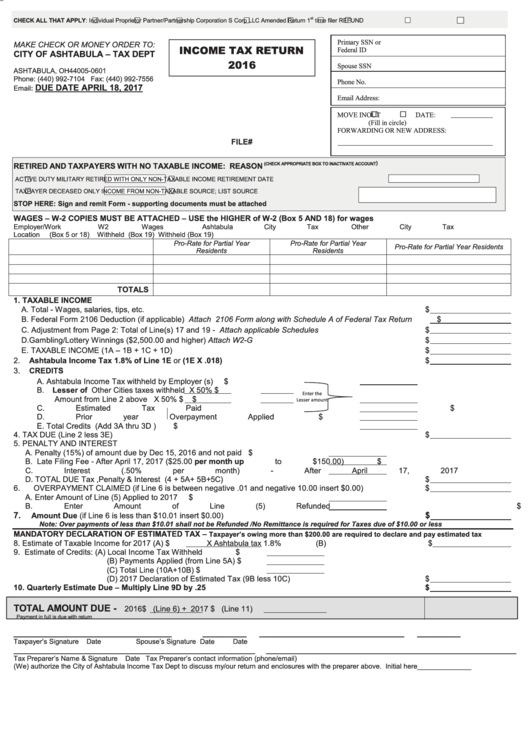

Income Tax Return - City Of Ashtabula - 2016

ADVERTISEMENT

st

CHECK ALL THAT APPLY:

Individual

Proprietor

Partner/Partnership

Corporation

S Corp

LLC

Amended Return

1

time filer

REFUND

Primary SSN or

MAKE CHECK OR MONEY ORDER TO:

INCOME TAX RETURN

Federal ID

CITY OF ASHTABULA – TAX DEPT

2016

P.O. Box 601

Spouse SSN

ASHTABULA, OH 44005-0601

Phone: (440) 992-7104 Fax: (440) 992-7556

Phone No.

DUE DATE APRIL 18, 2017

Email:

Email Address:

MOVE IN

OUT

DATE:

(Fill in circle)

FORWARDING OR NEW ADDRESS:

FILE#

)

RETIRED AND TAXPAYERS WITH NO TAXABLE INCOME: REASON

(CHECK APPROPRIATE BOX TO INACTIVATE ACCOUNT

ACTIVE DUTY MILITARY

RETIRED WITH ONLY NON-TAXABLE INCOME

RETIREMENT DATE

TAXPAYER DECEASED

ONLY INCOME FROM NON-TAXABLE SOURCE; LIST SOURCE

STOP HERE: Sign and remit Form - supporting documents must be attached

WAGES – W-2 COPIES MUST BE ATTACHED – USE the HIGHER of W-2 (Box 5 AND 18) for wages

Employer/Work

W2 Wages

Ashtabula City Tax

Other City Tax

Location

(Box 5 or 18)

Withheld (Box 19)

Withheld (Box 19)

Pro-Rate for Partial Year

Pro-Rate for Partial Year

Pro-Rate for Partial Year Residents

Residents

Residents

TOTALS

1.

TAXABLE INCOME

A. Total - Wages, salaries, tips, etc.

$

B. Federal Form 2106 Deduction (if applicable) Attach 2106 Form along with Schedule A of Federal Tax Return

$

C. Adjustment from Page 2: Total of Line(s) 17 and 19 - Attach applicable Schedules

$

D.Gambling/Lottery Winnings ($2,500.00 and higher) Attach W2-G

$

E. TAXABLE INCOME (1A – 1B + 1C + 1D)

$

2.

Ashtabula Income Tax 1.8% of Line 1E or (1E X .018)

$

3.

CREDITS

A.

Ashtabula Income Tax withheld by Employer (s)

$

B.

Lesser of Other Cities taxes withheld

X 50% $

Enter the

Amount from Line 2 above

Amount from Line 2 above

X 50% $

X 50% $

$

$

Lesser amount

C. Estimated Tax Paid

$

D. Prior year Overpayment Applied

$

E.

Total Credits (Add 3A thru 3D )

$

4.

TAX DUE (Line 2 less 3E)

$

5.

PENALTY AND INTEREST

A.

Penalty (15%) of amount due by Dec 15, 2016 and not paid

$

B.

Late Filing Fee - After April 17, 2017 ($25.00 per month up to $150.00)

$

C.

Interest (.50% per month) - After April 17, 2017

$

D.

TOTAL DUE Tax ,Penalty & Interest (4 + 5A+ 5B+5C)

$

6.

OVERPAYMENT CLAIMED (if Line 6 is between negative .01 and negative 10.00 insert $0.00)

$

A.

Enter Amount of Line (5) Applied to 2017

$

B.

Enter Amount of Line (5) Refunded

$

7.

$

Amount Due (if Line 6 is less than $10.01 insert $0.00)

Note: Over payments of less than $10.01 shall not be Refunded /No Remittance is required for Taxes due of $10.00 or less

MANDATORY DECLARATION OF ESTIMATED TAX –

Taxpayer’s owing more than $200.00 are required to declare and pay estimated tax

8.

Estimate of Taxable Income for 2017

(A) $

X Ashtabula tax 1.8%

(B)$

9.

Estimate of Credits: (A) Local Income Tax Withheld

$

(B) Payments Applied (from Line 5A)

$

(C) Total Line (10A+10B)

$

(D) 2017 Declaration of Estimated Tax (9B less 10C)

$

10. Quarterly Estimate Due – Multiply Line 9D by .25

$

TOTAL AMOUNT DUE -

2016 $

(Line 6) + 2017 $

(Line 11)

Payment in full is due with return

____________________________________

__________

_________________________________

__________

Taxpayer’s Signature

Spouse’s Signature

Date

Date

Date

_______________________________________________________

_________________________________________________________

Tax Preparer’s Name & Signature

Tax Preparer’s contact information (phone/email)

Date

(We) authorize the City of Ashtabula Income Tax Dept to discuss my/our return and enclosures with the preparer above. Initial here______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2