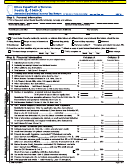

Step 3 (Continued)

16

16

16

Income tax from Page 1, Line 15.

.00

.00

17

17

17

Credit from Schedule CR (attach Schedule CR with amended figures)

.00

.00

18

Property tax and K-12 education expense credit from Schedule ICR

18

18

(attach Schedule ICR with amended figures)

.00

.00

19

Credit from Schedule 1299-C (attach Schedule 1299-C with amended

19

19

figures)

.00

.00

20

20

20

Nonrefundable credits. Add Lines 17 through 19.

.00

.00

21

21

21

Tax after nonrefundable credits. Subtract Line 20 from Line 16.

.00

.00

22

22

22

Household employment tax

.00

.00

23

23

23

Total Tax. Add Lines 21 and 22.

.00

.00

24

Total of all previous overpayments, refunds, or credit carryforward

(whether or not you received it), original contributions, and use tax

24

reported on your original return. (see instructions)

.00

25

25

Tax after previous overpayments and use tax. Add Lines 23 and 24.

.00

26

26

26

Illinois Income Tax withheld (see instructions)

.00

.00

27

27

27

Estimated payments (IL-1040-ES, IL-505-I, and prior year credit)

.00

.00

28

Pass-through entity payments - nonresident and part-year residents

28

28

only (attach Schedule K-1-P or K-1-T)

.00

.00

29

Earned income credit from Schedule ICR (attach Schedule ICR with

29

29

amended figures)

.00

.00

30

Amount of tax paid with original return plus additional tax paid after it

30

was filed (see instructions)

.00

31

31

Total payments and refundable credit. Add Column B, Lines 26 through 30.

.00

Step 4: Refund or Balance Due

32

32

Overpayment. If Line 25 is less than Line 31, subtract Line 25 from Line 31.

.00

33

33

Underpayment. If Line 25 is greater than Line 31, subtract Line 31 from Line 25.

.00

34

34

Penalty and interest (see instructions)

.00 +

.00 =

.00

Penalty amount

Interest amount

35

35

If Line 32 is greater than Line 34, subtract Line 34 from Line 32. This is your refund.

.00

If you want to deposit your refund directly into your checking or savings account, complete the direct

deposit information below.

Routing number

Checking or

Savings

Account number

or

36

If Line 32 is less than Line 34, subtract Line 32 from Line 34.

36

If you have an amount on Line 33, add Lines 33 and 34. This is the amount you owe.

.00

Step 5: Sign and Date and Third Party Designee

Under penalties of perjury, I state that I have examined this return, and, to the best of my knowledge, it is true, correct, and complete.

Your signature

Date

Daytime phone number

Your spouse’s signature

Date

Paid preparer’s signature

Date

Preparer’s phone number

Preparer’s FEIN, SSN, or PTIN

Check, and complete below, to allow another person to discuss this return with the Illinois Department of Revenue.

Designee’s

Designee’s

Name (please print)

Phone number

Mail to: Illinois Department of Revenue, P.O. Box 19007, Springfield, IL 62794-9007

*361502110*

DR

ID

X3

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of

IL-1040-X (R-12/13)

Page 2 of 4

this information is required. Failure to provide information could result in a penalty.

Reset

Print

1

1 2

2 3

3 4

4