FORM

XX00014X

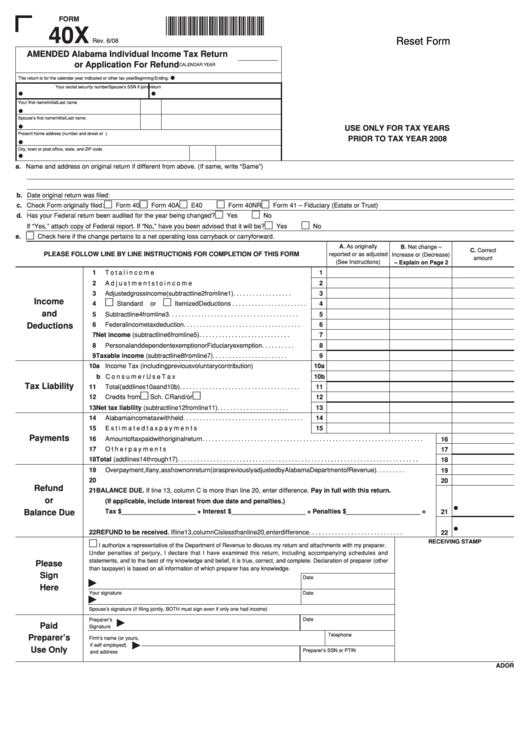

40X

Reset Form

Rev. 6/08

AMENDED Alabama Individual Income Tax Return

or Application For Refund

CALENDAR YEAR

•

This return is for the calendar year indicated or other tax year Beginning:

Ending:

Your social security number

Spouse’s SSN if joint return

•

•

Your first name

Initial

Last name

•

Spouse’s first name

Initial

Last name

•

USE ONLY FOR TAX YEARS

Present home address (number and street or P.O. Box number)

PRIOR TO TAX YEAR 2008

•

City, town or post office, state, and ZIP code

•

a. Name and address on original return if different from above. (If same, write “Same”)

b. Date original return was filed:

c. Check Form originally filed:

Form 40

Form 40A

E40

Form 40NR

Form 41 – Fiduciary (Estate or Trust)

d. Has your Federal return been audited for the year being changed?

Yes

No

If “Yes,” attach copy of Federal report. If “No,” have you been advised that it will be?

Yes

No

e.

Check here if the change pertains to a net operating loss carryback or carryforward.

A. As originally

B. Net change –

C. Correct

PLEASE FOLLOW LINE BY LINE INSTRUCTIONS FOR COMPLETION OF THIS FORM

reported or as adjusted

Increase or (Decrease)

amount

(See Instructions)

– Explain on Page 2

1

Total income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2

Adjustments to income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3

Adjusted gross income (subtract line 2 from line 1) . . . . . . . . . . . . . . . . . .

3

Income

4

Standard or

Itemized Deductions . . . . . . . . . . . . . . . . . . . . . . .

4

and

5

Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Deductions

6

Federal income tax deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7

Net income (subtract line 6 from line 5). . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8

Personal and dependent exemption or Fiduciary exemption . . . . . . . . . .

8

9

Taxable income (subtract line 8 from line 7) . . . . . . . . . . . . . . . . . . . . . . .

9

10a Income Tax (including previous voluntary contribution) . . . . . . . . . . . . . . .

10a

b Consumer Use Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10b

Tax Liability

11

Total (add lines 10a and 10b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12

Credits from

Sch. CR and/or

Sch. OC . . . . . . . . . . . . . . . . . . . . .

12

13

Net tax liability (subtract line 12 from line 11) . . . . . . . . . . . . . . . . . . . . . .

13

14

Alabama income tax withheld. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15

Estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

Payments

16

Amount of tax paid with original return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17

Other payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18

Total (add lines 14 through 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19

Overpayment, if any, as shown on return (or as previously adjusted by Alabama Department of Revenue) . . . . . . . . .

19

20

Subtract line 19 from line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

Refund

21

BALANCE DUE. If line 13, column C is more than line 20, enter difference. Pay in full with this return.

or

(If applicable, include interest from due date and penalties.)

•

Balance Due

Tax $_____________________ + Interest $_____________________ + Penalties $_____________________ =

21

Calculate Interest

•

22

REFUND to be received. If line 13, column C is less than line 20, enter difference . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

RECEIVING STAMP

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and

statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other

Please

than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Date

Here

Your signature

Date

Spouse’s signature (if filing jointly, BOTH must sign even if only one had income)

Preparer’s

Date

Paid

Signature

Telephone

Preparer’s

Firm’s name (or yours,

if self employed)

Use Only

Preparer’s SSN or PTIN

and address

ADOR

1

1 2

2