is a reportable

For the latest information about developments related to

exchange. In addition, a transfer under a land contract is

Forms 1099-S, and its instructions, such as legislation

reportable in the year in which the parties enter into the

enacted after they were published, go to

contract.

form1099s.

What's New

Ownership interest. An ownership interest includes fee

simple interests, life estates, reversions, remainders, and

perpetual easements. It also includes any previously created

Truncating transferor’s identification number on paper

rights to possession or use for all or part of any particular

payee statements. Pursuant to proposed regulations §§

year (for example, a leasehold, easement, or timeshare), if

1.6042-4(b) and 301.6109-4 (REG-148873-09), all filers of

such rights have a remaining term of at least 30 years,

this form may truncate a transferor’s identification number

including any period for which the holder may renew such

(social security number (SSN), individual taxpayer

rights, determined on the date of closing. For example, a

identification number (ITIN), or adoption taxpayer

preexisting leasehold on a building with an original term of 99

identification number (ATIN)) on payee statements. See part

years and a remaining term of 35 years on the closing date is

M in the 2013 General Instructions for Certain Information

an ownership interest; however, if the remaining term is 10

Returns.

years, it is not an ownership interest. An ownership interest

Reminder

does not include any option to acquire real estate. An

ownership interest also includes any contractual interest in a

In addition to these specific instructions, you should also use

sale or exchange of standing timber for a lump-sum payment

the 2013 General Instructions for Certain Information

that is fixed and not contingent.

Returns. Those general instructions include information

about the following topics.

Involuntary conversion. A sale of real estate under threat

Backup withholding.

or imminence of seizure, requisition, or condemnation is

Electronic reporting requirements.

generally a reportable transaction.

Penalties.

Timber. Report on Form 1099-S payments of timber

Who must file (nominee/middleman).

royalties made under a pay-as-cut contract, reportable under

When and where to file.

section 6050N. For more information, see Announcement

Taxpayer identification numbers.

90-129, 1990-48 I.R.B. 10.

Statements to recipients.

Corrected and void returns.

Exceptions

Other general topics.

The following is a list of transactions that are not reportable;

however, you may choose to report them. If you do, you are

You can get the general instructions from

subject to the rules in these instructions.

form1099s

or by calling 1-800-TAX-FORM

(1-800-829-3676).

1. Sale or exchange of a residence (including stock in a

cooperative housing corporation) for $250,000 or less if you

Specific Instructions

received an acceptable written assurance (certification) from

the seller that such residence is the principal residence

File Form 1099-S, Proceeds From Real Estate Transactions,

(within the meaning of section 121) of the seller and the full

to report the sale or exchange of real estate.

amount of the gain on such sale is excludable from gross

income under section 121. If the certification includes an

Reportable Real Estate

assurance that the seller is married, the preceding sentence

Generally, you are required to report a transaction that

shall be applied by substituting “$500,000” for “$250,000.” If

consists in whole or in part of the sale or exchange for

there are joint sellers, you must obtain a certification from

money, indebtedness, property, or services of any present or

each seller (whether married or not) or file Form 1099-S for

future ownership interest in any of the following:

any seller who does not make the certification. The

certification must be signed by each seller under penalties of

1. Improved or unimproved land, including air space;

perjury.

2. Inherently permanent structures, including any

A sample certification format can be found in Revenue

residential, commercial, or industrial building;

Procedure 2007-12, 2007-4 I.R.B. 354, available at

3. A condominium unit and its appurtenant fixtures and

irb/2007-04_IRB/ar09.html.

common elements, including land;

Rev. Proc. 2007-12 does not reflect changes made

4. Stock in a cooperative housing corporation (as defined

by Public Law 110-289, section 3092(a), which

in section 216); and

!

added section 121(b)(4 [sic (5)]). The sample

5. Any non-contingent interest in standing timber.

CAUTION

certification included in Rev. Proc. 2007-12 does not include

an assurance that there has been no period of nonqualified

Sale or exchange. A sale or exchange includes any

use (as that term is defined in section 121(b)(4 [sic (5)])(C))

transaction properly treated as a sale or exchange for federal

after December 31, 2008. Also, the sample certification

income tax purposes, even if the transaction is not currently

Dec 18, 2012

Cat. No. 27988X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4