Instructions For Form Cg-112.3

ADVERTISEMENT

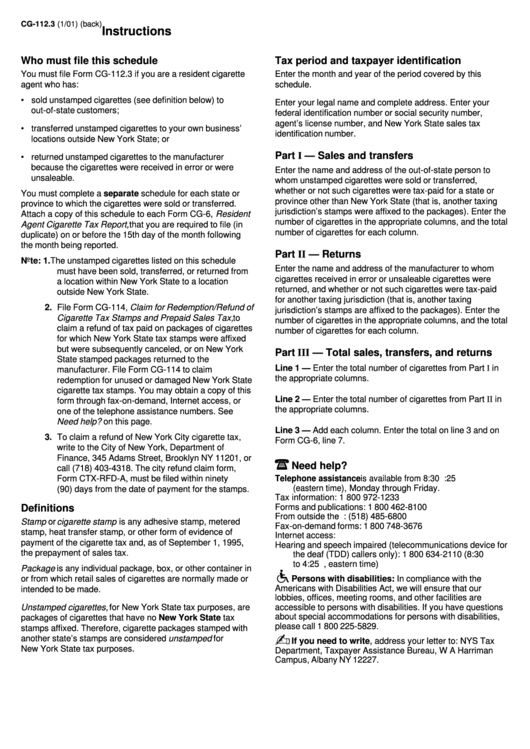

CG-112.3 (1/01) (back)

Instructions

Who must file this schedule

Tax period and taxpayer identification

You must file Form CG-112.3 if you are a resident cigarette

Enter the month and year of the period covered by this

agent who has:

schedule.

• sold unstamped cigarettes (see definition below) to

Enter your legal name and complete address. Enter your

out-of-state customers;

federal identification number or social security number,

agent’s license number, and New York State sales tax

• transferred unstamped cigarettes to your own business’

identification number.

locations outside New York State; or

Part I — Sales and transfers

• returned unstamped cigarettes to the manufacturer

because the cigarettes were received in error or were

Enter the name and address of the out-of-state person to

unsaleable.

whom unstamped cigarettes were sold or transferred,

whether or not such cigarettes were tax-paid for a state or

You must complete a separate schedule for each state or

province other than New York State (that is, another taxing

province to which the cigarettes were sold or transferred.

jurisdiction’s stamps were affixed to the packages). Enter the

Attach a copy of this schedule to each Form CG-6, Resident

number of cigarettes in the appropriate columns, and the total

Agent Cigarette Tax Report, that you are required to file (in

number of cigarettes for each column.

duplicate) on or before the 15th day of the month following

the month being reported.

Part II — Returns

Note: 1. The unstamped cigarettes listed on this schedule

Enter the name and address of the manufacturer to whom

must have been sold, transferred, or returned from

cigarettes received in error or unsaleable cigarettes were

a location within New York State to a location

returned, and whether or not such cigarettes were tax-paid

outside New York State.

for another taxing jurisdiction (that is, another taxing

2. File Form CG-114, Claim for Redemption/Refund of

jurisdiction’s stamps are affixed to the packages). Enter the

Cigarette Tax Stamps and Prepaid Sales Tax, to

number of cigarettes in the appropriate columns, and the total

claim a refund of tax paid on packages of cigarettes

number of cigarettes for each column.

for which New York State tax stamps were affixed

but were subsequently canceled, or on New York

Part III — Total sales, transfers, and returns

State stamped packages returned to the

Line 1 — Enter the total number of cigarettes from Part I in

manufacturer. File Form CG-114 to claim

the appropriate columns.

redemption for unused or damaged New York State

cigarette tax stamps. You may obtain a copy of this

Line 2 — Enter the total number of cigarettes from Part II in

form through fax-on-demand, Internet access, or

the appropriate columns.

one of the telephone assistance numbers. See

Need help? on this page.

Line 3 — Add each column. Enter the total on line 3 and on

3. To claim a refund of New York City cigarette tax,

Form CG-6, line 7.

write to the City of New York, Department of

Finance, 345 Adams Street, Brooklyn NY 11201, or

Need help?

call (718) 403-4318. The city refund claim form,

Telephone assistance is available from 8:30 a.m. to 4:25 p.m.

Form CTX-RFD-A, must be filed within ninety

(eastern time), Monday through Friday.

(90) days from the date of payment for the stamps.

Tax information: 1 800 972-1233

Forms and publications: 1 800 462-8100

Definitions

From outside the U.S. and outside Canada: (518) 485-6800

Stamp or cigarette stamp is any adhesive stamp, metered

Fax-on-demand forms: 1 800 748-3676

stamp, heat transfer stamp, or other form of evidence of

Internet access:

payment of the cigarette tax and, as of September 1, 1995,

Hearing and speech impaired (telecommunications device for

the prepayment of sales tax.

the deaf (TDD) callers only): 1 800 634-2110 (8:30 a.m.

to 4:25 p.m., eastern time)

Package is any individual package, box, or other container in

or from which retail sales of cigarettes are normally made or

Persons with disabilities: In compliance with the

Americans with Disabilities Act, we will ensure that our

intended to be made.

lobbies, offices, meeting rooms, and other facilities are

Unstamped cigarettes, for New York State tax purposes, are

accessible to persons with disabilities. If you have questions

about special accommodations for persons with disabilities,

packages of cigarettes that have no New York State tax

please call 1 800 225-5829.

stamps affixed. Therefore, cigarette packages stamped with

another state’s stamps are considered unstamped for

If you need to write, address your letter to: NYS Tax

New York State tax purposes.

Department, Taxpayer Assistance Bureau, W A Harriman

Campus, Albany NY 12227.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1