INSTRUCTIONS FOR REGISTRATION FORM FOR COMMERCIAL EMPLOYERS

An employer is required by law to file a registration form with the Employment Development Department (EDD) within fifteen (15) days

after paying over $100 in wages for employment in a calendar quarter. Please complete the registration process by doing one of the

following:

Register online from the EDD’s e-Services for Business at https://eddservices.edd.ca.gov.

Mail your completed registration form to the EDD, Account Services Group (ASG) MIC 28, P.O. Box 826880, Sacramento, CA 94280-0001.

Fax your completed registration form to the EDD at 916-654-9211.

Call for telephone registration at 916-654-8706.

If you are already registered and have a change in form or ownership, please complete a Change of Employer Account Information (DE 24).

Attach additional sheets if your information will not fit in the space provided.

Industry specific registration forms for Agricultural, Government/Schools/Indian Tribes, Household Workers, Nonprofit, or Personal Income Tax

Only, are available online at

NEED MORE HELP OR INFORMATION?

If you have questions regarding this form or the registration account number and assignment process and about whether your business

entity is subject to reporting and paying state payroll taxes, you may visit our website at

You may also call our Taxpayer Assistance Center at

888-745-3886. For TTY (nonverbal) access, call 800-547-9565. Outside the U.S. or Canada, call 916-464-3502.

The EDD provides seminars and other educational opportunities for taxpayers to learn how to report employees’ wages and pay taxes,

pointing out the pitfalls that create errors and unnecessary billings. Visit our website at or call us

at 888-745-3886 for more information.

Access the EDD website at

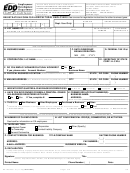

A.

LIST INDIVIDUAL OWNER(S), PARTNER(S), CORPORATE OFFICER(S), OR LLC/LLP Members/Managers/Officers – Enter name, title,

Social Security Number, and California driver’s license number of each individual.

B.

BUSINESS NAME – Enter name by which your business is known to the public. Enter “N/A” if business name is not different from Box A.

C.

OWNERSHIP BEGAN – Enter date the new ownership began operating.

D.

FEDERAL TAX NUMBER – Enter Federal Employer Identification Number. If not assigned, enter “Applied For.”

E.

CORPORATION/LLC/LLP/LP NAME – Enter Corporation/LLC/LLP/LP name exactly as spelled and registered with the Secretary of State.

E1. SECRETARY OF STATE CORP/LLC/LLP ID NUMBER – Enter the California Corporate/LLC/LLP/LP identification number.

F.

PHYSICAL BUSINESS LOCATION – Enter the California street address (not P.O. Box) and phone number where business is physically

conducted. If you have multiple California locations, please attach the physical business addresses on a separate sheet of paper.

G.

MAILING ADDRESS – Enter mailing address where the EDD correspondence and forms should be sent. Provide daytime phone number.

H.

INDICATE FIRST QUARTER AND YEAR WAGES EXCEEDED $100 – Check the appropriate box for the quarter in which you first paid over

$100 in wages. These wages are subject to Unemployment Insurance, Employment Training Tax, and State Disability Insurance withholdings.

I.

PRIOR REGISTRATION – If any part of the ownership shown in items A, B, or E are operating or have ever operated a business at another

location, check “Yes” and provide account number, business name, and address in box J.

J.

FORMER BUSINESS INFORMATION – If “Yes” is checked in box I, provide former EDD account number, business name, and address.

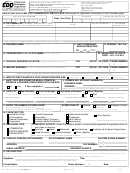

K.

STATUS OF BUSINESS – Check the box that best describes why you are completing this form. If the business was purchased, provide

previous owner and business name, EDD account number, purchase price, and date ownership was transferred to this ownership.

L.

NUMBER OF EMPLOYEES – Enter the number of employees working in California (CA) or, when applicable, enter the number of employees

residing in CA and working outside of CA. Refer to Information Sheet: Employment (DE 231) and Information Sheet: Multi-State Employment

(DE 231D) on our website at for additional information.

M. FAMILY EMPLOYEES – Refer to Information Sheet: Family Employment (DE 231FAM) and Information Sheet: Specialized Coverage

(DE 231SC) on our website at for additional information.

N.

TAXPAYER TYPE – Check box that best describes the legal form of the ownership shown in items A, B, or E. Co-ownership is defined as

husband/wife, spouse, or registered domestic partners. If other, please specify.

O.

EMPLOYER TYPE – Check box that best describes your employer type.

P.

INDUSTRY ACTIVITY – Check box that best describes the industry activity of your business. Describe the particular product or service in

detail. This information is used to assign an Industrial Classification Code to your business. If you would like more information on industry

coding or the North American Industry Classification System (NAICS), you can visit the website at

Q.

CONTACT PERSON FOR BUSINESS – Enter the name, title/company name, address, daytime phone number, fax number, e-mail address,

and business website of the person authorized by the ownership shown in item A to provide the EDD staff information needed to maintain

the accuracy of your employer account.

R.

DECLARATION – This declaration must be signed by an individual having the authority to sign on behalf of the business.

We will notify you of your EDD Account Number by mail. To help you understand your tax withholding and filing responsibilities, you will be

sent a California Employer’s Guide (DE 44). Please keep your account status current by completing a Change of Employer Account

Information (DE 24) for all future changes to the original registration information. The DE 44 and DE 24 can be accessed through our website at

DE 1 Rev. 76 (11-12) (INTERNET)

Page 2 of 2

1

1 2

2