Estate, Gift, And Trust Tax Provisions

ADVERTISEMENT

17

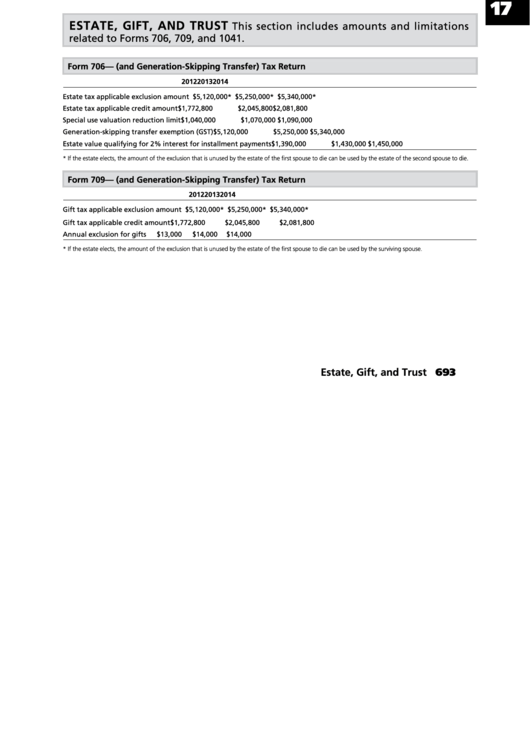

ESTATE, GIFT, AND TRUST

This section includes amounts and limitations

related to Forms 706, 709, and 1041.

Form 706—U.S. Estate (and Generation-Skipping Transfer) Tax Return

2012

2013

2014

Estate tax applicable exclusion amount

$5,120,000*

$5,250,000*

$5,340,000*

Estate tax applicable credit amount

$1,772,800

$2,045,800

$2,081,800

Special use valuation reduction limit

$1,040,000

$1,070,000

$1,090,000

Generation-skipping transfer exemption (GST)

$5,120,000

$5,250,000

$5,340,000

Estate value qualifying for 2% interest for installment payments

$1,390,000

$1,430,000

$1,450,000

* If the estate elects, the amount of the exclusion that is unused by the estate of the first spouse to die can be used by the estate of the second spouse to die.

Form 709—U.S. Gift (and Generation-Skipping Transfer) Tax Return

2012

2013

2014

Gift tax applicable exclusion amount

$5,120,000*

$5,250,000*

$5,340,000*

Gift tax applicable credit amount

$1,772,800

$2,045,800

$2,081,800

Annual exclusion for gifts

$13,000

$14,000

$14,000

* If the estate elects, the amount of the exclusion that is unused by the estate of the first spouse to die can be used by the surviving spouse.

693

Estate, Gift, and Trust

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2