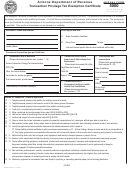

16. Groundwater measuring devices required under ARS § 45-604.

17. Machinery or equipment used directly in the following processes:

Manufacturing, processing or fabricating.

Job printing.

Refi ning or metallurgical operations.

Extraction of ores or minerals from the earth for commercial purposes.

Extraction of, or drilling for, oil or gas from the earth for commercial purposes.

18. Printed, photographic, electronic media or digital media materials purchased by or for publicly funded libraries including school district

libraries, charter school libraries, community college libraries, state university libraries or federal, state, county or municipal libraries for

use by the public.

19. Other: Cite specifi c statutory authority for the exemption of the tangible personal property.

Exemptions based on the purchaser being a government entity, public school, or a qualifying health care institution.

20. Food, drink or condiments for consumptions within the premises of any prison, jail or other institution under the jurisdiction of the state department of

corrections, the department of public safety, the department of juvenile corrections or a county sheriff. Food, drink, condiments or accessories purchased

by a school district for consumption at a public school within the district during school hours.

21. Tangible personal property sold or leased directly to the United States Government or its departments or agencies by a manufacturer, modifi er, assembler

or repairer.

22. Fifty percent of the gross proceeds or gross income from the sale of tangible personal property directly to the United States Government or its

departments or agencies, which is not deducted under number 21 above. This exemption does not apply to leases.

23. Tangible personal property sold or leased directly to a qualifying non profi t hospital, health care organization, community health center, or rehabilitation

program for mentally or physically handicapped persons (an exemption letter for these entities must accompany this form).

Transactions with Native Americans & Native American Businesses

24. Sale or lease of tangible personal property including Motor Vehicles to affi liated Native Americans if the solicitation for the sale, signing of the contract,

delivery of the goods and payment for the goods all occur on the reservation.

24a. Sale of a Motor Vehicle to an enrolled member of a tribe who resides on the reservation established for that tribe.

Transactions with nonresidents

25. Sales of tangible personal property to nonresidents of Arizona who are temporarily within Arizona, for their use outside of Arizona, when the vendor ships

the property out of Arizona by common carrier or United States mail or delivers such property out of Arizona via the vendor’s own conveyance.

NOTE: The vendor shall retain adequate documentation substantiating the shipment of the property out of Arizona.

26. Sale of a motor vehicle (vehicle must be self-propelled) to a nonresident of Arizona whose state of residence does not allow a use tax exemption for

transaction privilege taxes paid to Arizona and who has secured a special 30-day nonresident registration for the vehicle (please see Arizona Form 5010).

Describe the tangible personal property or service purchased or leased and its use below. (Use additional pages if needed)

Describe the tangible personal property or service purchased or leased and its use below. (Use additional pages if needed)

Certifi cation

Certifi cation

A vendor that has reason to believe that the certifi cate is not accurate or complete will not be relieved of the

A vendor that has reason to believe that the certifi cate is not accurate or complete will not be relieved of the

burden of proving entitlement to the exemption. A vendor that accepts a certifi cate in good faith will be relieved

burden of proving entitlement to the exemption. A vendor that accepts a certifi cate in good faith will be relieved

of the burden of proof and the purchaser may be required to establish the accuracy of the claimed exemption.

of the burden of proof and the purchaser may be required to establish the accuracy of the claimed exemption.

If the purchaser cannot establish the accuracy and completeness of the information provided in the certifi cate,

If the purchaser cannot establish the accuracy and completeness of the information provided in the certifi cate,

the purchaser is liable for an amount equal to the transaction privilege tax, penalty and interest which the vendor

the purchaser is liable for an amount equal to the transaction privilege tax, penalty and interest which the vendor

would have been required to pay if the vendor had not accepted the certifi cate. Misuse of this Certifi cate will

would have been required to pay if the vendor had not accepted the certifi cate. Misuse of this Certifi cate will

subject the purchaser to payment of the ARS § 42-5009 amount equal to any tax, penalty or interest. Willful misuse

subject the purchaser to payment of the ARS § 42-5009 amount equal to any tax, penalty or interest. Willful misuse

of this Certifi cate will subject the purchaser to criminal penalties of a felony pursuant to ARS § 42-1127.B.2.

of this Certifi cate will subject the purchaser to criminal penalties of a felony pursuant to ARS § 42-1127.B.2.

I, (print full name) _____________________________________________, hereby certify that these transactions are

I, (print full name) _____________________________________________, hereby certify that these transactions are

exempt from Arizona transaction privilege tax and that the information on this Certifi cate is true, accurate and complete.

exempt from Arizona transaction privilege tax and that the information on this Certifi cate is true, accurate and complete.

Further, if purchasing or leasing as an agent or offi cer, I certify that I am authorized to execute this Certifi cate on behalf of

Further, if purchasing or leasing as an agent or offi cer, I certify that I am authorized to execute this Certifi cate on behalf of

the purchaser named above.

the purchaser named above.

Signature of purchaser

Signature of purchaser __________________________________________________________________

__________________________________________________________________ Date

Date _________________________

_________________________

Title

Title _________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________

ADOR 60-2010 (12/04)

1

1 2

2