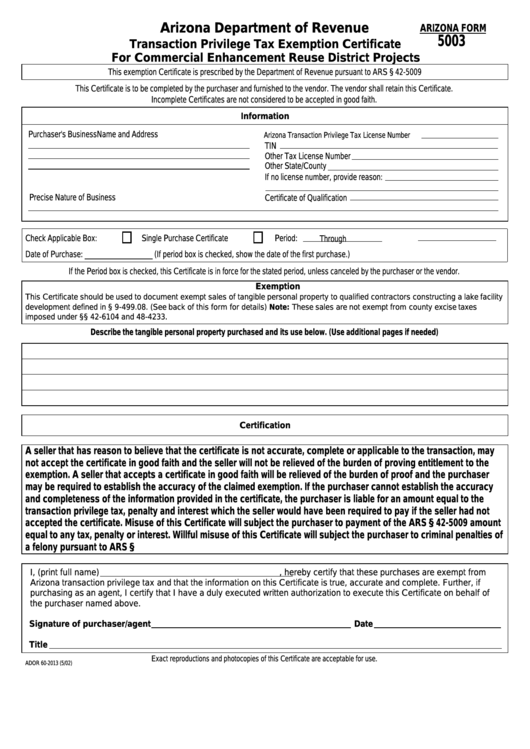

ARIZONA FORM

Arizona Department of Revenue

5003

Transaction Privilege Tax Exemption Certificate

For Commercial Enhancement Reuse District Projects

This exemption Certificate is prescribed by the Department of Revenue pursuant to ARS § 42-5009

This Certificate is to be completed by the purchaser and furnished to the vendor. The vendor shall retain this Certificate.

Incomplete Certificates are not considered to be accepted in good faith.

Information

Purchaser's Business Name and Address

Arizona Transaction Privilege Tax License Number

TIN

Other Tax License Number

Other State/County

If no license number, provide reason:

Precise Nature of Business

Certificate of Qualification

Check Applicable Box:

Single Purchase Certificate

Period:

Through

Date of Purchase: _________________ (If period box is checked, show the date of the first purchase.)

If the Period box is checked, this Certificate is in force for the stated period, unless canceled by the purchaser or the vendor.

Exemption

This Certificate should be used to document exempt sales of tangible personal property to qualified contractors constructing a lake facility

development defined in A.R.S. § 9-499.08. (See back of this form for details) Note: These sales are not exempt from county excise taxes

imposed under A.R.S. §§ 42-6104 and 48-4233.

Describe the tangible personal property purchased and its use below. (Use additional pages if needed)

Certification

A seller that has reason to believe that the certificate is not accurate, complete or applicable to the transaction, may

not accept the certificate in good faith and the seller will not be relieved of the burden of proving entitlement to the

exemption. A seller that accepts a certificate in good faith will be relieved of the burden of proof and the purchaser

may be required to establish the accuracy of the claimed exemption. If the purchaser cannot establish the accuracy

and completeness of the information provided in the certificate, the purchaser is liable for an amount equal to the

transaction privilege tax, penalty and interest which the seller would have been required to pay if the seller had not

accepted the certificate. Misuse of this Certificate will subject the purchaser to payment of the ARS § 42-5009 amount

equal to any tax, penalty or interest. Willful misuse of this Certificate will subject the purchaser to criminal penalties of

a felony pursuant to ARS § 42-1127.B.2.

I, (print full name)

, hereby certify that these purchases are exempt from

Arizona transaction privilege tax and that the information on this Certificate is true, accurate and complete. Further, if

purchasing as an agent, I certify that I have a duly executed written authorization to execute this Certificate on behalf of

the purchaser named above.

Signature of purchaser/agent

Date

Title

Exact reproductions and photocopies of this Certificate are acceptable for use.

ADOR 60-2013 (5/02)

1

1 2

2