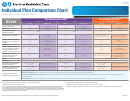

Us-Based Medical Benefits - Plan Comparison Chart Page 2

ADVERTISEMENT

In-Network

Out-of-Network

HIP Health Plan

Benefits

AETNA

BLUE CROSS

AETNA

BLUE CROSS

of New York

2

(In-Network

Only)

MEDICAL BENEFITS

100%

100% after

100% after

80% after deductible

80% after deductible

Office/Home visits

$15/$20

$15/$20

PCP/Specialist

PCP/Specialist

co-pay

co-pay

100%

100% after

100% after

80% after deductible

80% after deductible

Routine Physical

once every

$15 co-pay once

$15co-pay once

once every 12 months

once every 12 months

12 months

every 12 months

every 12 months

100%

100%

100%

80% after deductible

80% after deductible

Surgery

PRESCRIPTION DRUGS

$5.00 for

20% co-pay up to

20% co-pay up to

US: 60% after

US: 60% after deductible

Pharmacy

generic/brand per

$20 per 30-day

$20 per 30-day

deductible

Int’l: 80% after deductible

30-day supply

supply

supply

Int’l: 80% after

deductible

$2.50 for

100% after $15

100% after $15 co-

N/A

N/A

Mail Order

generic/brand per

co-pay

pay

30-day supply

per 90-day supply

per 90-day supply

BEHAVIOURAL HEALTH CARE BENEFITS (must be pre-certified; benefit maximum for in-network and out-of-network

combined)

100%

100%

100%

100% after

80% after deductible

Inpatient Mental

Health Care

100%

100%

100%

80% after deductible

80% after deductible

Outpatient Mental

Health Care

100%

100%

100%

100% after

80% after deductible

Inpatient Alcohol

and Substance

Abuse Care

100%

100%

100%

80% after deductible

80% after deductible

Outpatient Alcohol

and Substance

Abuse Care

2

Please note that HIP Health Plan for New York is a “closed” plan and will not accept new participants except for new dependents of

subscribers currently enrolled in the plan.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3