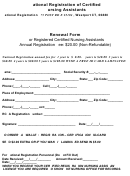

Renewal Form - Pend Oreille County Page 2

ADVERTISEMENT

SENIOR CITIZEN & DISABLED PERSON

PROPERTY TAX EXEMPTION

Filing Your Renewal

The Effects of Death

RENEWAL

and/or Retirement

INSTRUCTIONS

Failure to complete and return the renewal

in a timely manner may result in the

VERIFICATION OF ALL

cancellation of your property tax exemption.

If your spouse/co-tenant/domestic partner

INCOME IS REQUIRED.

The full property tax amount will then become

died or retired in 2016, your income amount

due.

may be computed differently.

Please

A 2016 bank statement will be required

Complete the Renewal included on the

contact our office for assistance.

in addition to other income documents.

reverse of this paper and return to:

Pend Oreille County Assessor’s Office

th

625 W 4

, PO Box 5010

Levels of Reduction

Newport, WA 99156-5010

Disabled Veterans

There are three income levels that

or

If you return the Renewal and proof of

determine

the

level

of

reduction

income by mail, the form must be signed by

Surviving Spouse

(exemption) that you receive on your annual

the applicant, or his/her attorney, or a duly

property taxes. These levels are set by state

authorized agent or guardian and two

The Legislature passed SS5256 which

law.

witnesses.

allows you to exclude veterans’ disability

If you return the Renewal to our office in

benefits and dependency and indemnity

Income Level 1: $30,000 or less

person, our staff will witness your signature.

compensation as defined in Title 38 part 3,

Exempt from regular property taxes on

sections 3.4 and 3.5 of the code of federal

$60,000 or 60% of the valuation, whichever

Residency

regulations. If you are receiving these

is greater, plus exempt from 100% of excess

benefits they will be deducted from your

levies.

Your residence is defined as your principal

disposable income. You must still include

single family dwelling unit, whether separate

other military and veterans benefits other

Income Level 2: $30,001 - $35,000

or part of a multi-unit dwelling. A mobile

than

attendant-care

and

medical-aid

Exempt from regular property taxes on

home on leased or rented land also qualifies as

payments. CRSC, CRDP benefits must still

$50,000 or 35% of the valuation, whichever

your residence.

be included in disposable income.

is greater, not to exceed $70,000, plus

The applicant must have owned and

exempt from 100% of excess levies.

occupied the residence as of December 2016.

Confinement to a hospital, nursing home,

Income Level 3: $35,001 - $40,000

adult care facility or assisted living may not

Exempt from 100% of excess levies.

dis-qualify the applicant if the residence is:

Allowable Expenses

1) temporarily unoccupied,

2) occupied by a spouse or domestic partner

You may take deductions from your

and/or persons financially dependent for

disposable income for the following

support,

expenses paid by you, your spouse, co-

Questions?

3) rented for the purpose of paying the facility

tenant or domestic partner:

costs, or

Non-reimbursed amounts paid for a

Contact our office at 509-447-4312

4) occupied by an unpaid caretaker.

nursing home, boarding home, or adult

family home.

Taxable and Non-Taxable

Non-reimbursed amounts paid for

Gross Income

prescription drug.

All income of the applicant and spouse/co-

Insurance premiums for Medicare

tenant/

domestic

partner,

including

under Title XVIII of the Social Security

contributions from other household members,

Act. (Part B, C/Medicare Advantage plan

during 2016 must be included.

Income

documentation is required.

If you file an

and D)

Currently, there is no allowable

income tax return with the IRS, please wait

deduction for supplemental, long-term care or

until you file before submitting your renewal

other types of insurance premiums.

to us. If you will not be able to make the

Pend Oreille County Assessor’s Office

Non-reimbursed amounts paid for

renewal deadline due to filing please contact

goods and services received by in-home

our office.

care, items such as oxygen, special needs

Losses or depreciation cannot be used to

furniture, attendant-care, light

offset other income.

Capital gains, veteran’s benefits, dividends

housekeeping tasks, meals-on-wheels, and

and other income are to be reported at full

life alert.

value.

REDUCTIONS RECEIVED ON BASIS OF ERRONEOUS INFORMATION SHALL BE SUBJECT TO THE COLLECTION OF TRUE TAXES PLUS 100%

PENALTY FOR UP TO FIVE YEARS AS PROVIDED FOR IN RCW 84.40.130

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2