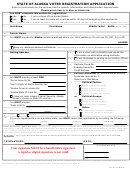

Registration Instructions

General Instructions:

1.

The substitute IRS Form W-9 is for the use of United States entities only. Non-US entities must submit an IRS Form W-8.

2.

Type or legibly print all information except for signature.

3.

All sections are mandatory and require completion.

Specific Information:

1.

NAME

a.

Partnership, Corporation, Government or Nonprofit – Enter legal business name as registered with the Internal Revenue

Service (IRS) in first box. If the company operates under another name, provide it in the second box.

b.

Proprietorship – Enter the proprietor’s name in the first box and the business name (DBA) in the second box.

c.

Individual – Name must be as registered with the Social Security Administration (SSA) for the Social Security number (SSN)

listed in Section 3.

2.

ADDRESS/CONTACT INFORMATION

a.

Address A – If the address is non-deliverable by the United States Postal Service, complete both Address A and B sections.

Company – Provide physical location of company headquarters.

Individual – Provide physical location of residence.

E-mail – Provide complete e-mail address when available.

Telephone Number – Include area code.

Fax Number – Include area code.

Primary Contact – Person (and phone number or extension) to be contacted for payment-related questions or issues.

b.

Address B – Provide additional remittance address and related information when appropriate.

3.

ORGANIZATION TYPE AND TAX IDENTIFICATION NUMBER (TIN)

a.

Individual – A person that has no association with a business.

b.

Proprietorship – A business owned by one person.

c.

Partnership – A business with more than one owner and not a corporation.

d.

Corporation – A business that may have many owners with each owner liable only for the amount of his investment in the

business.

e.

LLC – Limited Liability Company. Must mark appropriate classification – disregarded entity, partnership or corporation.

f.

Government – The federal government, a state or local government, or instrumentality, agency, or subdivision thereof.

g.

Tax Exempt/Nonprofit – Organization exempt from federal income tax under section 501(a) or 501(c)(3) of the Internal

Revenue Code.

h.

Doctor or Medical Facility – Person or facility related to practice of medicine.

i.

Attorney or Legal Facility – Person or facility related to practice of law.

j.

In-state – Nevada entity.

k.

Disadvantaged Business Enterprise (DBE) – A small business enterprise that is at least 51% owned and controlled by one or

more socially and economically disadvantaged individuals. Provide certification number. See

for certification information.

l.

Nevada Business License number – Current NV business license number which was issued by the NV Secretary of State.

m. The Taxpayer Identification Number (TIN) is always a 9-digit number. It will be a Social Security Number (SSN) assigned

to an individual by the SSA or an Employer Identification Number (EIN) assigned to a business or other entity by the IRS.

Per the IRS, use the owner’s social security number for a proprietorship.

4.

ELECTRONIC FUNDS TRANSFER

Per NRS 227, payment to all payees of the State of Nevada will be electronic. Provide a copy of a voided imprinted check or

restate bank information on letterhead. A deposit slip will not be accepted. Information on this form and the support

documentation must match.

a.

Bank Name – The name of the bank where account is held.

b.

Bank Account Type – Indicate whether the account is checking or savings.

c.

Transit Routing Number – Enter the 9-digit Transit Routing Number.

d.

Bank Account Number – Enter bank account number.

e.

Direct Deposit Remittance Advice – Direct Deposit Remittance Advices are sent via e-mail when possible. Companies

should provide an address that will not change, i.e. .

5.

IRS FORM W-9 CERTIFICATION AND SIGNATURE

a.

The Certification is copied from IRS Form W-9 (rev. January 2011). See IRS Form W-9 for further information.

b.

The Signature should be provided by the individual, owner, officer, legal representative or other authorized person of the

entity listed on the form.

c.

Print the name and title, when applicable, of the person signing the form.

d.

Enter the date the form was signed. Forms over three years old will not be processed.

Do not complete any remaining areas. They are for State of Nevada use only.

Mail or Fax signed form to:

NEVADA STATE CONTROLLER’S OFFICE

555 E WASHINGTON AVE STE 4300

LAS VEGAS NV 89101-1071

Fax: 702/486-3813

Sending to any other location will delay processing.

Questions can be directed to 702/486-3810 or 702/486-3856 or e-mailed to vendordesk@controller.state.nv.us.

1

1 2

2