Reset

Print Form

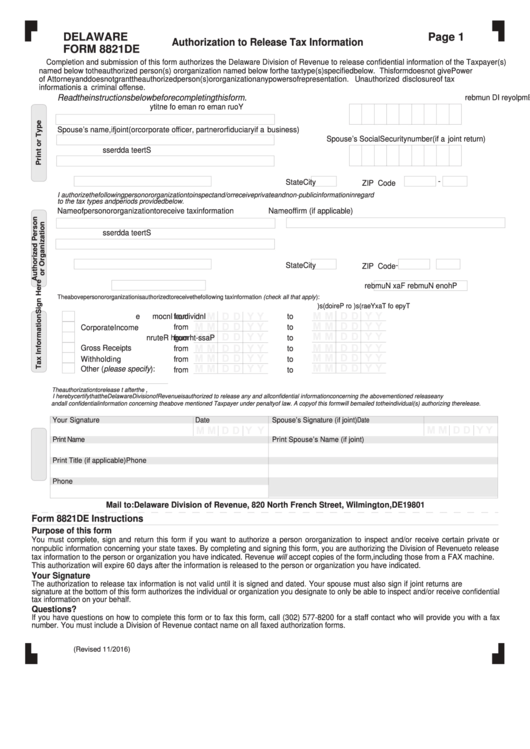

DELAWARE

Page 1

Authorization to Release Tax Information

FORM 8821DE

Completion and submission of this form authorizes the Delaware Division of Revenue to release confidential information of the Taxpayer(s)

named below to the authorized person(s) or organization named below for the tax type(s) specified below. This form does not give Power

of Attorney and does not grant the authorized person(s) or organization any powers of representation. Unauthorized disclosure of tax

information is a criminal offense.

Read the instructions below before completing this form.

S

c o

l a i

S

c e

r u

y t i

r o

F

e

d

r e

l a

E

m

l p

y o

r e

D I

n

u

m

b

r e

Y

o

r u

n

a

m

e

r o

n

a

m

e

f o

e

t n

y t i

Spouse’s name, if joint (or corporate officer, partner or fiduciary if a business)

Spouse’s Social Security number (if a joint return)

t S

e r

t e

a

d

d

e r

s s

-

City

State

ZIP Code

I authorize the following person or organization to inspect and/or receive private and non-public information in regard

to the tax types and periods provided below.

Name of person or organization to receive tax information

Name of firm (if applicable)

t S

e r

t e

a

d

d

e r

s s

City

State

-

ZIP Code

P

h

o

n

e

N

u

m

b

r e

F

x a

N

u

m

b

r e

The above person or organization is authorized to receive the following tax information (check all that apply):

T

y

p

e

f o

T

a

x

Y

e

a

( r

) s

r o

P

r e

o i

( d

) s

n I

d

v i

d i

u

l a

n I

o c

m

e

from

to

Corporate Income

from

to

P

s a

- s

h t

o r

u

g

h

R

e

u t

n r

from

to

Gross Receipts

from

to

Withholding

from

to

Other (please specify):

from

to

The authorization to release tax information is not valid until it is signed and dated. It will expire 60 days after the information is released. By signing this form,

I hereby certify that the Delaware Division of Revenue is authorized to release any and all confidential information concerning the above mentioned release any

and all confidential information concerning the above mentioned Taxpayer under penalty of law. A copy of this form will be mailed to the individual(s) authorizing the release.

Date

Your Signature

Date

Spouse’s Signature (if joint)

Print Name

Print Spouse’s Name (if joint)

Print Title (if applicable)

Phone

Phone

Mail to: Delaware Division of Revenue, 820 North French Street, Wilmington, DE 19801

Form 8821DE Instructions

Purpose of this form

You must complete, sign and return this form if you want to authorize a person ororganization to inspect and/or receive certain private or

nonpublic information concerning your state taxes. By completing and signing this form, you are authorizing the Division of Revenueto release

tax information to the person or organization you have indicated. Revenue will accept copies of the form,including those from a FAX machine.

This authorization will expire 60 days after the information is released to the person or organization you have indicated.

Your Signature

The authorization to release tax information is not valid until it is signed and dated. Your spouse must also sign if joint returns are listed.Your

signature at the bottom of this form authorizes the individual or organization you designate to only be able to inspect and/or receive confidential

tax information on your behalf.

Questions?

If you have questions on how to complete this form or to fax this form, call (302) 577-8200 for a staff contact who will provide you with a fax

number. You must include a Division of Revenue contact name on all faxed authorization forms.

(Revised 11/2016)

1

1