Print

Reset form

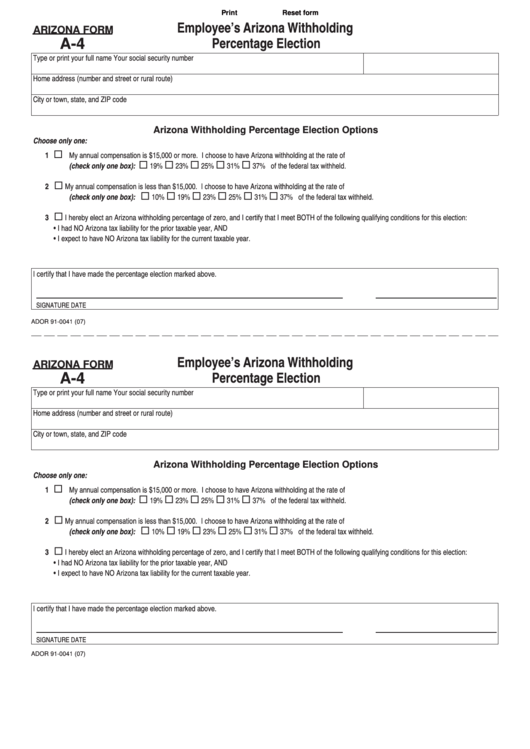

Employee’s Arizona Withholding

ARIZONA FORM

Percentage Election

A-4

Type or print your full name

Your social security number

Home address (number and street or rural route)

City or town, state, and ZIP code

Arizona Withholding Percentage Election Options

Choose only one:

1

My annual compensation is $15,000 or more. I choose to have Arizona withholding at the rate of

(check only one box):

19%

23%

25%

31%

37% of the federal tax withheld.

2

My annual compensation is less than $15,000. I choose to have Arizona withholding at the rate of

(check only one box):

10%

19%

23%

25%

31%

37% of the federal tax withheld.

3

I hereby elect an Arizona withholding percentage of zero, and I certify that I meet BOTH of the following qualifying conditions for this election:

•

I had NO Arizona tax liability for the prior taxable year, AND

•

I expect to have NO Arizona tax liability for the current taxable year.

I certify that I have made the percentage election marked above.

SIGNATURE

DATE

ADOR 91-0041 (07)

Employee’s Arizona Withholding

ARIZONA FORM

Percentage Election

A-4

Type or print your full name

Your social security number

Home address (number and street or rural route)

City or town, state, and ZIP code

Arizona Withholding Percentage Election Options

Choose only one:

1

My annual compensation is $15,000 or more. I choose to have Arizona withholding at the rate of

(check only one box):

19%

23%

25%

31%

37% of the federal tax withheld.

2

My annual compensation is less than $15,000. I choose to have Arizona withholding at the rate of

(check only one box):

10%

19%

23%

25%

31%

37% of the federal tax withheld.

3

I hereby elect an Arizona withholding percentage of zero, and I certify that I meet BOTH of the following qualifying conditions for this election:

•

I had NO Arizona tax liability for the prior taxable year, AND

•

I expect to have NO Arizona tax liability for the current taxable year.

I certify that I have made the percentage election marked above.

SIGNATURE

DATE

ADOR 91-0041 (07)

1

1 2

2