Instructions For Form It-112-R

ADVERTISEMENT

IT-112-R-I

New York State Department of Taxation and Finance

Instructions for Form IT-112-R

New York State Resident Tax Credit

—

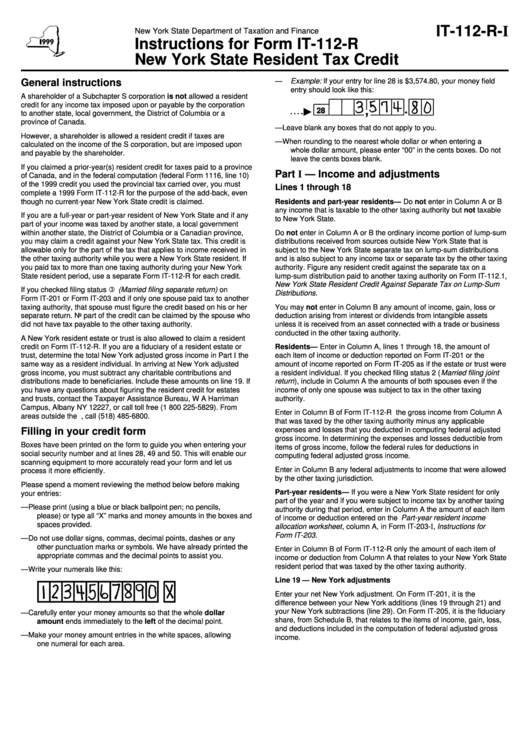

Example: If your entry for line 28 is $3,574.80, your money field

General instructions

entry should look like this:

A shareholder of a Subchapter S corporation is not allowed a resident

credit for any income tax imposed upon or payable by the corporation

to another state, local government, the District of Columbia or a

province of Canada.

—

Leave blank any boxes that do not apply to you.

However, a shareholder is allowed a resident credit if taxes are

—

When rounding to the nearest whole dollar or when entering a

calculated on the income of the S corporation, but are imposed upon

whole dollar amount, please enter “00” in the cents boxes. Do not

and payable by the shareholder.

leave the cents boxes blank.

If you claimed a prior-year(s) resident credit for taxes paid to a province

Part I — Income and adjustments

of Canada, and in the federal computation (federal Form 1116, line 10)

of the 1999 credit you used the provincial tax carried over, you must

Lines 1 through 18

complete a 1999 Form IT-112-R for the purpose of the add-back, even

though no current-year New York State credit is claimed.

Residents and part-year residents — Do not enter in Column A or B

any income that is taxable to the other taxing authority but not taxable

If you are a full-year or part-year resident of New York State and if any

to New York State.

part of your income was taxed by another state, a local government

within another state, the District of Columbia or a Canadian province,

Do not enter in Column A or B the ordinary income portion of lump-sum

you may claim a credit against your New York State tax. This credit is

distributions received from sources outside New York State that is

allowable only for the part of the tax that applies to income received in

subject to the New York State separate tax on lump-sum distributions

the other taxing authority while you were a New York State resident. If

and is also subject to any income tax or separate tax by the other taxing

you paid tax to more than one taxing authority during your New York

authority. Figure any resident credit against the separate tax on a

State resident period, use a separate Form IT-112-R for each credit.

lump-sum distribution paid to another taxing authority on Form IT-112.1,

New York State Resident Credit Against Separate Tax on Lump-Sum

If you checked filing status ƒ (Married filing separate return) on

Distributions.

Form IT-201 or Form IT-203 and if only one spouse paid tax to another

taxing authority, that spouse must figure the credit based on his or her

You may not enter in Column B any amount of income, gain, loss or

separate return. No part of the credit can be claimed by the spouse who

deduction arising from interest or dividends from intangible assets

did not have tax payable to the other taxing authority.

unless it is received from an asset connected with a trade or business

conducted in the other taxing authority.

A New York resident estate or trust is also allowed to claim a resident

credit on Form IT-112-R. If you are a fiduciary of a resident estate or

Residents — Enter in Column A, lines 1 through 18, the amount of

trust, determine the total New York adjusted gross income in Part I the

each item of income or deduction reported on Form IT-201 or the

same way as a resident individual. In arriving at New York adjusted

amount of income reported on Form IT-205 as if the estate or trust were

gross income, you must subtract any charitable contributions and

a resident individual. If you checked filing status 2 ( Married filing joint

return ), include in Column A the amounts of both spouses even if the

distributions made to beneficiaries. Include these amounts on line 19. If

you have any questions about figuring the resident credit for estates

income of only one spouse was subject to tax in the other taxing

and trusts, contact the Taxpayer Assistance Bureau, W A Harriman

authority.

Campus, Albany NY 12227, or call toll free (1 800 225-5829). From

Enter in Column B of Form IT-112-R the gross income from Column A

areas outside the U.S. and Canada, call (518) 485-6800.

that was taxed by the other taxing authority minus any applicable

expenses and losses that you deducted in computing federal adjusted

Filling in your credit form

gross income. In determining the expenses and losses deductible from

Boxes have been printed on the form to guide you when entering your

items of gross income, follow the federal rules for deductions in

social security number and at lines 28, 49 and 50. This will enable our

computing federal adjusted gross income.

scanning equipment to more accurately read your form and let us

Enter in Column B any federal adjustments to income that were allowed

process it more efficiently.

by the other taxing jurisdiction.

Please spend a moment reviewing the method below before making

Part-year residents — If you were a New York State resident for only

your entries:

part of the year and if you were subject to income tax by another taxing

—

Please print (using a blue or black ballpoint pen; no pencils,

authority during that period, enter in Column A the amount of each item

please) or type all “X” marks and money amounts in the boxes and

of income or deduction entered on the Part-year resident income

spaces provided.

allocation worksheet , column A, in Form IT-203-I, Instructions for

Form IT-203.

—

Do not use dollar signs, commas, decimal points, dashes or any

other punctuation marks or symbols. We have already printed the

Enter in Column B of Form IT-112-R only the amount of each item of

appropriate commas and the decimal points to assist you.

income or deduction from Column A that relates to your New York State

resident period that was taxed by the other taxing authority.

—

Write your numerals like this:

Line 19 — New York adjustments

Enter your net New York adjustment. On Form IT-201, it is the

difference between your New York additions (lines 19 through 21) and

your New York subtractions (line 29). On Form IT-205, it is the fiduciary

—

Carefully enter your money amounts so that the whole dollar

share, from Schedule B, that relates to the items of income, gain, loss,

amount ends immediately to the left of the decimal point.

and deductions included in the computation of federal adjusted gross

—

Make your money amount entries in the white spaces, allowing

income.

one numeral for each area.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2