Instructions For Form 1099-S - Proceeds From Real Estate Transactions - 2016

ADVERTISEMENT

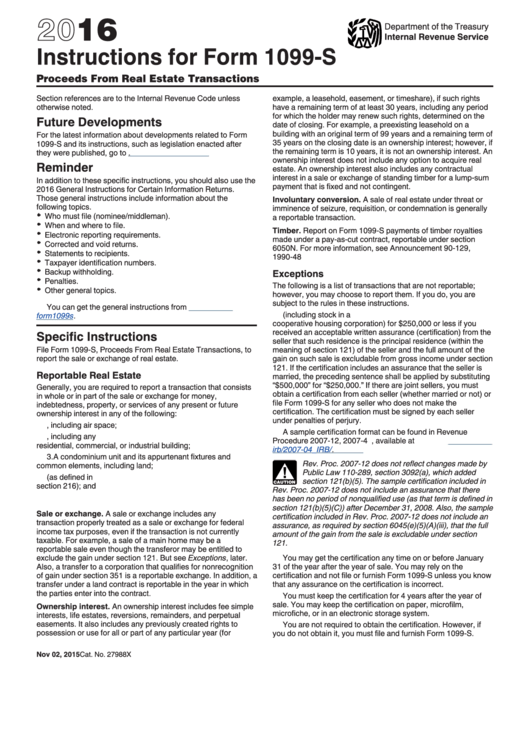

2016

Department of the Treasury

Internal Revenue Service

Instructions for Form 1099-S

Proceeds From Real Estate Transactions

Section references are to the Internal Revenue Code unless

example, a leasehold, easement, or timeshare), if such rights

otherwise noted.

have a remaining term of at least 30 years, including any period

for which the holder may renew such rights, determined on the

Future Developments

date of closing. For example, a preexisting leasehold on a

building with an original term of 99 years and a remaining term of

For the latest information about developments related to Form

35 years on the closing date is an ownership interest; however, if

1099-S and its instructions, such as legislation enacted after

the remaining term is 10 years, it is not an ownership interest. An

they were published, go to

ownership interest does not include any option to acquire real

Reminder

estate. An ownership interest also includes any contractual

interest in a sale or exchange of standing timber for a lump-sum

In addition to these specific instructions, you should also use the

payment that is fixed and not contingent.

2016 General Instructions for Certain Information Returns.

Those general instructions include information about the

Involuntary conversion. A sale of real estate under threat or

following topics.

imminence of seizure, requisition, or condemnation is generally

Who must file (nominee/middleman).

a reportable transaction.

When and where to file.

Timber. Report on Form 1099-S payments of timber royalties

Electronic reporting requirements.

made under a pay-as-cut contract, reportable under section

Corrected and void returns.

6050N. For more information, see Announcement 90-129,

Statements to recipients.

1990-48 I.R.B. 10.

Taxpayer identification numbers.

Backup withholding.

Exceptions

Penalties.

The following is a list of transactions that are not reportable;

Other general topics.

however, you may choose to report them. If you do, you are

subject to the rules in these instructions.

You can get the general instructions from

1. Sale or exchange of a residence (including stock in a

form1099s.

cooperative housing corporation) for $250,000 or less if you

received an acceptable written assurance (certification) from the

Specific Instructions

seller that such residence is the principal residence (within the

File Form 1099-S, Proceeds From Real Estate Transactions, to

meaning of section 121) of the seller and the full amount of the

report the sale or exchange of real estate.

gain on such sale is excludable from gross income under section

121. If the certification includes an assurance that the seller is

Reportable Real Estate

married, the preceding sentence shall be applied by substituting

“$500,000” for “$250,000.” If there are joint sellers, you must

Generally, you are required to report a transaction that consists

obtain a certification from each seller (whether married or not) or

in whole or in part of the sale or exchange for money,

file Form 1099-S for any seller who does not make the

indebtedness, property, or services of any present or future

certification. The certification must be signed by each seller

ownership interest in any of the following:

under penalties of perjury.

1. Improved or unimproved land, including air space;

A sample certification format can be found in Revenue

2. Inherently permanent structures, including any

Procedure 2007-12, 2007-4 I.R.B. 354, available at

residential, commercial, or industrial building;

irb/2007-04_IRB/ar09.html.

3. A condominium unit and its appurtenant fixtures and

Rev. Proc. 2007-12 does not reflect changes made by

common elements, including land;

Public Law 110-289, section 3092(a), which added

!

4. Stock in a cooperative housing corporation (as defined in

section 121(b)(5). The sample certification included in

section 216); and

CAUTION

Rev. Proc. 2007-12 does not include an assurance that there

5. Any non-contingent interest in standing timber.

has been no period of nonqualified use (as that term is defined in

section 121(b)(5)(C)) after December 31, 2008. Also, the sample

Sale or exchange. A sale or exchange includes any

certification included in Rev. Proc. 2007-12 does not include an

transaction properly treated as a sale or exchange for federal

assurance, as required by section 6045(e)(5)(A)(iii), that the full

income tax purposes, even if the transaction is not currently

amount of the gain from the sale is excludable under section

taxable. For example, a sale of a main home may be a

121.

reportable sale even though the transferor may be entitled to

exclude the gain under section 121. But see Exceptions, later.

You may get the certification any time on or before January

Also, a transfer to a corporation that qualifies for nonrecognition

31 of the year after the year of sale. You may rely on the

of gain under section 351 is a reportable exchange. In addition, a

certification and not file or furnish Form 1099-S unless you know

that any assurance on the certification is incorrect.

transfer under a land contract is reportable in the year in which

the parties enter into the contract.

You must keep the certification for 4 years after the year of

sale. You may keep the certification on paper, microfilm,

Ownership interest. An ownership interest includes fee simple

microfiche, or in an electronic storage system.

interests, life estates, reversions, remainders, and perpetual

easements. It also includes any previously created rights to

You are not required to obtain the certification. However, if

possession or use for all or part of any particular year (for

you do not obtain it, you must file and furnish Form 1099-S.

Nov 02, 2015

Cat. No. 27988X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4