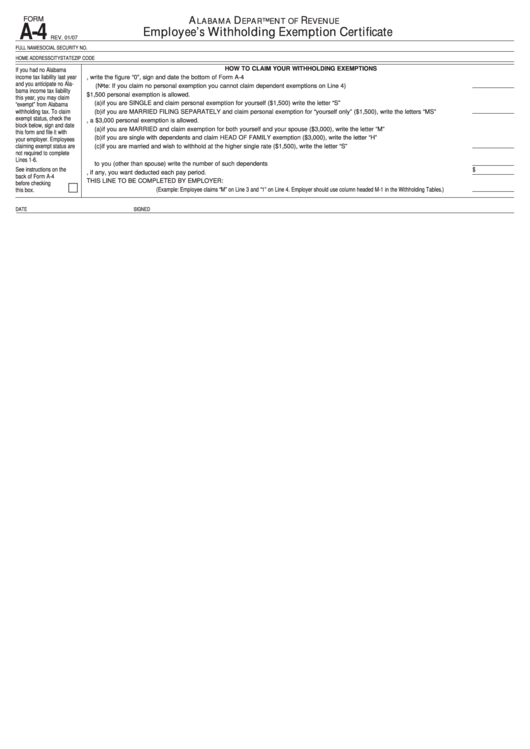

Form A-4 - Employee'S Withholding Exemption Certificate - Alabama Department Of Revenue

ADVERTISEMENT

FORM

A

D

R

LABAMA

EP ARTMENT OF

EVENUE

A-4

Employee’s Withholding Exemption Certificate

REV. 01/07

FULL NAME

SOCIAL SECURITY NO.

HOME ADDRESS

CITY

STATE

ZIP CODE

HOW TO CLAIM YOUR WITHHOLDING EXEMPTIONS

If you had no Alabama

income tax liability last year

1. If you claim no personal exemption for yourself, write the figure “0”, sign and date the bottom of Form A-4

and you anticipate no Ala-

(Note: If you claim no personal exemption you cannot claim dependent exemptions on Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

bama income tax liability

2. IF YOU ARE SINGLE or MARRIED FILING SEPARATELY a $1,500 personal exemption is allowed.

this year, you may claim

(a) if you are SINGLE and claim personal exemption for yourself ($1,500) write the letter “S”

“exempt” from Alabama

withholding tax. To claim

(b) if you are MARRIED FILING SEPARATELY and claim personal exemption for “yourself only” ($1,500), write the letters “MS” . . . . . . . . . . .

exempt status, check the

3. IF YOU ARE MARRIED or SINGLE CLAIMING HEAD OF FAMILY, a $3,000 personal exemption is allowed.

block below, sign and date

(a) if you are MARRIED and claim exemption for both yourself and your spouse ($3,000), write the letter “M”

this form and file it with

(b) if you are single with dependents and claim HEAD OF FAMILY exemption ($3,000), write the letter “H”

your employer. Employees

claiming exempt status are

(c) if you are married and wish to withhold at the higher single rate ($1,500), write the letter “S” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

not required to complete

4. If during the year you will provide more than one-half of the support of persons closely related

Lines 1-6.

to you (other than spouse) write the number of such dependents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

See instructions on the

$

5. Additional amount, if any, you want deducted each pay period. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

back of Form A-4

THIS LINE TO BE COMPLETED BY EMPLOYER:

before checking

6. TOTAL EXEMPTIONS (Example: Employee claims “M” on Line 3 and “1” on Line 4. Employer should use column headed M-1 in the Withholding Tables.) . . . . . . . .

this box. . . . . . . . . . . . . .

DATE

SIGNED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2